24 Essential ESG Statistics and Trends in 2023

The world is starting to feel the effects of climate change, and investors are taking notice. Here are 23 statistics showing how ESG investing is growing and changing the landscape of finance.

Sustainable, ethical, and socially responsible investing – also known as ESG investing – is becoming more popular each year. In fact, ESG-related investments now account for a third of the money managed globally, according to the Global Sustainable Investment Alliance.

There’s no doubt that environmental and social responsibility are important issues to many people. But when it comes to getting a return on our investment, how much do we really care?

Here are 24 ESG statistics and trends that show how big the ESG industry has become, where investors are putting their money, and where the ESG market might be headed in the future.

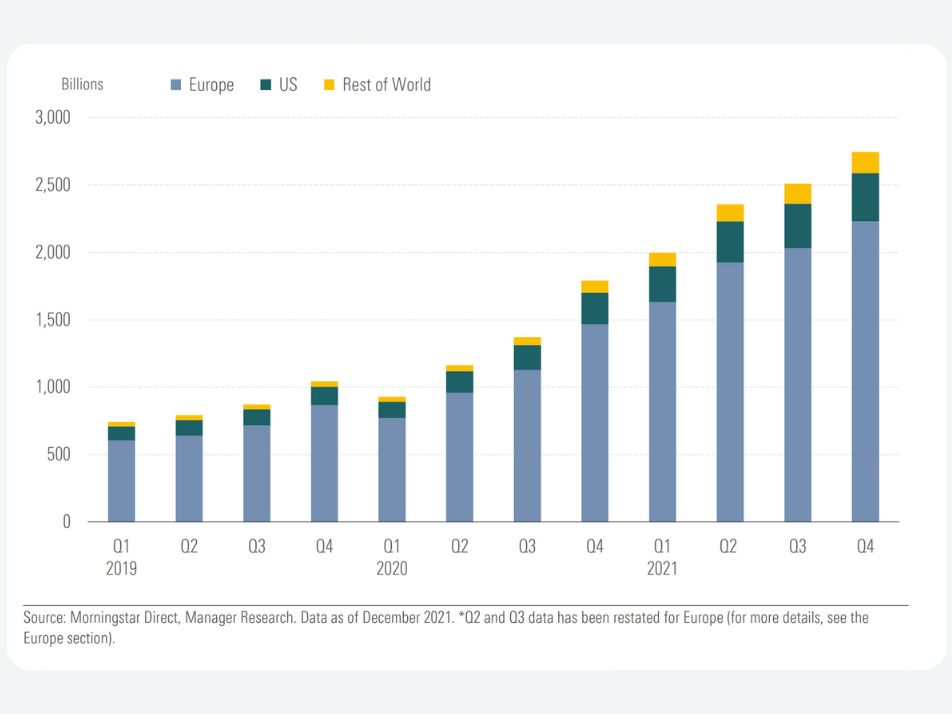

1. $2,778 billion is invested in ESG funds

Over $2.77 trillion were held in ESG mutual funds and ESG ETFs globally at the end of the first quarter of 2022, according to Morningstar. In the first quarter of 2022, approximately $97 was invested in sustainable funds worldwide, despite the broad cool-off in the equity markets. In 2021, $596 billion was invested in sustainable funds worldwide, representing a 53% increase compared to 2020.

