The Best Online Stock Brokers in Europe for 2023

During Roman times, people journeyed to the Forum Romanum to trade shares. Now, the marketplaces have moved online, but the choice is overwhelming. This comprehensive look to the best online brokerages in Europe will help you navigate today’s virtual plaza of options.

If you’re looking to secure your financial future through the capital markets, you’ll need access to an online brokerage platform. An online broker lets you trade instruments like stocks, ETFs, bonds, and options so you can build a portfolio that meets your investment goals.

But for European investors, it can be challenging to find a trustworthy low-cost broker available in their country. Especially one that will be around in the long run. So, we put the most popular stock brokers in Europe through a series of different tests to see which one is truly the best, cheapest, and most reliable. Here’s what we found out.

Best Online Brokers in Europe

A growing number of people use fee-free neobrokers to invest in capital markets. But investors should pay attention to the potential risks of unlimited free trading. We selected the best brokers based on a number of objective and subjective criteria (scroll down to get the picture). Long-term wealth accumulation and non-gamification were two of the main criteria for this ranking.

Here are the best online brokers in Europe for 2023, based on our research:

Whether single stocks or ETFs are part of your strategy, you’ll want to compare different brokers to find the one that best suits your needs. Considerations might include account fees, availability in your jurisdiction, the range of markets and products you want to trade, ease of use, and the broker’s mobile app.

5/5

Interactive Brokers continues to dominate the European brokerage scene thanks to its superior product offerings, highly competitive pricing, and, most importantly, time-tested reliability and accessibility across Europe without any fuss.

Fees: $0.35 per US stock trade, €1.25 per European stock/ETF trade; $1.00/contract for US options, ~€1.00/contract for European options.

Supported European countries: Albania, Andorra, Austria, Belgium, Bosnia and Herzegovina, Bulgaria, Channel Islands and Jersey, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, Isle of Man, Ireland, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Moldova, Monaco, Montenegro, Netherlands, North Macedonia, Norway, Poland, Portugal, Moldova, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, United Kingdom.

Products: Stocks, ETFs, options, futures, bonds, currencies, CFDs, metals, bonds, cryptocurrencies, mutual funds.

Trading platforms: Client Poral (web), Impact, GlobalTrader, IBKR Mobile, Trader Workstation, IBKR APIs.

Where your account is based: In Ireland (IBKR Ireland Limited), Hungary (IBKR Central Europe Zrt.), or the UK (IBKR U.K. Limited).

4.5/5

DEGIRO‘s low-cost ETF offering makes it a great choice for buy-and-hold investors. It’s location in Germany and the Netherlands, trusted jurisdictions, is a huge plus, with the added benefit of €100.000 cash protection.

Fees: $2.00 per US stock trade, €4.90 per European stock trade, €1.00-3.00 per ETF trade; $0.75/contract for US options, €0.75/contract for European options.

Supported European countries: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, French Guiana, Germany, Greece, Guadeloupe, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Martinique, Mayotte, Netherlands, Poland, Portugal (including Azores, Madeira), Reunion, Romania, Saint Martin, Slovakia, Slovenia, Spain (including Canary Islands, Ceuta and Melilla), Sweden, Switzerland, United Kingdom.

Products: Stocks, ETFs, options, futures, bonds, currencies, metals, bonds, cryptocurrencies (ETNs), mutual funds.

Trading platforms: Web app, mobile app.

Where your account is based: In the Netherlands with flatexDEGIRO Bank Dutch Branch. Cash is held in Germany with flatexDEGIRO Bank AG.

4.0/5

XTB‘s large selection of commission-free real stocks and ETFs, which is available in 9 countries, combined with its time-tested track record of over 20 years, makes it a dependable choice, though it lacks the features of bigger contenders.

Fees: $0.00 per US stock trade, €0.00 per European stock/ETF trade.

Supported European countries: Stocks and ETFs with ownership of the underlying asset are available in the Czech Republic, France, Germany, Poland, Portugal, Romania, Slovenia, Spain, United Kingdom.

Products: Stocks, ETFs, CFDs (on various assets).

Trading platforms: xStation 5 (web app), xStation Mobile (mobile app).

Where your account is based: In Poland with XTB S.A.

