Capital Gains Tax Guide Portugal for 2023

We collected everything you need to know about taxes on capital gains in Portugal

Over the past decade, Portugal has become an incredibly popular spot for people from all over the world. They’ll even pay you to move to the rural interior of the country. And if you’re one of the many foreigners now living in the Land of Pastel de Nata — or if you’re considering making the move — you might also be investing in stocks, ETFs, mutual funds, crypto, properties, or some other asset.

But figuring out how those investments are taxed in Portugal can feel a bit like trying to understand a complex Fado song – every time you think you’ve got it, there’s another layer to uncover. And it’s especially frustrating for foreigners, who get a friendly “bem-vindo” but soon find themselves lost in a tax labyrinth as complex as a Portuguese tile pattern.

This guide aims to cover all you need to know about capital gains taxes in Portugal, including stocks, ETFs, bonds, properties, and cryptocurrency, as well as how dividends are taxed. You’ll also find guidance on calculating and reporting taxes to the Autoridade Tributária. Lastly, we’ll delve into the specifics of how capital gains tax applies to Non-Habitual Residents (NHRs) in Portugal and ways NHRs can potentially avoid taxes on foreign-sourced income.

👋 A necessary disclaimer: Although we use primary sources such as government websites to back up what we write, this article shouldn’t be viewed as official tax or legal advice. Think of it as a handy introduction to the country and its tax system. If you have any doubts, always talk to a certified specialist to figure out what you should do based on your unique circumstances.

Do you have to pay tax on capital gains in Portugal?

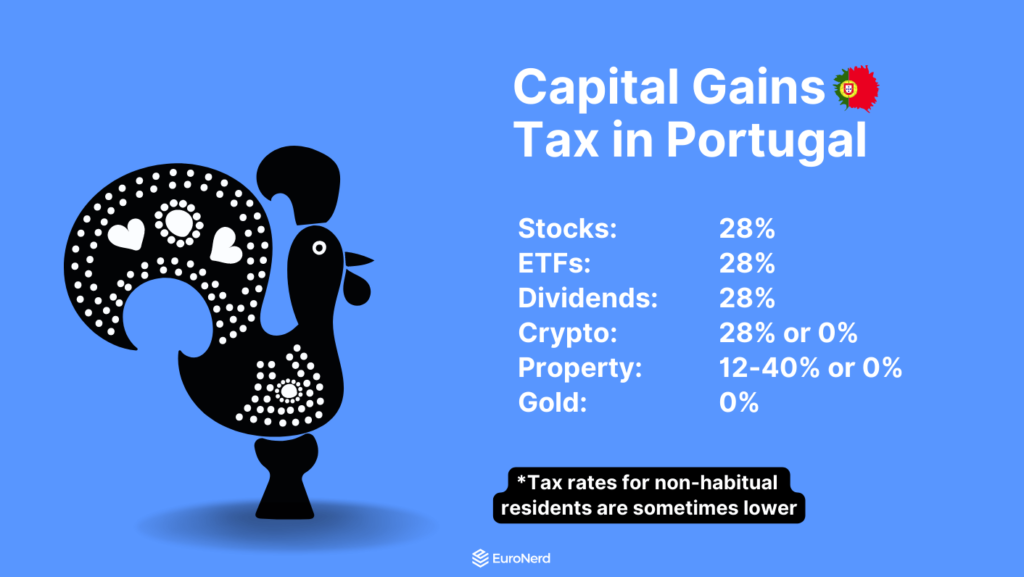

Yes, capital gains are taxed in Portugal — however, there are exceptions depending on what asset you’re investing in and whether you’re classified as an NHR.

Capital gains on stocks, ETFs, mutual funds, other securities and bonds are generally taxed 28% in Portugal. If you have any losses, those can be subtracted from your profits to reduce your tax burden.1 If you’re a high-income earner, be aware you’ll need to wait one year before realising your capital gains to qualify for the 28% rate. If you’re a U.S. citizen with NHR status, you’ll likely be taxed in the U.S. instead of Portugal due to a provision in the tax treaty.2

Dividends are also taxed at 28%, but if you hold the NHR status, you’re usually exempt from paying taxes on dividends if they are considered foreign-sourced.