Source: Morningstar, Bloomberg

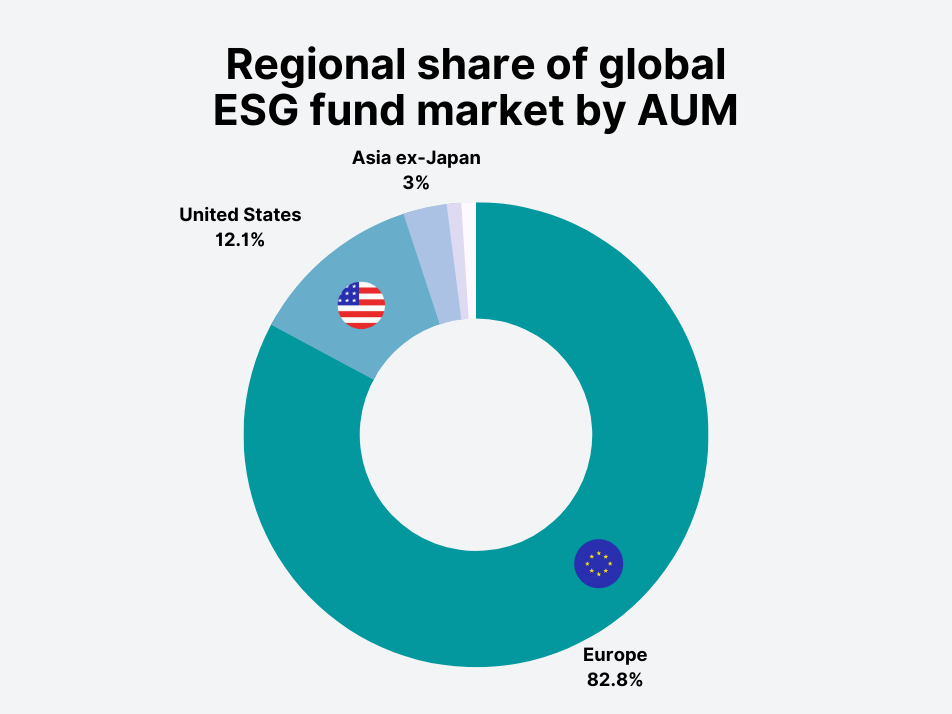

2. Europe dominates the ESG market

Europe continues to dwarf other regions when it comes to investments in sustainable funds. In Q1 2022, Europe had $2,276 billion in ESG assets under management, or 82%, of the global total. The US came in second place with $343 billion, representing 12% of global sustainable assets under professional management. Asia (ex Japan) accounted for only 3%, while Australia/New Zealand, Japan, Canada, and the Americas had less than one per cent each of the global market share.

Source: Morningstar

3. The US has $343 billion in ESG assets

In the United States, ESG funds assets under management hit $357 billion at the end of 2021 but fell to $343 billion in Q1 of 2022 during the global market rout. The US still lags far behind Europe when it comes to ESG investing. Despite continuous media coverage on the topic and a tremendous increase in the number of ESG investment options, actual adoption by US investors has been relatively slow.

Source: Morningstar

4. $649 billion flowed into ESG funds in 2021

In 2021, a record $649 billion poured into ESG-focused funds globally, an increase of almost 20% from the $542 billion that flowed into these funds in 2020. US-domiciled sustainable funds attracted nearly $70 billion in net flows in 2021, a 35% increase over the previous record set in 2020. The popularity of ESG funds rose in line with the rest of the equity market in 2020-2021 as investors poured money into stocks after the Covid-19 pandemic decimated valuations.

Source: Morningstar

5. Are ESG funds really more ESG-friendly?

Not everyone is convinced that ESG funds are actually more environmentally and socially responsible than traditional investment funds. Researchers at Columbia University and the London School of Economics compared the environmental, social, and governance (ESG) records of U.S. firms included in 147 ESG fund portfolios to those of 2,428 non-ESG portfolios. They discovered that companies in ESG funds had a poorer compliance record for both labour and environmental standards.

Truth be told, it’s hard for the average person to know whether their ESG fund is really doing good. Screening companies for ESG compliance is more than a full-time job, and it’s one that most people are not qualified to do. For example, I invest in an ESG exchange-traded fund (ETF) that tracks the MSCI World ESG Screened Index. When writing this piece, I looked at this fund’s holdings and realised that many of those companies would not have passed my personal ESG screens. It’s simply less a “less bad” version than its non-ESG variant, not good.

