How to Buy Gold in Europe: The 3 Best Ways to Invest in It

Gold is often seen as a hedge against inflation and other economic uncertainties. Here we take a look at the best places to buy gold in Europe, and what you need to consider when making your purchase.

Gold. It’s scarce, imperishable, and gleaming with a lustre that draws the eye no matter whether we think of it as kitsch or class. For thousands of years, the stuff has served as civilisation’s go-to store of wealth. Even our oldest books were captivated by its distinctive qualities. In Homer’s Iliad, for example, there are endless mentions of gold as a status symbol among the Greeks and Trojans.

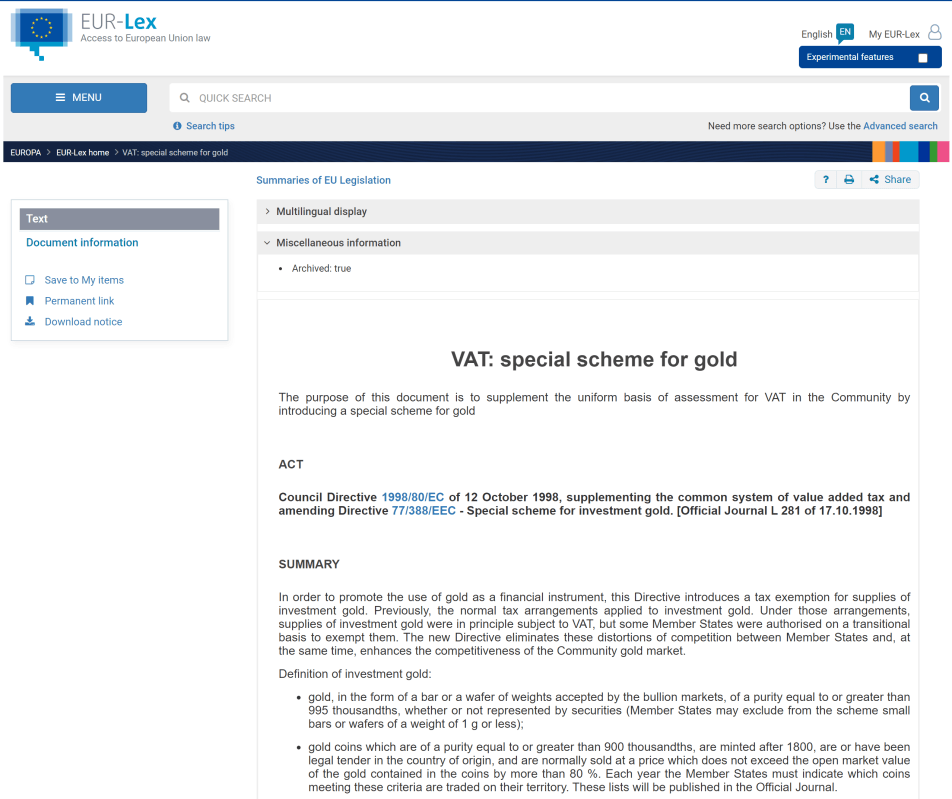

But gold has always been more than just a pretty trinket. It has been the basis for great economies, both ancient and modern. A specific quantity of gold used to be alloyed into coins or back the value of paper currency. Gold coins were the first form of money in Ancient Greece, and following them, paper currencies were backed by gold. The most powerful nations of the modern world maintain large gold reserves. Germany, for example, holds more than 3,374 tonnes of gold in its vaults.

One thing’s for sure: Whether you think gold is a primitive holdover or a timeless safe haven, it’s not going away anytime soon. It’s a limited resource that requires significant effort to extract. The United States Geological Survey estimates that only 20% of the world’s gold is left to be mined. Most of what’s dug up is kept in vaults underground or in jewellery boxes of private investors. It has been around for so long that it’s become a part of human culture and will no doubt continue to be for millennia to come.

The best ways to buy gold in Europe

Buying gold used to be a complicated affair. Today, you can do it online, and it’s as easy as trading stocks. These two most popular ways are to buy physical gold (bullion) in the form of coins or bars or invest in gold-backed exchange-traded funds (ETFs). There are also indirect, albeit more risky, ways to get exposure to gold, such as through mining stocks or futures contracts.

1. Gold bullion

Nothing beats having the actual physical gold in your hands. Gold bars and coins are referred to as bullion, and they come in different sizes and shapes. You can hold it, feel how heavy it is, and store it wherever you think is safe. The best thing is that it’s not hidden away in some computer code in your brokerage account; it’s right there in front of you.