Cryptocurrency profits are taxed at a rate of 28%, but you won’t have to pay any tax if you wait one year before selling. You also won’t attract capital gains tax if you swap one cryptocurrency for another without converting to fiat (traditional) currency. The 28% tax only applies when you sell your cryptocurrency for fiat currency.3

Property capital gains in Portugal are exempt from taxation if you use the profits from selling your main residence to purchase another home in Portugal or in the European Union within 36 months (or 24 months before). However, if you don’t reinvest the full proceeds or if it’s not your main residence, you’ll attract a tax on 50% of the gain at the scale rates of income tax.

Precious metals, like gold, as well as personal possessions, are usually exempt from taxation.4

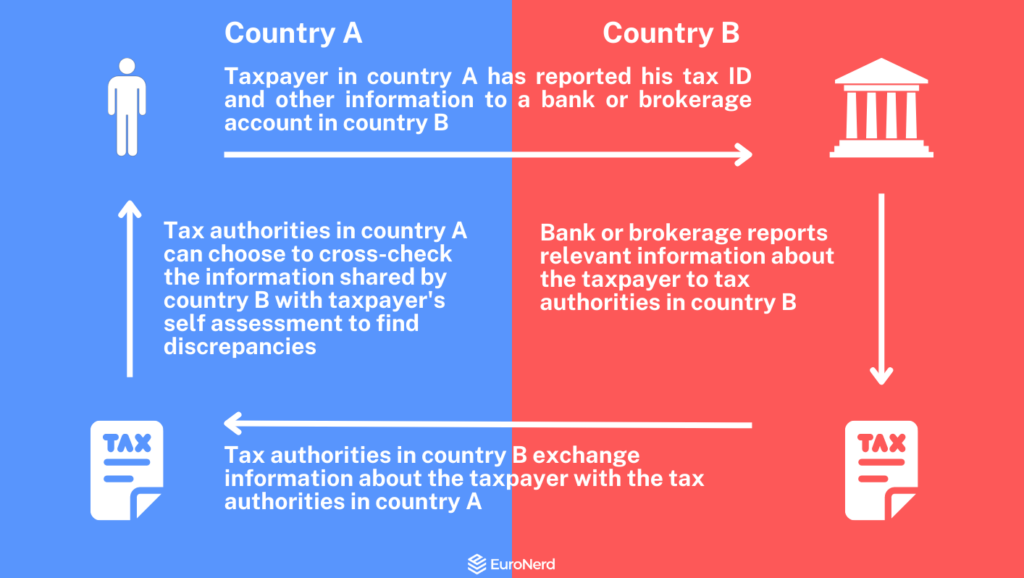

Does the Autoridade Tributária know about my investments?

If you informed your brokerage or bank that you live in Portugal and gave them your NIF, then yes – the Autoridade Tributária e Aduaneira (TA), the Portuguese Tax and Customs Authority, will most likely know of your investment accounts and foreign bank accounts. This is because financial institutions in most developed countries are forced to share information about their clients under the Common Reporting Standard (CRS). Brokerages and banks will report your information to their local tax authority, which in turn shares it with the Portuguese tax authority.5

Overseas properties are something the Portuguese authorities may be aware of, but typically only if you’ve mentioned their sale on your tax return or if they’ve obtained information through an international agreement. Typically, you’re only required to declare your non-Portuguese property if you sell them or receive rental income from them.

There’s really no point in trying to hide from the Portuguese tax authorities. In 2021, Portugal automatically exchanged 5,217,215 pieces of information with other countries, and this trend will only increase in the future. The good news is with a solid understanding of the capital gains tax system in Portugal and, if necessary, the guidance of an experienced lawyer or accountant, you should be able to navigate the Portuguese tax system with confidence and comply with all legal requirements.

Overview of capital gains taxes in Portugal

As an individual, the taxation of your capital gains and losses from stocks, ETFs, mutual funds, bonds, cryptocurrencies, property, and other investments are outlined in Portugal’s Income Tax Code, known in Portuguese as the Código do Imposto sobre o Rendimento das Pessoas Singulares (CIRS). Article 10, titled “Capital Gains,” outlines the general rules for capital gains, while Articles 71 and 72 specify the relevant tax rates. To gain a comprehensive understanding of the law, you can read the full version of the code online.

In a nutshell, Portuguese law requires you to pay 28% capital gains tax for profits earned from selling securities like stocks, index funds, ETFs, and bonds. If you have capital losses, you can deduct them from capital gains over the next five years. If you sell your cryptocurrency within one year of buying, you’ll also be taxed at 28%, but if you wait one year, the tax rate is usually 0%. To get a better overview, here’s a simplified look at the typical taxation of capital gains in Portugal.