Source: Harvard Business Review

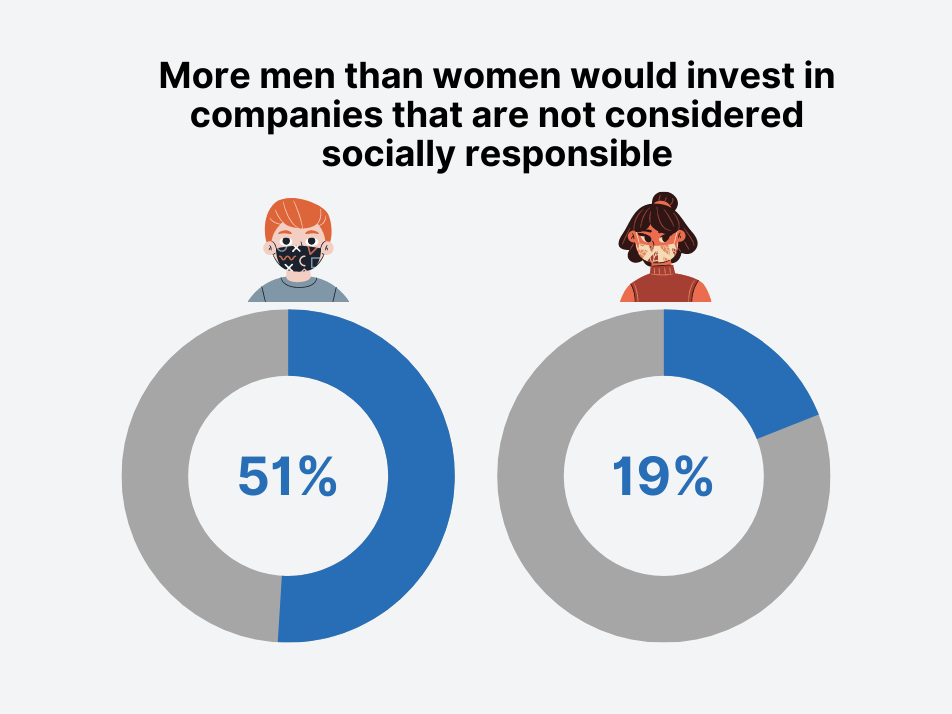

6. Women are more likely to invest in ESG funds

Many people, consciously or not, invest in a way that is inconsistent with their values in everyday life. For example, they might shop at sustainable stores or drive an electric car but then invest in companies that pollute the environment or pay workers poorly.

Women are more likely to align their personal values with their investments than men. According to a survey by Money Crashers, only 19% of women respondents said they would invest in a company that was not considered socially responsible, compared to 51% of men. A study by the Employee Benefit Research Institute (EBRI) found that 34% of women are more likely than men to prefer ESG funds if they are available in their plans, whereas 29% of men were.

In Europe, according to a study by Danske Bank, the largest bank in Denmark, only 41% of women were ready to invest in companies that ignored sustainability, provided they generated higher returns. Among men, the figure was 59%

Source: Money Crashers, Employee Benefit Research Institute (EBRI), Bloomberg, Danske Bank

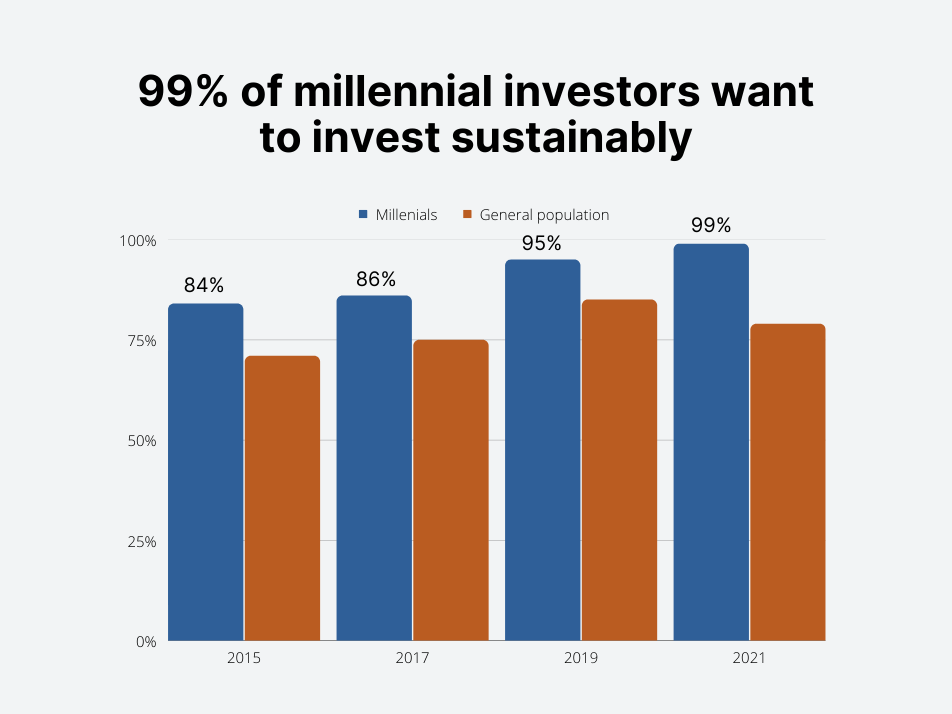

7. 99% of millennial investors want to invest sustainably

A study by Morgan Stanley found that nearly all (99%) US millennial investors were interested in sustainable investing, up from 84% in 2015. However, only 59% of the average millennial’s portfolio is actually invested in companies or investment funds seeking to make a positive social or environmental impact. It’s worth noting that the poll was done among investors with $100,000 or more in investable assets.