4.0/5

Scalable Capital, available in 6 countries, offers free ETF and stock savings plans, cash interest, and trusted German jurisdiction with €100,000 cash protection in Baader Bank; however, its continuous operating losses are a concern for some.

Fees: €0.00-0.99 per US stock trade, €0.00-0.99 per European stock/ETF trade.

Supported European countries: Austria, France, Germany, Italy, the Netherlands, Spain.

Products: Stocks, ETFs, bonds, mutual funds, cryptocurrency ETPs, derivatives.

Trading platforms: Web app, mobile app.

Where your account is based: In Germany with Scalable Capital GmbH.

4.0/5

Trade Republic, Eurozone-wide available, offers around 2,500 stocks and 2,200 ETFs at no charge, 2% p.a. interest on uninvested funds, and cash protection up to €100,000. But, its significant operating losses may give some investors pause.

Fees: €0.00-1.00 per US stock trade, €0.00-1.00 per European stock/ETF trade.

Supported European countries: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, Spain.

Products: Stocks, ETFs, derivatives.

Trading platforms: Web app, mobile app.

Where your account is based: In Germany with Trade Republic Bank GmbH.

3.5/5

Lightyear‘s €0 ETF trades and $1 US stock trades are nothing revolutionary, but its interest-paying multi-currency accounts can be a draw for some. But their relatively short history and Estonian location may raise some eyebrows.

Fees: ~$1.00 per US stock trade, €1.00 per European stock/ETF trade.

Supported European countries: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain, and United Kingdom.

Products: Stocks, ETFs.

Trading platforms: Web app, mobile app.

Where your account is based: In Estonia with Lightyear Europe AS.

| Interactive Brokers | DEGIRO | Saxo Bank | XTB | Trade Republic | Scalable Capital | Swissquote | |

|---|---|---|---|---|---|---|---|

| Founded | 1978 | 2008 | 1992 | 2002 | 2015 | 2014 | 1996 |

| No. of securities licenses | 11 | 2 | 9 | 6 | 1 | 1 | 7 |

| Assets under management | USD 373.8B | EUR 43.9B | DKK 640B | ? | EUR 6.0B | EUR 2.5B | CHF 33.5B |

| Countries available (Europe) | 44 | 18 | 44 | 7 | 6 | 5 | 44 |

| Securities lending | Optional | Yes | No | No | No | No | No |

| Execution venues | Multiple | Multiple | Multiple | Multiple | Single | Single | Multiple |

| Payment for order flow | No | No | No | No | Yes | Yes | No |

| Bank license | No | Yes | Yes | No | Yes | No | Yes |

| Publicly traded | Yes | Yes | No | Yes | No | No | No |

| Cash protection | €20K-€100K | €100K | €100K | €20K | €100K | $100K | €100K |

1. Interactive Brokers

The foundations of Interactive Brokers (aka “IBKR” or “IB”) were laid all the way back in 1973 by Thomas Peterffy (Péterffy Tamás), an industrious person, to say the least. Peterffy is a Hungarian-born, now American billionaire who arrived in New York in 1965 with $100 in his pocket. If you go online and watch videos of him, you’ll discover that he’s a no-nonsense, old-school guy, completely self-made.

Peterffy started out as a software developer on the American Stock Exchange and practically invented modern electronic trading. He helped introduce the first handheld computers on the trading floor in 1983 and the first fully automated algorithmic trading system in 1987. Many of Peterffy’s innovations were initially banned from the trading floor because they were considered too disruptive to the existing state of affairs, although they are now standards in the industry.

Strengths

- Interactive Brokers is the oldest and by far the largest broker available in Europe. It had over $10.00 billion in equity capital and $1.3 billion in pretax profit in 2020. On average, 50,000 new customers signed up to IBKR every month in 2021, and it held $373.8 billion worth of customer assets at the end of that year. IBKR is a member of NYSE, FINRA, and SIPC. Interactive Brokers Group subsidiaries are regulated by securities agencies and financial authorities worldwide.

- IBKR offers more trading products than any other European online broker, including stocks, ETFs, and bonds to options, futures, and forex. It provides access to over 150 markets in 33 countries, including the NYSE, NASDAQ, LSE, Euronext, and Deutsche Börse.

- IBKR uses multiple execution venues, does not receive payment for order flow, and does not limit your access to a single or few select stock exchanges. It uses Smart Order Routing (SmartRouting) to route orders to the ECN or market maker with the promise of obtaining the best execution price, speed, and overall cost.