- Shares (stocks): If you sell your shares in companies like Apple or Microsoft, you need to pay 28% capital gains tax on your profits. If you lose money on your shares, you can use those losses to offset your gains.

- ETFs: Just like stocks, if you sell ETFs like those from iShares or Vanguard, you’ll pay 28% tax on the capital gains.

- Mutual funds: Capital gains made from selling mutual funds are also taxed at 28%.

- Bonds: If you receive interest payments (coupon payments) on bonds, you’ll need to pay 28% in taxes. If you make a profit from selling bonds, you’ll pay 28% in capital gains tax. Government and corporate bonds are taxed the same way.

- Dividends: You’ll need to pay 28% in taxes on any dividends you receive from securities, including dividends from distributing ETFs and from dividend-paying stocks.

- Cryptocurrencies: If you hold onto your cryptocurrencies for more than a year, you won’t have to pay any taxes when you sell them. However, if you sell your crypto within a year, you’ll need to pay 28% in taxes. If you actively trade cryptocurrencies, it may be considered self-employment, and you’ll need to pay income tax and social security.

- Property: If you sell your primary residence, you won’t have to pay any capital gains tax as long as you reinvest the profits into another home within the EU. If you don’t reinvest the profits, you’ll need to pay a tax rate of 12% to 40% on 50% of the profits.

- Gold: If you sell gold bars and coins, you won’t have to pay tax on the profits. This exemption doesn’t apply to gold ETFs and other securities that provide indirect ownership of gold.

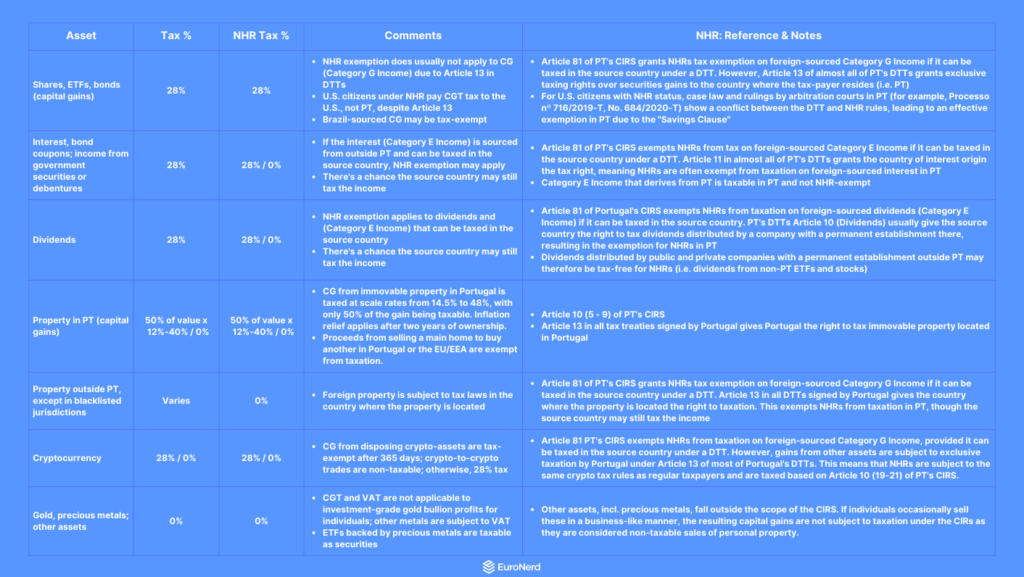

Here is an overview of how different types of investment income and capital gains are taxed in Portugal for ordinary and non-habitual residents. Keep in mind that these are just superficial guidelines. You should consult a tax-adviser to get an accurate understanding of your obligations:

