Interactive Brokers Statistics: Key Facts and Numbers for 2024

All the numbers you were looking for about the brokerage, plus some interesting titbits.

Founded as a one-man market maker firm in 1977, Interactive Brokers (IBKR) has grown to become one of the largest online stock brokerages in the world. Today, the company’s trading platforms are available in 218 countries and territories across every continent and are home to over 2.2 million professional and personal customers, with around 20% more being added every year.

The brokerage’s success can largely be attributed to its visionary founder, Thomas Peterffy, who arrived in New York in 1965 as a penniless immigrant. Peterffy, who grew up in communist Hungary, defied all odds to become one of the world’s wealthiest individuals by practically inventing digital trading and computers to the trading floors of Wall Street. By 1979, he had a team of four traders working alongside him; today, IBKR boasts nearly 3,000 employees worldwide.

Below, we collected the most interesting statistics about Interactive Brokers. Read on to find the latest insights about its financial performance, user base, market presence, and much more.

IBKR key stats and insights

- IBKR has 2.29 million users, compared to 2.09 million at the end of 2022

- 414 thousand investors joined IBKR in 2021, which was the year of the meme stock craze.

- IBKR generated $3.07 billion in revenue in 2022. Interest income made up 54.4% of IBKR revenues.

- Customers hold over $365.0 billion in client equity at IBKR.

- 150 exchanges in 33 countries are accessible to IBKR customers, which is the highest for any brokerage available to the general public.

- Through his ownership of IBKR, Peterffy has achieved the status of being one of the 100 richest people in the world.

- Despite being a U.S.-headquartered brokerage, most IBKR clients reside outside the U.S.

IBKR overview

Interactive Brokers was founded by Thomas Peterffy, an immigrant who fled communist Hungary to New York in 1965. He began his career as a technical drawer at a highway designing firm, where he taught himself computer programming. With this skill, he transitioned to Wall Street, where he worked for Mocatta Metals as a commodity trading software designer.

In 1977, Peterffy had saved enough to buy a seat on the American Stock Exchange to trade equity options under his own name. The year after, in 1978, he founded the company T.P. & Co to employ more traders and expand trading activities. In 1982, it was renamed Timber Hill Inc. and once again Interactive Brokers in 2001. Today, headquartered in Greenwich, Interactive Brokers logs around two million trades per day.

| Company name | Interactive Brokers Group |

| Company type | Public (Nasdaq: IBKR) |

| Headquarters | Greenwich, United States |

| Financial year | 1 January to 31 December |

| IPO date | 3 May, 2007 |

| Key people | Thomas Peterffy (Founder, Chairman), Milan Galik (CEO) |

| No. of employees | 2,850 (Q2, 2023) |

How many users does IBKR have?

Interactive Brokers has 2.29 million personal and institutional client accounts.

The brokerage’s client base started seeing significant growth in 2020, which aligns with the start of the previous bull market during the global lockdown. Another important growth booster may have been the removal of the inactivity and small accounts fee in July 2021.

Here’s the full breakdown of IBKR’s yearly user growth since 2008:

| Year | Number of client accounts |

|---|---|

| 2008 | 110.7 thousand |

| 2009 | 133.6 thousand |

| 2010 | 157.9 thousand |

| 2011 | 189.1 thousand |

| 2012 | 209.6 thousand |

| 2013 | 239.3 thousand |

| 2014 | 281.1 thousand |

| 2015 | 331.1 thousand |

| 2016 | 385.1 thousand |

| 2017 | 482.9 thousand |

| 2018 | 598.2 thousand |

| 2019 | 689.9 thousand |

| 2020 | 1.07 million |

| 2021 | 1.68 million |

| 2022 | 2.09 million |

| 2023, Q3 | 2.29 million |

Source: Interactive Brokers

It should be noted that it’s unclear how Interactive Brokers defines a “client account” and what the distribution is between personal and institutional clients.

Interactive Brokers vs competitors

Where do IBKR customers come from?

IBKR accepts clients from more than 218 countries and territories, which makes it the most widely available broker worldwide. The Company operates its automated global business in the U.S. and international markets on more than 150 electronic exchanges and market centres.