Read more: The best online gold dealers in Europe

For true gold bugs, physical gold is the only way to go. From the Lydian Lion and the Roman aureus to the Byzantine solidus and Venetian ducat, in their minds, gold (and silver) has always been a tangible insurance policy against the unknown. Investors like real gold because they can storage it however they want. While it’s a high-density metal, it’s still mobile in modest quantities and can be hidden or taken with you in the event of an emergency. Its existence is not dependent on electricity or the internet. It’s the ultimate “offline money”.

Advantages of physical gold

You don’t need to be King Midas to understand why physical gold has long been the preferred store of value. It’s portable, divisible, and has had permanent worth throughout history. Gold is extremely ductile. You can shred it into thousands of pieces, yet it retains its real worth when the scraps are remelted. Roman coins recovered at the bottom of the ocean are as pure as the day they were struck 2,000 years ago. A gold coin is a gold coin, whether it was just minted or dug up out of the ruins of Troy.

Disadvantages of physical gold

The disadvantage of buying physical gold is that it comes with storage costs and risk. You have to keep it somewhere safe, which means either renting a deposit box from a bank or storing at home somewhere hidden. Also, bank safe-deposit boxes are unfortunately not as safe as many think. Authorities can easily seize deposit box contents with a bit of creative legal work.

Even if you don’t think this is relevant to you, there’s still another cost you have to factor in: insuring it against loss or theft. Many standard insurance policies don’t cover rare metals, so you might need to buy a separate rider. Also, when you buy gold coins or bars from a gold dealer, you have to pay a small premium over the spot price because the vendor has to cover his costs and make a profit.

How to buy gold bullion in Europe

The easiest way to buy gold bars and coins in Europe is from an online dealer. There isn’t a “cheapest” or “best” country to buy gold in Europe as most gold dealers buy their gold from the same suppliers. It pays to browse around to find the one with the best prices and reputation. You can also purchase gold from a physical vendor, collector, or from private individuals. The latter is not recommended unless you know the person well and have verified that the gold is genuine.

What about gold coins versus gold bars? There’s no definite answer. The most popular gold coins are the American Gold Eagle, Canadian Maple Leaf, South African Krugerrand, and Austrian Philharmonic. They have an aesthetic value over bars but usually trade at a premium over bars due to their commemorative value. Gold bars are less exciting design-wise but represent a more practical way of storing wealth.

2. Gold ETFs

Investing in gold through an exchange-traded fund (ETF) is the most popular way to get exposure to gold without having to take possession of the metal. Properly speaking, a gold ETF is called a exchange-traded commodity or ETC. They’re an easy, quick, and efficient way to invest. Gold ETFs are traded on stock exchanges like regular shares, and they aim to track the spot price of gold. When you buy a share of a gold ETF, you’re buying a stake in a basket of gold bullion held by the fund. You can move in and out of a position quickly, and there are no direct storage costs.

Advantages of gold ETFs

Gold ETFs are certainly not an exciting way to own gold, but they do have a few benefits. First, you don’t have to worry about storage and insurance costs because the gold is held by the fund. Second, buying and selling is as easy as trading any other stock. You can buy and sell gold ETFs anytime during market hours. There’s no waiting for delivery, worrying about where to store the gold, or finding a seller in case you want to get rid of it quickly. You just need an online stockbroking account, and you’re good to go.

Disadvantages of gold ETFs

The disadvantage of gold ETFs is that you’re never really buying the physical metal. You’re just buying a piece of digital paper that says you own gold, but you don’t actually have it. This means you’re subject to the whims of the stock market. In a weird, far-fetched but not completely unrealistic scenario, where the internet goes down, or warfare breaks out, you won’t have access to your gold to trade it.

How to buy gold ETFs in Europe

In order to buy gold ETFs in Europe, you need to have an investment account with a broker. You can find a list of recommended online stock brokers here, but any broker should do. The most popular European gold ETFs by fund size are:

- iShares Physical Gold ETC

- Invesco Physical Gold A

- WisdomTree Physical Gold

- Xtrackers IE Physical Gold ETC Securities

- WisdomTree Physical Swiss Gold

Keep in mind that regardless of the currency in which the ETF is traded, gold is almost always priced in US dollars. These ETFs are traded on London, Frankfurt, and Zurich exchanges, primarily the London Stock Exchange, XETRA, and SIX Swiss Exchange.

3. Gold mining stocks

An alternative way to get exposure to gold is through gold mining stocks. These are the stocks of companies that mine and produce gold. When you buy a share of gold mining stock, you’re buying into a company with real operations, costs, and profits. It’s similar to buying stock in any other company. This means that there’s a lot more to consider than just the price of gold when assessing these stocks.