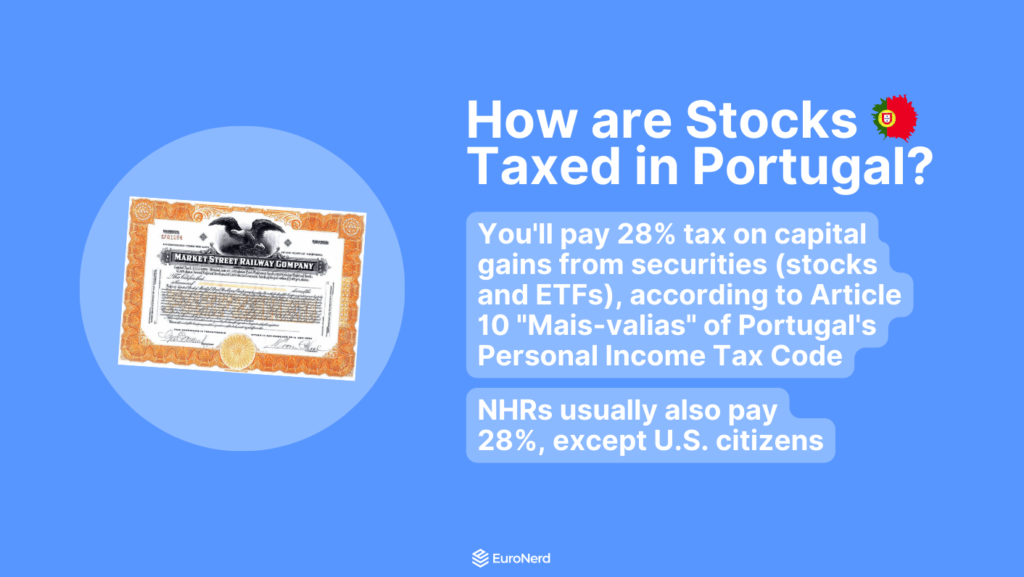

Capital gains tax on shares in Portugal

If you sold a share for more than you bought it, you’ve made a profit – a capital gain. If you’re a tax resident of Portugal, you need to pay 28% tax on this profit. However, you won’t have to pay social security contributions on these gains. If you had losses from selling shares, you can use those losses to offset your capital gains. This means you will only be taxed on your net profit, which is the amount after you subtract your losses from your gains.

If you belong to the highest income tax bracket in Portugal, you need to know that if you sell your shares within one year of buying them, Portugal will tax your profits at the highest rates, just like ordinary income, instead of the flat rate of 28%. This is a new rule that came into effect in 2023. Investors who belong to this category should therefore be extra mindful of short-term investing and active trading.

How to calculate capital gains

Every time you sell, trade, swap, or dispose of your securities – stocks, ETFs, etc. – you trigger a capital gain or loss. A capital gain or loss occurs when the value of your securities changes from the time you bought them to the time you no longer own them. If the value has gone up, you have a capital gain. If the value has gone down, you have a capital loss.

To figure out your gains, you’ll want to start with the cost basis. The cost basis is how much you paid for the security, including related fees. Portugal uses an adjusted cost basis method. This means that the cost basis can be adjusted to reflect the real cost of the security, including fees related to buying and selling, like commissions, trading fees, and currency exchange costs.

Once you know your cost basis, calculate your capital gain or loss by subtracting the cost basis and related fees from the sale price of the securities. In Portugal, the usual formula for calculating capital gains is:

Capital gains = Sale price – (Purchase price x Inflation coefficient)- Trading fees

- Sale price: This is the amount you received when you sold your stock, ETF or other security.

- Purchase price: This is the value of the security when you first got it. It could be the price you paid for it, or it could be the value when it was given to you as a gift or inheritance.

- Inflation adjustment: This helps to account for the effects of inflation over time. It’s officially called the inflation correction coefficient, or coeficiente de desvalorização da moeda. It’s a multiplier that increases the purchase value to take into account the time value of money and reduces the capital gain you need to report. The tax authority releases an official number each year you can use. According to Article 50 “Monetary Correction” of Portugal Income Tax Code, you’re allowed to adjust the acquisition value of your shares for inflation if more than 24 months have passed since you bought them.

- Trading fees: These are the costs of buying or selling a security. This could include fees like brokerage fees, trading fees, and currency exchange fees, but it does not include ongoing costs like securities custody fees. The expenses must be directly related to buying or selling the security to be included.

Example 1: Only profits

Let’s assume you bought 100 shares of Microsoft in 2019 for €88 each. At the time, your investment was worth €8,800 (= 100 x €88). In 2023, you decide to sell all of your Microsoft shares at a price of €225 each, for a total of €22,500 (= 100 x €225). You paid €10 in commissions and trading fees, which you are allowed to deduct. From 2019 to 2023, assume the official inflation coefficient is 1.01.

In this example, your capital gain would be €13,602 (= €22,500 – (€8,800 x 1.01) – €10). You would therefore have to pay €3,808.56 in tax (= €13,602 x 28%).

Example 2: Profits and losses

How do things look if you have made a profit with one stock and losses with another stock? Let’s say you bought 100 shares of Amazon in 2020 for €100 each = €10,000. At the same time, you also bought 100 shares of Facebook (now Meta) in 2020 at €100 per share = €10,000. For both stocks, let’s assume you paid 2 x €10 in commissions and fees. From 2020 to 2023, assume the inflation coefficient is 1.01.