- Customers of IBKR are not required to lend their shares to short-sellers. Investors can freely choose to participate in the optional securities lending program and earn around 50% of the earnings IBKR obtains from borrowers.

- IBKR accepts customers from almost every European country, territory, and dependency and has offices in the UK., Switzerland, Hungary, Estonia, and Ireland (in addition to its headquarters in Greenwich, Connecticut, USA, and global presence in Australia, Canada, China, Hong Kong, India, Japan, Russia, and Singapore).

- There are no gamification, social, or incentivizing elements on IBKR’s platforms that encourage reckless day trading among retail investors. It feels more like a place that caters to serious investors about their money.

Weaknesses

- IBKR has long been criticized for its poor customer service, with complaints ranging from slow response times to not resolving customer issues. The live chat function is well-hidden on the website and only available during US market hours. It seems they haven’t been able to scale their customer service with the explosive growth. On the other hand, the FAQ section has been expanded considerably, which has improved some customer service issues.

- IBKR does not hold a bank license in Europe. It keeps customers’ uninvested cash balances in pooled accounts with large banks within and outside the EEA, such as Citibank in Germany and money market funds. Although Client Assets are kept separate from Company Assets by law, it’s unknown what would happen to money deposits if those banks failed.

- Despite its attempts to establish itself as a European brokerage, it lacks a genuinely local feel. The website and all of the materials have a strong American flavour to them. This is only a minor complaint, but it might still put you off.

Current status

IBKR went public in May of 2007 and is one of the few brokerages that has been profitable every single year since then, despite the 2008 financial crisis. The company has never relied on “Silicon Valley” methods to cut fees for retail investors by burning through venture capital, but has found other ways to organically sustain its organization despite the increasing competition.

The company is headquartered in Greenwich, Connecticut but has a significant international presence with offices worldwide. Following Brexit, in 2021, Interactive Brokers stopped serving continental European clients through its UK subsidiary. They transferred them to two new branches in the European Union: Interactive Brokers Ireland Limited (“IBIE”) and Interactive Brokers Central Europe (“IBCE”) in Hungary.

2. DEGIRO

DEGIRO was launched as ‘deGiro’ (giro meaning the transfer of funds) in 2008 by five former employees of BinckBank, another Dutch brokerage that was recently acquired by Saxo Bank. DEGIRO initially targeted professionals, and it created its own hedge fund, the HiQ Market Neutral Fund (which was ironically one of the worst-performing funds in 2015). In 2013, the firm shifted its focus to Dutch retail investors by launching its web platform and discount stock trading. Since 2014 expanded into most of Western, Northern, and Central Europe.

It wasn’t hard for DEGIRO to beat the incumbent Dutch brokers, who were still charging around €15-40 per trade at the time. DEGIRO undercut its rivals by a wide margin and offered a ‘self-service’ model, which was unique, with very low fees, minimums and no inactivity or maintenance fees. In the rest of Europe, DEGIRO was able to rapidly establish dominance in the market the same way as it did in the Netherlands because “people were fed up with paying high fees and the industry was pushing them away,” as Gijs Nagel said in a 2017 interview.

Strengths

- DEGIRO can be credited with bringing the ‘discount broker’ model to Europe. It’s easy to forget how expensive it used to be to invest in stocks and ETFs just 10 years ago. DEGIRO has successfully shaken up the industry, forcing traditional brokers to dramatically reduce their fees and laying the groundwork for other low-cost brokers to enter the market.

- The financials of flatexDEGIRO for 2021 look solid: 43.9b EUR assets under management, revenues increased by 60% to 418m EUR, 177.1m EUR EBITDA (42.4% profit margin), and around 2.06 million customers (from 1.33m in 2020; the number of active clients is unknown). This means DEGIRO acquired approximately 60,833 clients per month – more than Interactive Brokers.

- DeGiro B.V. combined with flatexDEGIRO Bank AG in early 2021 to form Europe’s largest online execution-only broker, with its own banking license. latexDEGIRO Bank AG is supervised by the German Federal Financial Supervisory Authority (BaFin). In the Netherlands, flatexDEGIRO Bank Dutch Branch is subject to supervision by DNB and the supervision of AFM. Because of its banking license, customers’ cash is now held in separate accounts and insured by the German deposit guarantee scheme up to a value of €100,000 per customer.