Advantages of mining stocks

Stocks in commodities can be more volatile than the underlying commodity itself, which means there’s potential for higher returns. Gold miners are also often leveraged to the price of gold, meaning that they stand to benefit more from a rise in the price of gold. Investors can benefit from this leverage through rising share prices. If the mining company is successful over time, there’s the potential to benefit twice.

Disadvantages of mining stocks

Gold mining stocks are a much more volatile way to own gold. They’re subject to all the normal risks of owning stocks, plus they have the added risk that comes with being a commodities producer. Many of the largest mines are located in politically unstable countries, which means that there’s the potential for disruptions to production. The mining sector, like many other sectors, is increasingly investigated for its social and environmental impact, which may result in higher expenses and lower earnings.

How to buy mining stocks in Europe

There’s no difference between buying a gold mining stock and any other kind of stock. You just need a brokerage account, and you’re good to go. Research the company before you buy to make sure it’s a solid investment. Some of the largest miners are Barrick Gold and Newmont, both of which are dividend-paying companies with long histories.

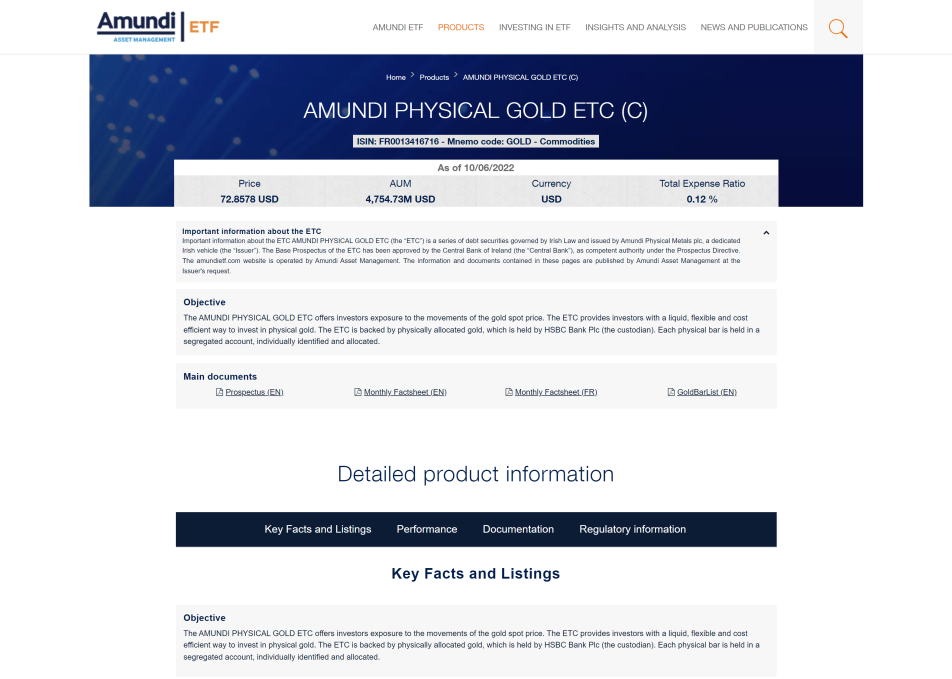

Is gold VAT free in Europe?

Yes, gold bullion in the form of coins and bars is VAT free throughout the European Union, the UK, and Switzerland. This means you don’t have to pay VAT on physical gold when buying or selling it. Other precious metals, including silver, palladium and platinum, are not exempt from VAT, although silver is VAT-free in some countries.

The main reason why gold is exempt form VAT and other metals are not is that silver and other metals are considered industrial components by our law makers, while gold is primarily viewed as a monetary asset. This difference does seem very arbitrary as silver and gold have been used as money for just about the same amount of time.

Best country to buy gold in Europe

There really isn’t a “best” country to buy gold in Europe. European online gold dealers source their gold from the same mints and add on a margin (their commission) depending on how much they think they can get away with. This means that the best and cheapest place to buy gold for European investors should be sought out by comparing prices between dealers. And it’s almost always the case that online shops have significantly lower prices than what you’ll find in a brick-and-mortar store.

For historic reasons, most European online bullion dealers are located in the UK, Switzerland, Estonia, and Germany. However, even in these countries, prices vary significantly from one seller to the next. The only way to ensure you’re receiving a fair price is to compare rates across several dealers before making a purchase. Before you purchase, always do your research. Be careful of anyone who promises prices too good to be true.