In 2022, 79% of IBKR customers resided outside the U.S., and over 50% of new customers came from outside the U.S. That’s a big difference from 2012 when 45% of IBKR customers resided in the U.S.

| Year | U.S. customers | Non-U.S. customers |

|---|---|---|

| 2012 | 45% | 55% |

| 2018 | 32% | 68% |

| 2022 | 21% | 79% |

Source: Interactive Brokers, SEC Filings

IBKR assets under management (AUM)

Client equity refers to the total value of investments, cash, and securities held by clients in their accounts at a brokerage.

In Q3 2023, IBKR held $365.0 billion in client equity. That’s 24% more compared to the same period last year despite the downturn in the markets in 2022.

| Year | Client equity |

|---|---|

| 2008 | $8.9 billion |

| 2009 | $15.2 billion |

| 2010 | $22.1 billion |

| 2011 | $25.1 billion |

| 2012 | $32.9 billion |

| 2013 | $45.7 billion |

| 2014 | $56.7 billion |

| 2015 | $67.4 billion |

| 2016 | $85.5 billion |

| 2017 | $124.8 billion |

| 2018 | $128.4 billion |

| 2019 | $174.1 billion |

| 2020 | $288.6 billion |

| 2021 | $373.8 billion |

| 2022 | $306.7 billion |

| 2023, Q3 | $365.0 billion |

Source: Interactive Brokers, SEC Filings

Individuals vs. institutional clients in IBKR

59% of customer assets on IBKR were owned by institutional clients in 2022, such as hedge funds, financial advisors, proprietary trading desks, and introducing brokers.

This means institutions held around $180.95 billion on IBKR that year, while individuals held $125.75 billion.

Who are IBKR’s best customers?

In 2022, IBKR made $1.506 billion in revenue from commissions and fees. Of that total, 0.931 billion or 62% was generated by IBKR’s U.S. entity, Interactive Brokers LLC, while $0.575 billion or 38% came from its non-U.S. entities. This suggests that U.S. clients are IBKR’s best customers, especially institutional clients, as they have the highest investments with the brokerage.

However, it should be noted that customers from several countries outside of the U.S., including Central and South America, also contract with IBKR’s U.S. entity.

What’s the average IBKR deposit size?

In 2022, IBKR had $306.7 billion in client equity and 2.091 million client accounts. On average, each account held $146,676 in assets with the broker.

IBKR daily average revenue trades (DARTs)

In the brokerage industry, Daily Average Revenue Trades (DARTs) are trades made by customers during trading days that generate payment for order flow, commissions, or fees for the brokerage.

In 2022, IBKR had 2.124 million DARTs, which is among the highest in the industry.

Here’s a comprehensive overview of the number of DARTs on IBKR’s platforms since 2013:

| Year | DARTs |

|---|---|

| 2008 | 357 thousand |

| 2009 | 347 thousand |

| 2010 | 379 thousand |

| 2011 | 444 thousand |

| 2012 | 413 thousand |

| 2013 | 486 thousand |

| 2014 | 566 thousand |

| 2015 | 647 thousand |

| 2016 | 660 thousand |

| 2017 | 688 thousand |

| 2018 | 862 thousand |

| 2019 | 833 thousand |

| 2020 | 1.79 million |

| 2021 | 2.57 million |

| 2022 | 2.12 million |

| 2023, Q2 | 1.87 million |

Source: Interactive Brokers, SEC Filings

IBKR measures Daily Average Revenue Trades (DARTs) as customer orders divided by the number of trading days in the period. The number of cleared DARTs is around 10% lower.

IBKR stocks and options trade volumes

With the increase in number of customers, the number of stock, options, and futures trades on IBKR has risen accordingly.

In 2022, IBKR customers traded a total of 325 million shares, 874 thousand options contracts, and 204 thousand futures contracts.

Here is a full breakdown of the number of trades on IBKR over a five-year period for each instrument:

| Year | Stocks (shares) | Options contracts | Futures contracts |

|---|---|---|---|

| 2018 | 198,909,375 | 358,852 | 148,485 |

| 2019 | 167,826,490 | 349,287 | 126,363 |

| 2020 | 331,263,604 | 584,195 | 164,555 |

| 2021 | 766,211,726 | 852,169 | 152,787 |

| 2022 | 325,368,714 | 873,914 | 203,933 |

These figures include both cleared customers for whom IBKR acts as an executing and clearing broker and also non-cleared customers for whom IBKR acts as an execution-only broker.