- Unlike other discount brokers, DEGIRO does not accept payments for order flow. The broker is not compensated for sending orders through paying trading venues. Instead, it focuses on providing the best possible price for clients from several independent exchange venues.

- DEGIRO can be credited with bringing the ‘discount broker’ model to Europe. The company has always been a low-cost provider and doesn’t offer bells and whistles. It’s a no-frills, self-service brokerage that keeps its costs down by automating as much as possible.

Weaknesses

- Share lending is mandatory on DEGIRO, which can turn off some investors. The company makes money by lending out shares held in custody for its clients. Customers receive none of the interest income generated from this lending, which appears to have generated €32.5m in revenue for DEGIRO in 2020. On the other hand, this business segment helps keep costs low.

- Investors in Eastern Europe and non-EU countries (outside of the Single Market) cannot use DEGIRO. This leaves a large portion of the continent’s population unable to use the platform, although they are the ones that could likely benefit the most from its low fees. It would be in the spirit of a company that wants to make “investing democratized and accessible to everyone” to expand into these markets even if they are not profitable.

- Multi-currency functionality is not fully functional on DEGIRO. Those users who can hold other currencies than the Euro need to go through a cumbersome process of turning the conversion feature on and off. This can be a significant inconvenience for investors who want to hold assets in multiple currencies or trade products that are not denominated in euros.

3. XTB

Strengths

- XTB has existed since 2002 and has been a publicly-traded company traded on the Warsaw Stock Exchange since 2016. In addition to its headquarters in London and Warsaw, the company has representations in 20 other locations.

- XTBs customer service was the best among the brokers we reviewed. Live chat was available without the need to log in, and the staff was knowledgeable and helpful. The website also has a FAQ section, but it’s unimpressive.

- XTB currently allows clients to invest in over 3,000 real stocks from 16 of the world’s largest stock exchanges, including the New York Stock Exchange, London Stock Exchange, Spanish Bolsa de Madrid, German Börse Frankfurt and Warsaw Stock Exchange. Besides stocks, XTB offers over 270 ETFs, including commodities, real estate and bonds.

Weaknesses

- XTB only offers real stocks and ETFs in a limited number of countries. It can be confusing to navigate their website to find out what is available in each jurisdiction.

- A detailed fee schedule can only be found in a PDF on their website and is not easily accessible.

- Their separation between real stocks and CFD variants is not always clear. The same account and platform is used for trading both types of products. This could potentially lead users to trade derivatives by mistake or nudge people into active high-risk trading.

- There is a significant emphasis on day and active trading on the site, owing to the fact that XTB began as a forex broker. This could be off-putting or confusing for some investors looking to buy and hold stocks for the long term.

- XTB does not have a bank license and is not a full-fledged bank. Users’ cash balances are gathered into omnibus accounts, which may be a problem if the bank goes bankrupt, although they are kept separate from the brokerage.

4. Scalable Capital

Scalable Capital is one of the many ‘hip’ neobrokers that have sprung up in the German tech scene in the last few years. The company was founded by former Goldman Sachs bankers and started out as a fund manager in 2014. Since the summer of 2020, customers have been able to trade self-directed in shares, ETFs, funds, cryptocurrencies and derivatives through its brokerage platform, which has driven the company’s growth. The broker has 200,000 customers (the number of active clients is unknown) with 2.5B EUR in customer assets under its hood.

The venture capital behind Scalable Capital makes up 266m EUR from six founding rounds, BlackRock and Tencent being the most well-known investors. It wouldn’t be a surprise if Scalable Capital were to list on a stock exchange in the next five years as per the business model described above. JustETF.com was acquired by Scalable Capital in 2021 for an undisclosed price, so the website now contains advertisements from the broker.

Strengths

- ETFs listed in Scalable Capital’s Savings Plan can be bought commission-free with a €1 minimum investment. ETFs from iShares, Invesco, and Xtrackers are also commission-free with a minimum of €250.

- Phone support, which is a rarity these days, is available from Monday to Friday during market hours.

- Customers’ money assets are kept in the custody bank (Baader Bank and ING) insured by the German Banking Compensation Scheme up to a deposit amount of 100,000 EUR.