Import duty is the main cost you need to check up on when buying gold online from a dealer in another country. For example, if you live in the EU and buy physical gold from the UK or US by post and have that bullion shipped to your home address, your local customs officials may charge import duties and taxes. However, there would typically be no charges if you bought the same gold from a dealer located in another EU member state.

If you bring physical bullion with you on your person, many EU countries have a threshold of EUR 10.000, at which point you need to declare the value of your monetary instruments to customs. This rule applies to investment-graded gold bars and coins, which are typically also exempt from VAT in the EU. However, there are significant differences in how various EU countries apply these rules, and it’s always best to check the website of your national customs office before purchasing online or bringing bullion with you physically.

Buying gold through a company

Gold is used by a wide range of businesses, both large and small, to preserve purchasing power. Companies with substantial cash reserves also use gold to avoid negative interest rates levied by their bank. They buy gold as part of a risk management plan and to protect against inflation, rather than seeking to make a profit. Many companies have far more cash on hand than it needs for day-to-day operations, but they still need access to liquidity for long-term planning purposes.

You can buy gold through a limited company the same way you can as an individual. Your company can purchase gold bullion or invest in gold ETFs through a brokerage account. If you run a trading company that generates a profit, buying gold could be a way to retain purchasing power for longer-term needs and avoid the hidden extra tax of inflation.

How to store gold

If you’re buying physical gold, there are two ways of storing it. The first is to keep it in your own possession, usually at home. This is not always the safest option because your home could be burglarized or confiscated by the authorities. The second storage option is to use a custodian service to store your gold in a professionally-managed and insured vault. The cost of this service will depend on the size of your gold holdings and how often you want to access them.

- Storage at home: If you’re going to store your gold at home, it’s essential to take some basic security precautions. First, never tell anyone how much gold you have or where you’re storing it. Second, don’t keep all of your gold in one place. Divide it up and store it in different locations. Third, consider if a safe is the best way to protect your belongings. You can hide your belongings in less obvious places, like a secret compartment, a birdhouse, or a cavity in a piece of furniture. There’s no shortage of creative options.

- Custodian storage: If you decide to use a custodian service, there are a few things to look for when choosing a provider. First, make sure the company is insured. Second, check to see if the company has been audited by a third party. Third, find out where the company stores its gold and how often you can access it. Fourth, ask about fees and charges. Some custodian services will charge a fixed annual fee, while others will charge per amount stored.

Self-custody implies that you put your faith in yourself and your storage method. There is no third party, such as a bank, involved. This eliminates the fear of the government or other organizations seizing your gold. When you use a custodian, you must trust the custodian and the jurisdiction in which they operate. If you’re storing gold in another country, be sure you understand the political and economic risks involved. Ultimately, the best storage option is a personal preference.

Differences between coins and bars

Coins have higher premiums than bars. The premium is the additional cost charged above the gold spot price attributed to manufacturing, distribution, and dealer mark-up. For example, it will be more expensive to produce, pack, vault, and sell 250 gold coins than doing the same with a single bar. That’s why gold bars are usually less expensive per gram or ounce than coins.

Collector coins

Some coins are more popular among collectors than others, and certain collector coins can be worth a lot more than their weight in gold. For example, the 1907 Saint-Gaudens $20 coin is worth thousands of dollars because only a few were made, and they’re highly sought after by collectors.

Some coins minted in a certain period can be valuable investments. This is similar to how some people invest in vintage whiskey or wine. Of course, there is no guarantee the price of a collector coin will go up. Most coins are not worth more than their weight in gold and will be worth less because of the premium.

Standard bars

Gold bars come in various sizes, from 1 gram up to 400 ounces. Ounces are standard weights used in bullion trading and date back to 15th century England. Smaller bars have higher premiums similar to those of gold coins, while larger bars have lower premiums.

Buying “in bulk” usually saves money because you pay less per ounce of gold. The larger the size of gold bars or silver bars, the more value they offer when you buy them. However, when you sell your gold, you need to sell it in the same size you bought it in later. You can’t sell just a part of it.

FAQs

Which country in Europe has the cheapest gold?

We often read that Switzerland or the UK has cheaper gold than the rest of Europe. That’s not true. The cheapest place to buy gold in Europe today is online, not in any particular country. The price of gold is more affected by how much you buy than where you get it. The gold market is a worldwide market in which supply and demand drive pricing. If the price is different in two different markets, traders will quickly buy and sell the gold to make money from the price difference and even out those price differences.

How much gold does Europe have?