How many exchanges are supported by IBKR?

A market or exchange is a trading venue or financial market where financial instruments such as stocks, bonds, commodities, currencies, and derivatives are bought and sold.

IBKR supports 150 exchanges spread across 33 countries. To our knowledge, this is the highest number of markets supported by any broker available to retail investors.

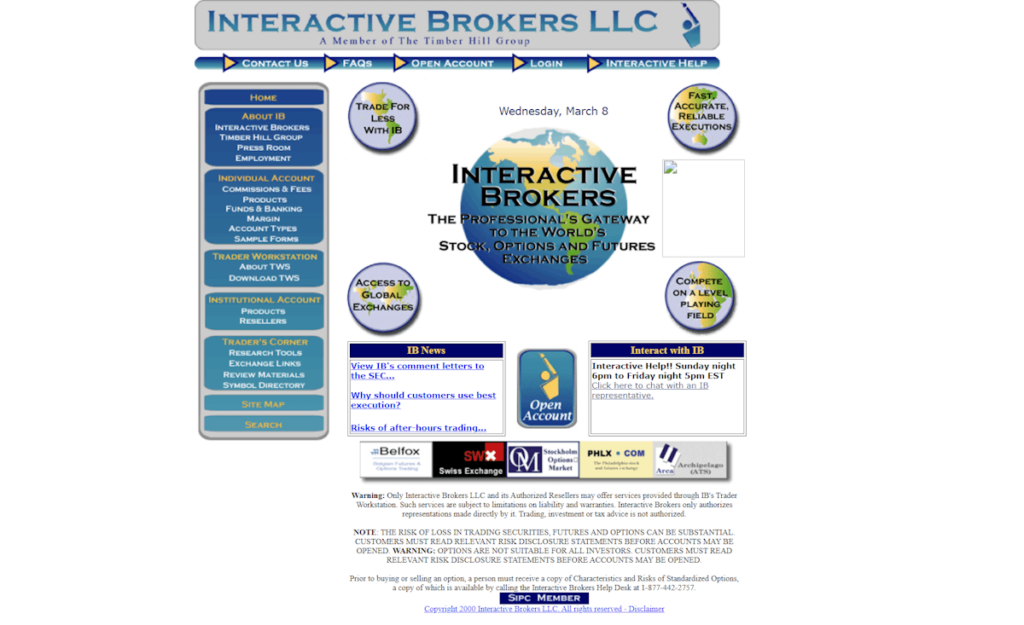

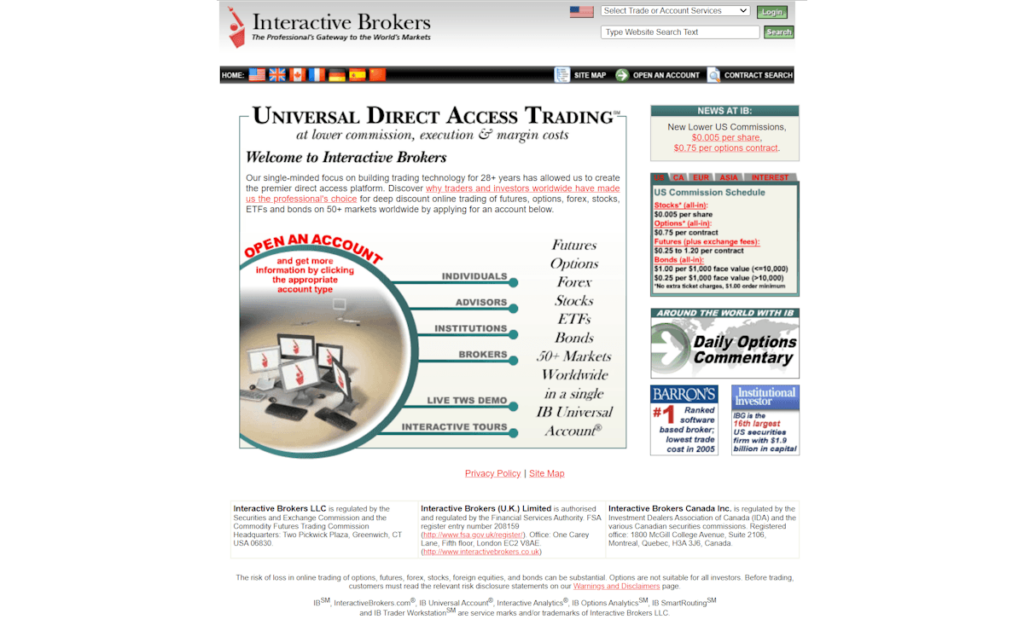

After reviewing the historical versions of their website, we found that in 1999, the company supported 24 exchanges, and this number increased to 70 in 2007 and 120 in 2018.