Source: Morgan Stanley

8. 48% of Americans are interested in sustainable investing

While 79% of American investors with over $100,000 in investable assets are interested in sustainable investing, only 48% of investors with $10,000 or more invested would consider it, according to Gallup. This suggests a difference in how much money retail investors have to invest and whether they would consider sustainable investments.

Source: Gallup

9. 76% of ESG investors are concerned about performance

The same study found that, when asked about their concerns regarding sustainable investing, the majority of respondents (76%) said they were worried about sacrificing returns, and 71% said they were concerned about the authenticity of sustainability claims made by companies. Although 99% of millennials say they are interested in sustainable investing, 83% also say that sustainable investing is a financial trade-off.

10. Only 35% of retail investors think about sustainability when making investment decisions

Money is the primary driver for most investors when making investment decisions, as it always has been. But that doesn’t mean people don’t want their money to do good – they just don’t think about it as much when making investment decisions.

Among US adults with more than $10,000 invested in the stock market, only 35% think about sustainability when making investment decisions. Female investors are 7% more likely to consider ESG factors than male investors when putting money in the stock market.

Source: Gallup

11. 78% of investors prefer high returns over sustainable/ethical values

When asked what was more important to them – making money or investing in companies that reflect their sustainable/ethical values – 78% of respondents said they think about getting returns on their investments, while only 35% said they think about sustainable values.

12. 155 of S&P 500 companies mention ESG initiatives

During each corporate earnings season, it is not unusual for companies to comment on their ongoing corporate goals and initiatives. After all, big companies are under constant pressure from the public to show that they’re good corporate citizens.

Of the 500 companies in the S&P 500 stock market index, 155 of them mentioned some form of sustainability or ESG goal during their Q4 2021 earnings calls. This is up from just 2 companies in 2017. According to FactSet, companies with higher scoring on environmental, social, and governance (ESG) metrics tend to discuss their ESG goals more often during their earnings calls than companies with lower ESG scores.

Source: FactSet

13. Only 11 S&P 500 companies are carbon neutral

We looked at the carbon footprint of companies in the S&P 500 index and found that only 11 companies have reached partial or full carbon neutrality. These include Alphabet (Google), Meta (Facebook), Microsoft, Goldman Sachs, MetLife, American Express, Capital One, Wells Fargo, Apple, Bank of America, and Delta Air Lines.

It should be noted that most of these companies have offset their emissions by investing in carbon credits or renewable energy rather than actually reducing their emissions. To be fair, it’s easier for a company that provides digital services, like Google or Facebook, to be carbon neutral than for a manufacturing company.

Source: Proprietary research

14. Streaming Netflix for one hour produces 100g of CO2e

Binging your favourite show on Netflix is one of the most popular pastimes during the lockdown, but it turns out that streaming video uses a lot of energy. Netflix has estimated that streaming one hour of video on its platform produces 100 grams of carbon dioxide equivalent (CO2e). That is equivalent to driving about 400 metres (a quarter-mile) in a gas-powered passenger car.