Weaknesses

- Scalable Capital appears to be heavily reliant on venture capital to fund its growth and is not making money at the moment. There is nothing inherently wrong with not being profitable initially. However, it can be considered high-risk because the company is still in its early stages of development.

- It posted a loss for 2020 of -15,633,370 EUR (of which 9,376,801 EUR was carried forward from the previous year) and states in its financial report that it relies on equity financing to cover its expenses. It’s difficult to believe that its investors would pour so much money into the company unless they thought it could eventually go public with a unicorn valuation.

- The only exchanges available are gettex (Bayrische Börse) and Xetra (Deutsche Börse). Scalable Capital does not offer direct access to execution venues but commissions orders to its partner banks. Scalable Capital writes that it may (indirectly via the banks) receive payments from the executions venues, security providers, and market makers (see section c) in Bericht zur Ausführungsqualität der Ausführungsplätze für 2020). This doesn’t necessarily mean the order execution provides inferior pricing. Still, it would be preferable if such agreements were easier to find and transparently discussed on its website.

- Germany, Spain and France are the only countries where Scalable Capital is currently available. Austria and Italy are in the process of being rolled out.

5. Trade Republic

Trade Republic is a commission-free German neobroker very similar to Scalable Capital. It was established in Munich in 2015 but quickly relocated to Germany’s technology capital Berlin. In 2017, Sino AG, a financial service provider, purchased the majority stake in Trade Republic, which allowed the company to develop its own trading platform and accelerate its growth. Since then, the broker has acquired around 1m clients and has 6b EUR in customer assets under management. The company operates in six countries: Germany, Austria, Spain, France, Italy and the Netherlands, and plans to roll out to more countries in the near future.

Trade Republic’s commission-free savings plans include around 2,500 international stocks and 1,500 ETFs. It routes orders through the LS Exchange, an electronic trading system operated by Börse Hamburg, in cooperation with HSBC Transaction Services. Despite its modest size, the LSX is linked to the XETRA reference market, which boosts confidence in its order quality.

Strengths

- The automatic, self-directed savings plan allows buy-and-hold investors to invest commission-free in ETFs.

- Shares are not lent out by Trade Republic.

- Cash accounts are legally insured by up to €100,000 per investor. The banks Trade Republic uses are Solarisbank AG, Citibank Europe (Ireland), and Deutsche Bank.

- HSBC Germany is used as the custodian bank for holding shares.

Weaknesses

- Trade Republic appears to be heavily reliant on venture capital to fund its growth and is not making money at the moment. There is nothing inherently wrong with this, but it can be considered high-risk because the company is still in its early stages of development.

- It posted a loss for 2020 of 10,175,543 EUR.

Others brokers we considered

Saxo Bank

Saxo Bank was founded in 1992 by Lars Seier Christensen, Kim Fournais, and Marc Hauschildt. There’s no wild story behind its founding, just three young guys with a shared interest in technology and financial markets who wanted to start their own business. Like many other online brokers, the company began as a trading platform for foreign exchange but has since expanded to different asset classes. The company is headquartered in Copenhagen with offices in 20 countries.

Strengths

- Saxo Bank has been operating since 1992, initially as a local Danish brokerage and later as a worldwide-accessible trading platform. Although Saxo Bank is a private corporation, it must file quarterly financial statements accessible to the general public. According to its 2021 audited financials, Saxo had 820,000 customers from 170 countries, DKK 640 billion worth of customer assets (~ EUR 86 billion), and DKK 755 million in net profit from a revenue of DKK 4.5 billion. Saxo Bank has been profitable almost every year since its founding.

- Saxo Bank is a licensed bank and holds a Danish banking license, which gives it an edge in terms of safety and trustworthiness. If Saxo Bank is unable to meet its obligations and goes into bankruptcy, client cash deposits are guaranteed by up to 100,000 EUR.

- The company offers one of the broadest product ranges, with over 30,000 stocks and 5,500 ETFs available on 60+ exchanges across. Like IBKR, Saxo Bank uses smart order routing (SOR) technology to source liquidity from multiple execution venues and optimize order quality and pricing.

- It accepts customer applications from almost every European country, territory, and dependency, including those traditionally underserved. It was one of the first pan-European retail brokers and provides a white-label infrastructure to over 200+ banks and 400+ financial intermediaries worldwide.