In 2023, you decided to sell all of your shares to help finance your new home in Portugal. Your Amazon shares had gone up in value to €150 each, which means this position would be worth €15,000 in total. Your profit from selling your Amazon shares would therefore be €4,890 = €15,000 – (€10,000 x 1.01) – €10.

Unfortunately, your Meta shares had fallen to €80 per share and were now only worth €8,000 in total when you sold them. This means you had a loss of -€2,110 = €8,000 – (€10,000 x 1.01) – €10.

In this example, the calculation of your net capital gain would take into account both your profit from the Amazon shares and your loss from the Meta shares. Your total net profit would therefore be €2,780 = €4,890 – €2,110. This results in a tax bill of €778.4 (= €2,780 x 28%).

What if I received a stock for free?

It’s not uncommon to receive “free” shares. Many online brokerages give away free shares to attract new clients. If you received a stock for free, for example, as a gift, the purchase price (acquisition value) of the stock would be considered zero. However, when you eventually sell the stock, the sale price will be subject to capital gains tax – so all of your earnings from the sale will be considered profit and subject to capital gains tax.

Did Portugal always tax capital gains?

No, for a long time, Portugal was one of the countries in Europe that did not tax profits from shares if you held them for more than twelve months before selling. From 2010 until 2013, Portugal started taxing these profits at a rate of 20%, but individuals had a €500 yearly tax-free allowance. In 2013, the government hiked the capital gains tax to the current rate of 28%. Before 2023, Portugal also did not tax crypto profits, but today, there is a tax on cryptocurrency gains from digital assets held for less than 12 months.

High-income earners beware

Starting in 2023, if you make a profit from selling securities that you owned for less than 365 days and you belong to the highest tax bracket in Portugal (in 2023, that means if your income is €75,009 or more), you will have to pay a higher tax rate on that profit. The tax rate will go up to 48% (plus a surcharge of 2.5% or 5% if applicable) instead of the flat rate of 28%. This is because the government changed the tax rules to discourage short-term speculation.

Example 1: 28% flat rate

João’s yearly salary is €100,000. In January 2022, he bought 100 shares of Apple stock in and held onto them for over a year before selling them in February 2023 for a profit of €10,000. Even though João belongs to the highest tax bracket, and his taxable income is above €75,009, he qualifies for the flat rate of 28% tax on his capital gains because he waited 1 year before selling his stocks. João therefore has to pay: €10,000 x 28% = €2,800 in taxes.

Example 2: 48% rate + 2.5% surcharge

Maria also earns €100,000 per year. She also bought 100 shares of Apple stock in January 2022, but she sold them after just 9 months for a profit of €10,000. Because Maria’s taxable income, including the capital gain from her stock sale, is greater than €75,009, she must pay the high-bracket rate of tax on her capital gains, which is 48% + a 2.5% surcharge. Maria therefore has to pay: (€10,000 x 48% = €4,800) + (€10,000 x 2.5% = €250 in surcharge) = €5,050 in taxes.

Capital gains tax on ETFs in Portugal

Like many other European countries, Portugal taxes ETFs the same way as shares. This means you’ll pay 28% tax on the capital gains made from selling ETFs in Portugal. If the ETF distributes dividends, these are also taxed at 28%.

Example

Let’s say you purchased ETF units in 2015 worth €10,000 and sold them in 2023 for €15,000. The capital gain in this scenario would be €5,000, and the tax owed would be €1,400 (28% of €5,000) if we disregard the inflation coefficient and allowed expenses. If you bought the distributing version of an ETF, the dividends would be taxed at 28% in the year you received them.

Accumulating or distributing ETFs in Portugal

When it comes to ETFs and taxes, you might have heard that it’s better to go with accumulating ETFs rather than distributing ETFs. The reason for this is that you can delay paying taxes until you sell the ETF. Accumulating ETFs reinvest any dividends they receive from the underlying stocks, which doesn’t create a taxable event for you. Distributing ETFs, on the other hand, pay out dividends, which trigger a tax obligation when you receive them. By choosing an accumulating ETF, you can postpone your tax bill until you sell.

Capital gains tax on crypto in Portugal

Portugal used to be one of Europe’s crypto tax havens, but things have now changed slightly. Previously, most crypto transactions were considered tax-free, but the Portuguese government has now closed this loophole with their 2023 State Budget and amendment of the Income Tax Code. All is not lost, however, as the new law also provides exemptions for those who stay clear of short-term speculation.