Source: Netflix

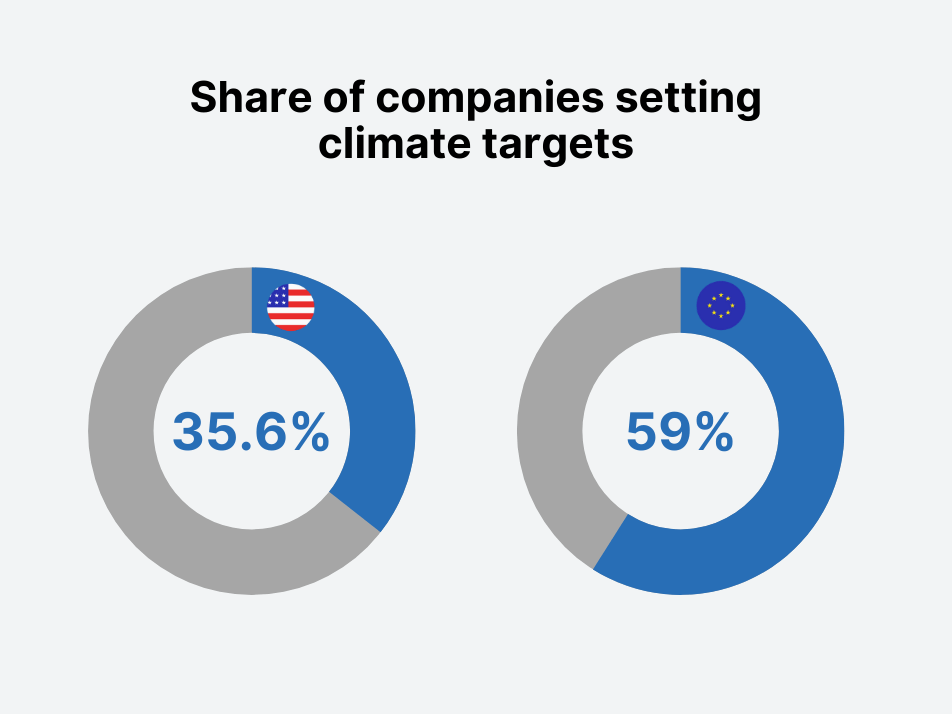

15. 59% of European companies have plans to reduce emissions

European large-cap companies have ramped up their sustainability efforts in recent years and are now leading the way when in promising to reduce emissions. An analysis by Standard & Poor’s found that 59% of European public companies have plans to reduce direct emissions and/or emissions associated with their purchased energy. Meanwhile, only 35.6% of companies in North America, 31.1% in Latin America, and 29.4% in Asia-Pacific have similar reduction targets.

Source: S&P Global

16. 19 members of the G20 have net-zero pledges

The net-zero pledge is a commitment to reduce greenhouse gas emissions to net-zero by 2050. The G20 countries account for 91% of the global GDP and 80% of the world’s emissions. So far, 19 members of the G20 have made net zero pledges, including the European Union, the United Kingdom, Canada, and Japan. However, most countries have not made their promises legally binding. So far, the G20 is falling behind on its commitments to reduce emissions.

Source: UN

17. Only 3 countries in the world are carbon neutral

So far, only three countries have achieved carbon neutrality: Suriname, Bhutan, and Panama. While Suriname and Bhutan are carbon-neutral, it’s important to remember that these countries make up a tiny fraction of the global carbon footprint. However, they are still important examples of what is possible. Bhutan’s legislation, for example, requires that the country maintain a forest cover of at least 60%. In Panama, forested area, which makes up 43% of the country, helps absorb more carbon dioxide than the country emits.

18. Morningstar has removed 1,600 ESG funds

While 2021 saw record-breaking amounts of money being funnelled into ESG funds, it was also a year of crackdowns on so-called “greenwashing.” The EU’s Sustainable Finance Disclosure Regulation (SFDR) went into force in March 2021 as part of a larger effort to combat false or misleading sustainability claims. As a result, Morningstar removed 1,600 or 27% of listed European ESG funds from their database that it believed were not in line with the new regulations.