According to the World Gold Council, central banks in Europe held a total of 15,066.88 tonnes of gold at the end of 2021. The top five countries with the largest gold reserves are, in order: Germany (3,359 tonnes), Italy (2,452 tonnes), France (2,436 tonnes), Russia (2299 tonnes), and Switzerland (1004 tonnes).

When did European currencies stop being backed by gold?

Great powers have been in and out of the gold and silver standard many times throughout history. What historically happened was that countries would replace gold or silver backed money with fiat backed money to expand military budgets during wartime. For example, king Frederick IV of Denmark-Norway temporarily suspended the convertibility of Denmark’s silver coins and replaced them with newly credit papers to finance his efforts in the Great Northern War in 1700–1721.

During the 20th, trust in rare metals was gradually been replaced with trust in fiat money backed the government (or trust in “men with guns”, as Paul Krugman has bluntly formulated it). Most countries in Europe kept a partial gold standard until the beginning of World War I, but when the war started nations had to print money at a rapid pace to finance their war efforts. Post World War I, there were countries that attempted to reintroduce the gold standard, but since then, almost all have gone completely off the gold standard since 1971. The most noticeable exemption is Switzerland, which kept a partial gold standard until the year 2000.

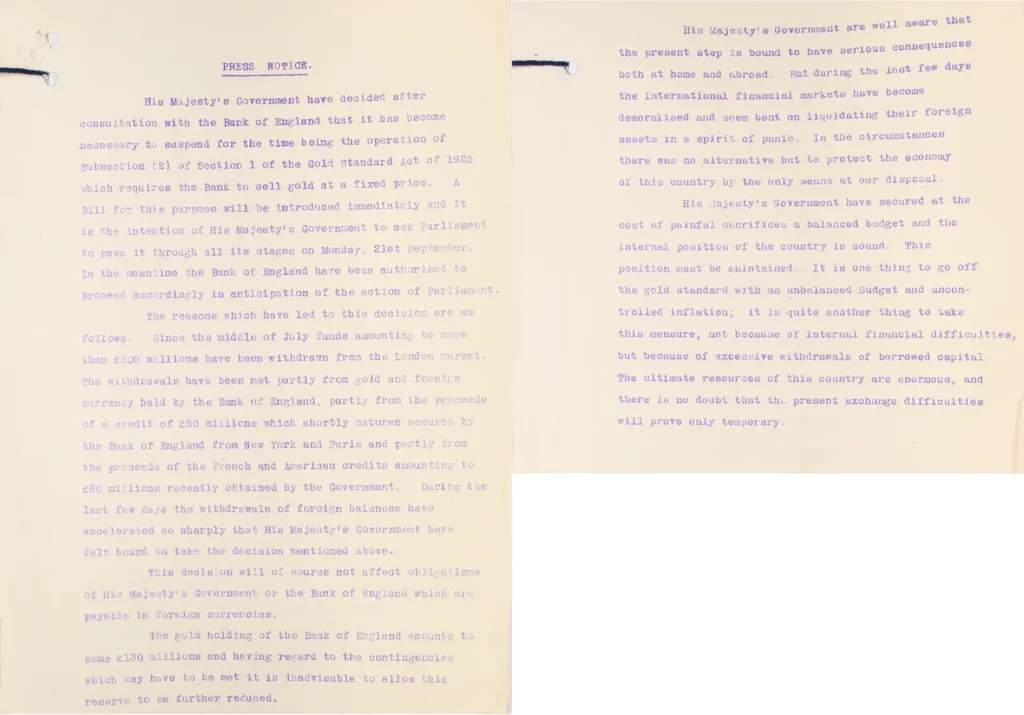

Another country that’s been on and off the gold standard several times is Great Britain. During WWI, it suspended the convertibility of its currency into gold. In the post-war era, gold was briefly reintroduced, until it was abandoned in 1931.

The takeaway

Central banks around the world are repatriating their gold reserves from overseas storage facilities these years, and some are amassing the metal at an unprecedented rate. It’s worth considering why they are doing this and whether it’s a good idea for private investors to follow suit.

If you want to buy gold in Europe, you have plenty of options when it comes to investment vehicles and different ways to store your gold. With the advent of online gold dealers, one thing is certain: buying gold in Europe is easier than ever before. Those sceptical of central banks or central authorities, believe in the right to privacy, or are worried about another global economic crisis should consider owning gold as a physical commodity. For those looking for the stability that comes with owning gold or simply want to speculate on price movements, ETFs may be the way to go as the premiums are much lower.

Whether you believe gold investments are a hedge against inflation or modern monetary policy, one thing is for sure: it’s never gone out of fashion. Ultimately, the best way to buy gold in Europe will depend on your individual financial goals and risk tolerance.