- Saxo Bank does not practice securities lending (lending your shares to short-sellers) and does not receive payment for order flow for directing orders to different parties for trade execution.

Weaknesses

- Saxo Bank is expensive. Its commissions are among the highest we looked at. If Saxo Bank was more affordable to trade with, it would be on par with Interactive Brokers, if not superior. The cost of trading varies somewhat by country, but typical trading expenses are generally twice or three times the price of other brokers for the same transaction.

- FX costs were also the highest of all the brokers we reviewed. The final nail in Saxo’s fee structure is the account custody charge, which has been almost completely eliminated from the market.

- The pricing structure is challenging to comprehend, with a bewildering range of pricing plans and obscure costs, making forecasting the overall cost near impossible.

- The different account tiers (Classic, Platinum, and VIP) and point system may encourage overtrading among retail investors who are told to “Trade more, pay less and get better service.”

- Customer service is notoriously bad, with long wait times, unhelpful staff, and unsolved tickets. In our experience, even if you manage to get someone on the phone, they will often not be able to help you. The FAQs are also not very helpful except for superficial information.

- Saxo Bank is privately owned, and the majority of shares are held by the Geely Holding Group, a Chinese multinational incorporated in the British Virgin Islands and Hong Kong.

Swissquote

Strengths

- Swissquote Bank Europe in Luxembourg is a full-fledged bank. Users have their own personal IBAN and multi-currency cash accounts. Cash deposits are protected up to 100,000 EUR.

- Swissquote Bank Europe is part of the Swissquote Group, a Swiss bank founded in 1996. The Swissquote Group has been publicly traded on the SIX Swiss Exchange since 2000. It was the first pure online bank in the country. The group has aggressively bought up other companies, such as Consors (insurance company), Skandia Bank, MIG Bank, and Internaxx Bank S.A. in Luxembourg (now Swissquote Bank Europe).

- Swissquote has consistently grown its revenue, profit, and client base over the years. The past performance of the company seems a good indicator of future sustainability. According to the latest statement (H1 2021), Swissquote had 459,800 user accounts, and the average deposit per customer was c. 109,000 CHF (~105,065 EUR). It reached 50.2B CHF in client assets under management.

- Swissquote does practice securities lending and does not receive payment for order flow.

- 30 exchanges on 19 global stock markets and around 20,000 ETFs are available. Swissquote also offers a multi-currency bank account that is fully insured and supports 20 or more different currencies.

- Every EU country is supported, plus the UK, the Channel Islands, Norway, and Switzerland.

- Real-time pricing data is freely available.

Weaknesses

- Swissquote has the highest currency conversion fees among all the brokers we reviewed: 0.9%. Its commissions are also very high, with a minimum commission of 14.95 EUR, making it the most expensive broker.

- The information on Swissquote’s Luxembourg site is somewhat limited and feels half-finished in certain areas. The FAQ section could be expanded. There is also no live chat support, and customer service is difficult to get in touch with.

- It’s challenging to get a sense of what the platform is like without opening an account. There are very few pictures and no videos of the platform offered by Swissquote Luxembourg (at least we didn’t find any), making it hard to get a feel for what you’re signing up for.

Funding methods and account features

Deposit fees are the fees charged by a broker when you deposit money into your trading account. Having money ready is the first step to trading, so it’s vital to know how much it will cost you.

- Bank transfers are free. All brokers offer the option to deposit via bank transfer for free. However, some brokers may charge a conversion fee when you deposit in a currency different from your account’s base currency.

- SEPA transfers. Those brokers that accepted EUR offered fee-free bank deposits as long as these were SEPA bank transfers. There may be instances when the sending or corresponding bank charges a fee, which the broker is not responsible for, but this is rarely the case with SEPA.

- Debit card. Many brokers also offer the option to deposit via credit/debit card. The fees charged for this method vary from broker to broker, with the best brokers charging no fee at all.

- Electronic payments. PayPal, Apple/Google Pay, Skrill, and other digital payment methods are also available with some brokers. The fees charged by the broker for these methods are generally higher than bank transfer or credit/debit card fees.