Here’s a table listing the number of markets supported by the IBKR platform since 1999:

| Year | Exchanges |

|---|---|

| 1999 | 24 |

| 2000 | 30 |

| 2005 | 50 |

| 2010 | 80 |

| 2015 | 100 |

| 2020 | 135 |

| 2023 | 150 |

Source: IBKR annual reports, archived website versions

How many currencies are supported by IBKR?

IBKR supports 24 currencies, which customers can deposit, exchange, and use the currency for their accounts. A base currency is the currency in which an investor’s account is denominated. It’s the primary currency used to calculate the value of trades, profits, and losses in the account.

Source: Interactive Brokers

IBKR revenues

IBKR generates revenues from commissions for clearing customer transactions, payments for order flow, and other fees such as market data fees. It also generates a significant portion of its revenue base from interest income on customer cash and margin loan balances.

In 2022, IBKR’s net revenues were $3.067 billion. That’s a 13.01% increase from 2021, when revenues were $2.714 billion.

IBKR’s income from commissions and fees saw a decline from $1.566 billion in 2021 to $1.399 billion in 2022. However, the new interest environment led to a significant increase of 45% in net interest income, rising from $1.148 billion in 2021 to $1.668 billion in 2022.

We’ve charted IBKR revenues since the beginning of 2009:

| Year | Revenue |

|---|---|

| 2009 | $1.10 billion |

| 2010 | $0.92 billion |

| 2011 | $1.36 billion |

| 2012 | $1.13 billion |

| 2013 | $1.08 billion |

| 2014 | $1.04 billion |

| 2015 | $1.19 billion |

| 2016 | $1.40 billion |

| 2017 | $1.70 billion |

| 2018 | $1.90 billion |

| 2019 | $1.94 billion |

| 2020 | $2.22 billion |

| 2021 | $2.71 billion |

| 2022 | $3.07 billion |

Source: Interactive Brokers

IBKR revenue distribution

Commissions and fees previously represented the majority of IBKR’s revenue. However, in 2022, interest income surpassed that source and became the company’s best revenue driver.

In 2022, commissions and fees made up 44.6% of IBKR revenue, while interest income, after interest expenses, made up 54.4%.

| Year | Commissions and fees | Net interest income |

|---|---|---|

| 2020 | 1.35 billion | 0.87 billion |

| 2021 | 1.57 billion | 1.19 billion |

| 2022 | 1.40 billion | 1.67 billion |

IBKR number of employees

As of 2023, IBKR employs 2,850 people globally at its 25 offices around the world. The number of employees has shown a steady increase over the years, with 2,721 in 2022 and 2,336 in 2021.

IBKR’s headquarters are located in Greenwich, Connecticut, and it operates primarily from there and its Chicago, Illinois office. Additionally, IBKR has a strong international presence, conducting business from offices in various countries, including Canada, the United Kingdom, Ireland, Switzerland, Hungary, India, China (Hong Kong and Shanghai), Japan, Singapore, and Australia.

Here’s a snapshot of IBKR’s headcount over the years:

| Year | Employees |

|---|---|

| 2012 | 891 |

| 2018 | 1,413 |

| 2020 | 2,033 |

| 2021 | 2,721 |

| 2023, Q2 | 2,850 |

Source: Interactive Brokers, SEC filings

FAQs

How does IBKR make money?

According to its annual reports, IBKR generates revenue through commissions on customer trades and interest earned on both customer and company cash balances, as well as interest on margin loans.

Is IBKR a bank?

No, IBKR does not have a banking licence. It relies on external banking relations around the world to facilitate customer deposits, such as Barclays and Citibank.

What is the most traded instrument on IBKR?

Shares (stocks) have the largest trading volumes on IBKR’s platforms, according to the company’s annual reports, followed by options.

How many customers does IBKR have?

IBKR has around 2.2 million personal and institutional customers.