Article 10 (“Capital Gains”) of Portugal’s Income Tax Code, which was previously reserved for stocks and other securities, now outlines the rules for crypto taxation in Portugal. The law doesn’t use the word “cryptocurrency” but relies on the broader terms of “digital representations of value stored electronically” and “crypto-assets”, etc., presumably to function as catch-all terms for any kind of digital asset.

How crypto is taxed in Portugal

If you’ve held your crypto for less than a year and made a profit from selling it, you’ll be taxed on those profits at the standard capital gains tax rate of 28%. However, if you’ve held the cryptocurrency for over a year, you can sell it tax-free, according to Article 10, Paragraph 19. This tax exemption only applies to cryptocurrencies that are not classified as securities and non-fungible tokens (NFTs). If you trade one cryptocurrency for another, there is also no tax.

When are crypto gains tax-free in Portugal?

There are two instances where you can sell your crypto tax-free in Portugal. The first case where you can sell crypto for fiat tax-free in Portugal is if you wait 365 days or more before selling. This is stated in Article 10, Paragraph 19 of Portugal’s Income Tax Code. For example, if you bought bitcoin in January 2022 and sold it to euros in February 2023, you wouldn’t pay any tax if you made a profit.

The second–and less well-known–case where crypto is tax-free in Portugal is if you trade one cryptocurrency for another. For example, if you trade or swap bitcoin for ether, or bitcoin for a stablecoin. This is stated in Paragraph 20. If you eventually want to trade the crypto assets for regular money (like euros or dollars), you would have to wait 365 days to benefit from the tax exemption; otherwise, you would have to pay a tax on the profit you made based on the value you first acquired the crypto assets.

What this means in practice is that the law allows you to legally circumvent the 365-day holding period requirement by exchanging your cryptocurrency for a stablecoin. After waiting 365 days, you can then convert the stablecoin into regular money. The reason behind this is that the government treats stablecoins the same as other cryptocurrencies.

Englobamento for crypto losses

If you choose the “englobamento” option to combine your personal taxes, you can carry forward your crypto losses to reduce the tax you owe on any gains and other income over the next 5 years. This can be useful if you have lost a significant amount of money on a cryptocurrency, as it reduces the base for your income tax.

Dividend tax in Portugal

Companies like Coca-Cola, Amcor, IBM, and many others share part of their profits with their shareholders in the form of dividends. Mutual funds and ETFs of the distributing type also do this. In Portugal, you pay 28% tax on dividends.

However, if you receive dividends from a company located in a country that is on Portugal’s blacklist or that Portugal doesn’t have a tax agreement with, you’ll have to pay 35%. Fortunately, most of the world’s biggest dividend-paying companies and fund providers are located in whitelisted jurisdictions.

A special rule is in place for Portuguese companies. If you receive dividends from a Portuguese company, only 50% of the dividends are taxed.

Tax on dividends from non-Portuguese companies

Unless you’re from Portugal, most of the companies you invest in are likely going to be based abroad. When you invest in a company outside of Portugal, you may receive dividends from that company, and figuring out your taxes involves a bit of legwork. The country where the company is located will typically take out a portion of the dividends as withholding tax, and the rate of withholding tax varies from country to country. To avoid double taxation (tax in the other country and in Portugal), Portugal has signed double tax treaties with several countries, including the United States.

For example, if you receive dividends from a U.S. company and you have filled out the W8BEN form with your brokerage, the U.S. will withhold 15%. You’ll then need to pay an additional 13% to Portugal, making a total tax of 28% on the dividends you received. Another example is if you receive dividends from a Dutch company. The Netherlands has the right to withhold 10% tax, and you will have to pay the remaining 18% to Portugal. If you have overpaid on the dividend tax, make sure to declare it on your tax return for a credit from the tax authority.

Example: Dividends from a U.S. company

Say you received $1,000 in dividends from a U.S. company. If you have filled out form W8BEN, your stock brokerage will withhold 15% or $150 of the initial dividend of $1,000. Post-withholding, this leaves you with $850 deposited into your trading account. Because the dividend tax in Portugal is 28%, you need to declare the received dividends on your tax return and pay the remaining 13% to the Portuguese state.