Funding methods summary

Here’s an overview of the deposit and payment methods offered by European stock brokers:

| Bank transfer | Debit card | Google/Apple Pay | Digital wallet | |

|---|---|---|---|---|

| Interactive Brokers | ✓ | x | x | x |

| DEGIRO | ✓ | x | x | x |

| Saxo Bank | ✓ | ✓ | x | x |

| XTB | ✓ | ✓ | x | ✓ |

| Scalable Capital | ✓ | x | x | x |

| Trade Republic | ✓ | ✓ | ✓ | x |

| Swissquote | ✓ | x | x | x |

| Trading 212 | ✓ | ✓ | ✓ | ✓ |

| Bux Zero | ✓ | x | x | x |

Account currencies and features summary

Here’s a summary of relevant account features for each broker, such as whether you can deposit multiple currencies (EUR, GBP, USD, etc.), get a personal clearing account (IBAN), and they have a banking license:

| Multi-currency | EUR | GBP | USD | Personal IBAN | Banking license | |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✓ | ✓ | ✓ | ✓ | x | x |

| DEGIRO | x | ✓ | x | x | ✓ | ✓ |

| Saxo Bank | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| XTB | ✓ | ✓ | x | ✓ | x | x |

| Scalable Capital | x | ✓ | x | x | ✓ | x |

| Trade Republic | x | ✓ | x | x | ✓ | ✓ |

| Swissquote | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Trading 212 | x | ✓ | ✓ | x | ✓ | x |

| Bux Zero | x | ✓ | x | x | ✓ | x |

Comments

Geographical restrictions: Many brokers provide a variety of currencies to clients in certain countries, but they may be restricted from doing so in other jurisdictions due to local legislation.

Multi-currency accounts: Interactive Brokers, Saxo Bank, Swissquote, XTB accept EUR and USD deposits. These brokers, except for XTB, also provided multicurrency sub-accounts in other currencies (GBP, CHF, HUF, SEK, etc.) many of which were directly fundable.

Cash deposit guarantee: A nota bene was that DEGIRO, Saxo Bank, Scalable Capital, Swissquote, Freetrade provided segregated personal cash accounts with deposit guarantee up to €100,000.

Bottom line: Deposit fees have fortunately gone the way of the dinosaur, but investors should be aware of any fees their own bank may charge for transfers transactions to brokerages that are located different than their own.

Currency exchange fees

A sneaky way brokers can make money from clients without charging them directly is through foreign currency conversion fees. A currency conversion fee is a spread the broker adds on top of the exchange rate they receive from their own bank or forex liquidity provider when you trade in a currency different from your account’s base currency.

How to avoid currency exchange fees: A popular way to save money on foreign exchange fees is to use a multi-currency online bank account. Most online banks provide free or very low-cost currency conversions, so you can exchange your money at best possible rate. This way, you can deposit funds to your brokerage account by bank or card transfer without losing money to unnecessary currency conversion fees

Base currency – what is it?

Every brokerage account has something called a “base currency”. The base currency of your account is the currency in which your account value is shown. An account must have a base currency as it is used to calculate profits, losses, and transactions in the books associated with your account. The first currency you use to finance your brokerage account will typically become your base currency.

- Settlement currency. If you have experience with accounting, you’ll know that the balance in a company’s books is usually settled in a base currency, mostly the local currency. The same usually goes if you have investments denominated in currencies that are different from your own.

- It derives from the forex market. The term base currency derives from the forex markets where currency units are quoted in currency pairs, such as EUR/USD. In the example of EUR/USD, EUR is the base currency, and USD is the quote currency being bought for euros.

- For example: You want to buy shares denominated in USD, but your base currency is EUR. In that case, your currency of settlement is different from the stock you’re buying. You either have to have cash in USD available in your account or convert from your EUR account into USD. Either way, your profits, losses, and value will be calculated into the base currency of EUR.

How European brokers handle currency conversions

There are typically two ways a broker will handle currency exchanges:

- One base currency, multiple currency sub-accounts: The most professional brokerages in the industry offer multiple currency sub-accounts. These sub-accounts can be funded directly via bank or card transfer in that currency. By having multiple subaccounts, you can fund your account in a currency different from your base currency and trade in those currencies without converting them first.

- One base currency, multiple currency balances: The second type of broker only offers a single currency account. The broker will convert your deposited funds into the desired currency if you want to trade in another currency. It only accepts the base currency of your account as a funding currency. Still, it will let you exchange that base currency into other currencies and hold these as cash balances. This is inferior to the multiple currency sub-account solutions in that you have no control over the rate.