Source: Bloomberg Law, European Commission

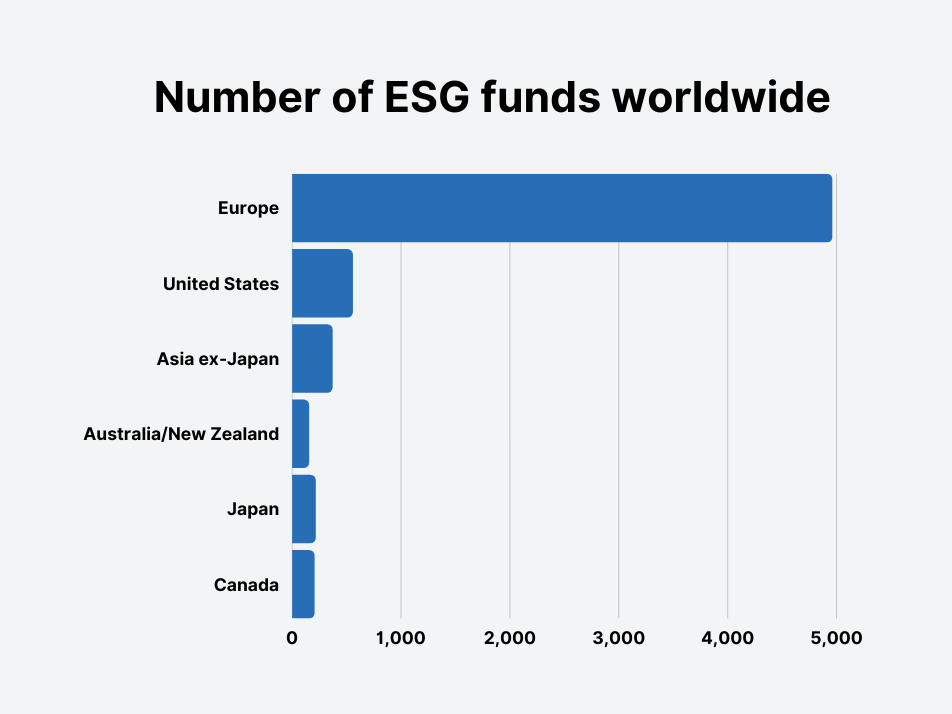

19. There are 6,452 ESG funds in the world

The number of ESG funds worldwide increased to 6,452 in Q1 2022, up from 4,153, or 55%, compared to the end of 2020. The majority of these funds are based in Europe (77%), with the US accounting for 9%, Asia (ex-Japan) just over 6%, and Australia/New Zealand at 2%.

Source: Morningstar

20. There are 534 ESG funds in the US

The number of ESG funds available to US investors increased to 534 in 2021, up 36% from 2020. In Q1 2022, that number had risen slightly, to 555 funds. Throughout 2021, 121 sustainable funds were launched, although some funds merged or were liquidated. In 2021, sustainable funds had a record $69.2 billion in net flows, which is 35% more than the previous record.

Source: Morningstar

21. Europe has 4,958 ESG funds

Nearly five thousand sustainable funds are available to European institutional and retail investors. In Q1 of 2022, European ESG funds made up 77% of the global total. The continent’s share of assets under management sat at $2,276 billion, equal to 82% of the world’s sustainable assets. The US, by comparison, only had 12% of the market share in the same quarter.

Source: Morningstar

22. Parnassus and iShares have the largest US ESG funds

In 2021, the largest actively managed ESG fund was the Parnassus Core Equity Fund, with over $32.0 billion in assets under management. The largest passively managed US ESG ETF was iShares ESG MSCI USA ETF, with over $25.0 billion in assets under management.

The Parnassus Core Equity Fund invests in US large-cap companies that the fund managers think perform well on environmental, social, and governance (ESG) metrics relative to their sector peers. The iShares ESG MSCI USA ETF is a fund that tracks the MSCI USA Index but with a more sustainable outcome.

23. Passive funds make up 40% of the ESG market, active funds 60%

At the end of 2021, 375 of the 534 sustainable mutual funds open to Americans were actively managed investments. In 2019, 81% of ESG fund assets were in active funds, but that number had dropped to 60% by the end of 2021. Investors have piled into passive funds in recent years, which are set to catch up and overtake their active counterparts in 2024.

24. ESG funds earn $1.8 billion in fees every year

The ESG asset-management industry earned $1.8 billion in fees from sustainable funds in 2021. That number is up from $1.1 in 2020, according to Morningstar. Historic inflows to ESG funds resulted in hefty fees for the best long-term fund managers, including Parnassus Investments, which amassed a staggering $320.7 million in fees in 2021. BlackRock, which owns the iShares brand of ETFs, lead the pack of passive ETF managers, taking in $116.5 million in fees from its sustainable funds.

Source: Bloomberg

The takeaway

ESG investing is much like putting solar panels on your house: it’s not so much about making money; it’s about doing (or feeling) good and saving the world for the future. Society is not going back to a rural way of living and primitive technologies, but institutional and retail investors are increasingly factoring in sustainability when deciding where to put their money in the modern world.