Tax on dividends from Portuguese companies

If you invest in Portuguese companies and use a brokerage or bank that is registered with Banco de Portugal, the Portuguese Central Bank, you will only be taxed on 50% of your dividends, according to Article 40-A. The entity that pays out the dividends will withhold the corresponding tax and pay it directly to the tax authority. In this case, you don’t have to declare anything unless you opt for “englobamento”, as all the paperwork and calculations are done for you. But it’s still a good idea to verify that everything has been reported and paid correctly.

Capital gains tax on property in Portugal

When you sell a property in Portugal, you might have to pay tax on your profits from the sale, but very often, you won’t.

If you’re a resident in Portugal or in the EU and you sell your home in Portugal, you’ll be taxed on half of your profits at tax rates that range from 12% to 48%. For example, if you make €100,000 in profits, €50,000 will be your tax base. You can subtract the cost of any improvements you made to the property in the 5 years before the sale–but remember to keep receipts and bank statements to prove your expenses. You won’t be taxed on the outright difference between the purchase and sale price, however, because your purchase price will be adjusted for inflation, which increases the purchase value and reduces your capital gain.

But, if you use the money from selling your property to buy another home or to build a new one in Portugal or in an EU/EEA country that has a tax treaty with Portugal, you won’t have to pay any tax. To get this tax exemption, your property must have been used as your primary residence or your family’s primary residence, and you must use the money from the sale within 36 months after the sale or 24 months before to buy that new home.

“Wealth tax” on valuable properties

Portugal doesn’t have a wealth tax per se, but since 2017, Portugal has been charging an annual tax called Adicional Imposto Municipal Sobre Imóveis (AIMI) on high-end properties. If your property (or properties) is worth over €600,000, you would be taxed an additional 0.4% to 1.5% per year. Couples who choose joint taxation receive a relief of €600,000 each, meaning that only if their property is worth over €1.2 million are they subject to AIMI.

Tax on gold in Portugal

There is no tax on profits from selling gold and other precious metals in Portugal. The only exception is for professional metal dealers who must receive authorisation and pay business taxes. But if you’re a regular individual who occasionally buys and sells precious metals, you can do so without having to pay any tax. The income tax code does not mention the asset, and it is therefore considered to fall outside the scope of personal taxation. You do need to pay VAT on metals except for gold.

Tax on paintings, collectibles, antiques, & other personal items

The default in Portugal is that you won’t be taxed on profits you make from selling your personal belongings such as paintings, rare wine, or collectable items like coins or that valuable set of rare Magic cards that you’ve been hoarding since the 90s. If your vintage bottle of Bordeaux or prized Charizard card happens to appreciate significantly in value, you can sell it off without worrying about losing a chunk of your profits to taxes.

However, if you purchase and resell item(s) with a commercial intention on a regular basis, there is a chance that the authorities will consider it professional income under Article 3 of the Income Tax Code. It’s not the size of the profits that is relevant; it’s the nature of how you made that profit.

Investment income Portugal NHR

The Non-Habitual Resident (NHR) programme is a set of tax incentives introduced by Portugal in 2009 to attract people and capital from abroad. The NHR programme exempts new residents from paying tax on income earned outside Portugal, including category E (e.g. interest and dividends) and category G (capital gains) if certain conditions are met. The NHR programme is set out in Article 81(5) of the Personal Income Tax Code (CIRS).

In order not to be taxed in Portugal under the NHR regime, the income must be potentially taxable in the source country under a double tax treaty (DTT) or the OECD Model Tax Convention and must not originate from a country on Portugal’s blacklist of tax havens. Whether NHRs are exempt from tax on capital gains, dividends, and other types of investment income therefore depends on the type of asset in question and whether the tax treaty grants taxing rights to Portugal or the other country.

Capital gains tax Portugal NHR

Unfortunately, capital gains on financial investments are usually not tax-exempt under the NHR programme. If you’re an NHR holder in Portugal, you’ll have to pay 28% tax on capital gains when selling securities, including shares and ETFs. The notable exceptions are if you’re a U.S. citizen or have capital gains sourced from Brazil.

While the NHR programme exempts foreign-sourced capital gains that can be taxed abroad under a tax treaty, almost all of Portugal’s tax treaties and the standard OECD model give taxing rights to the country where the seller of the asset is a tax resident. Capital gains are dealt with in Article 13 of all Portugal’s double tax treaties, or Article 14 in the case of the U.S.-PT treaty. Here, it is stated that “Gains from the alienation of any property other than those mentioned in paragraphs (1) and (2), shall be taxable only in the Contracting State of which the alienator is a resident.”

This means that Portugal will almost always have the right to tax your capital gains from the sale of securities and other types of “movable property” if you’re a tax resident of Portugal. Under the NHR rules, if the other country does not have the right to tax but Portugal does, the income will be taxable in Portugal. Brazil is the only country where the DTT says that capital gains from securities and any property other than that referred to in paragraphs (1), (2) and (3) may be taxed in both Contracting States. In theory, this grants Brazil the right to tax capital gains sourced from Brazil.

Capital gains tax on property NHR

Whether the profits from a property sale are tax-exempt for NHRs depends on where the property is located. If you’re an NHR and sell a property located abroad, the income you make from the sale is usually tax-exempt in Portugal unless it’s located in a blacklisted jurisdiction. However, if you sell a property located in Portugal, the income will not be exempt under the NHR scheme and will be subject to the normal rules for taxation of property sales.

The right to tax capital gains from immovable property is covered in Article 6 in almost all of Portugal’s tax treaties. Here, it’s stated that capital gains from selling a property are only taxed in the country where the property is situated. The general phrase you’re likely to encounter is “Income from immovable property may be taxed in the Contracting State in which such property is situated”.

Under the NHR rules, capital gains (Category G Income) are exempt if the other state has the right to tax, which is usually the case under Article 6. This means that you will not have to pay any tax on the property gains in Portugal. However, the country where the property is located may still tax the sale, depending on local rules.

Understanding capital gains under the NHR program

There is a kind of Byzantine logic to the NHR programme, which is what makes it difficult to navigate. It’s become a running joke among foreigners in Portugal that if you ask 10 different lawyers the same question, you’ll get 10 different answers about what is and isn’t exempt under the programme. To help you better understand the NHR rules, here is an overview that may help you determine whether the income is taxable or not in Portugal:

- The NHR program is officially called Decree-Law No. 249/2009, of September 23 (Decreto-Lei n.º 249/2009, de 23 de setembro). It’s not a separate law but rather an amendment to the Portuguese Income Tax Code.

- The section of the Tax Code that defines the relevant rules for NHR is found in Article 81, “Elimination of international double taxation”.

- Paragraph 5 of Article 81 says that individuals are exempt from paying personal income tax on foreign source investment income (Category E), real estate income (Category F), and capital gains (Category G) if:

- The income can be taxed at the source under a (DTT); or

- If there is no DTT, the income can be taxed at the source according to the OECD Model Convention as interpreted by Portugal and is not from a blacklisted tax haven jurisdiction nor considered a Portuguese source under domestic law.

- We now have to look at the tax treaty between Portugal and the country where the capital gains “arise”. These double tax treaties are usually pretty uniform for the countries Portugal has agreements with.

- To see which country has the right to taxation under the DTT, we need to find the relevant articles in the DTT. “Income from Immovable Property”, i.e. real property and land, is treated in Article 6. Dividends are treated in Article 10. Interest in Article 11. Capital Gains and movable property, i.e. securities, in Article 13.

To summarise, if the capital gains, dividends, interest, or other income from an asset or business can be taxed in the other state under a double tax treaty, you will often not be taxed in Portugal as an NHR. The specific Articles of the treaty between Portugal and the other country must be analysed to determine whether the other state has the right to taxation or if Portugal has the right to taxation.

It’s important to note that the phrase “may be taxed” is used in Article 81, Paragraph 5 (the “NHR Law”) of the Income Tax Code, which means that even if the other country has the right to tax but does not exercise that right in practice, the income will not be taxed in Portugal because it could legally be taxed in that other country.

Sources

- Autoridade Tributária e Aduaneira. CIRS, Art. 72. https://info.portaldasfinancas.gov.pt/pt/informacao_fiscal/codigos_tributarios/cirs_rep/Pages/codigo-do-irs-indice.aspx

- “U.S. Citizens and Portuguese NHR Tax Regime – Saved by the Savings Clause” https://www.korepartners.com/insights/us-citizens-and-portuguese-nhr-tax-regime-saved-by-the-savings-clause

- Autoridade Tributária e Aduaneira. CIRS, Art. 10, par. 17-22. https://info.portaldasfinancas.gov.pt/pt/informacao_fiscal/codigos_tributarios/cirs_rep/Pages/irs10.aspx

- Diário de Notícias. “Investimento em ouro escapa aos impostos.” February 22, 2012. https://www.dn.pt/dossiers/tv-e-media/revistas-de-imprensa/noticias/investimento-em-ouro-escapa-aos-impostos-2318607.html.

- OECD. “CRS by Jurisdiction.” Automatic Exchange of Information, OECD.