- One currency for everything: The third group only accepts payments in the account base currency. It applies automatic conversions whenever you trade a product denominated in a currency other than your account’s base currency. This is the most expensive way to trade foreign products, as you always pay the spread twice. First, when converting your money into the product’s currency and then again when converting your profits (or losses) back into your account’s base currency.

Sub-accounts in different currencies are not always available to all users. This is because legislation regarding foreign exchange (FX) and investment management differ from country to country. Brokerages must follow these limitations, which may be inconvenient for consumers but show compliance with regulatory standards.

European brokers currency exchange fee comparison

We calculated three different scenarios to show how much each broker charged for currency conversion. For all these, we used the EUR/USD pair. EUR was the base currency, and USD was the target currency, meaning we’re selling euros for dollars. Because the EUR/USD currency pair is the most liquid in the world, we should get a good indication of how much money each broker charges for currency exchange.

Important: The value of the Euro against the US Dollar fluctuates, so one dollar is not always the same amount of euros.

| €1,000 | €5,000 | €10,000 | €100,000 | Notes | |

|---|---|---|---|---|---|

| Interactive Brokers | $2.00/€1.75 (0.018%) | $2.00/€1.75 (0.035%) | $2.00/€1.75 (0.017%) | $2.00/€1.75 (0.0018%) | $2 if amount less than $100K |

| DEGIRO | €2.50 | €12.50 | €25.00 | €250 | Fixed 0.25% |

| Saxo Bank | €5-10 (0.5-1.0%) | €25-50 | €50-100 | €500-1,000 | Varies by country, from 0.45-1.0% |

| XTB | €5 | €25 | €50 | €500 | Fixed 0.50% |

| Scalable Capital | x | x | x | x | Only EUR available |

| Trade Republic | x | x | x | x | Only EUR available |

| Swissquote | €9 (0.9%) | €45 (0.9%) | €90 (0.9%) | €500 (0.5%) | Decreases with volume |

| Bux Zero | €2.50 | €12.50 | €25.00 | €250 | Fixed 0.25% |

| Trading 212 | €1.5 | €7.5 | €15 | €150 | Fixed 0.15% |

Bottom line: Brokers may be taking a larger cut of your currency transactions than you realize. Don’t underestimate this fee if you invest internationally.

Pips (percentage in point) calculation example:

- Base currency: 5,000 EUR

- Spot EURUSD bid rate: 1.1431

- Spot EURUSD ask rate: 1.1433

- Mark-up (broker FX fee): 50 pips (0.0050)

- Conversion rate: 1.1431 − 0.0050 = 1.1381

- EURUSD conversion: 5,000 EUR * 1.1381 = 5,690.5 USD

- Conversion fee: (5,000 EUR * 1.1431) – 5,690.5 USD = 25 USD or 0.5%

Trading fees

Trading fees are the costs you incur when buying or selling a security. Trading fees are made up of various elements that are sometimes referred to by different names. It’s essential to be aware of the different types of fees as they can add up quickly, eating into your profits (or increasing the losses on your portfolio).

The most common fee is the commission, usually a flat, fixed fee or percentage of the transaction. Other expenses can include exchange, clearing, and regulatory fees. It’s common among larger brokers to break down fees and commissions one by one, while neo-brokers mostly lump them together into a single fee.

Trading fees comparison for European stock brokers

Here’s a summary of the total trade costs from European online brokers. This comparison is based on information obtained from their websites and the current EUR/USD exchange rate. Actual prices may vary depending on the investor’s jurisdiction and other factors. To get a comprehensive breakdown of the expenses, read the notes below.

| 20 US shares of $50 ($1,000 trade) | 100 US shares of $50 ($5,000 trade) | 10 EU ETFs of €100 (€1,000 trade) | 12 x 10 EU ETFs of €100 (€12,000 across 12 mo.) | |

|---|---|---|---|---|

| Interactive Brokers | €2.20 | €2.52 | €1.25 | €22.80 |

| DEGIRO | €5.50 | €15.50 | €2.50 | €2.50 |

| Saxo Bank | €21.20 | 61.20 | €18.25 | €219 |

| XTB | €5 | €25 | €0.00 | €0.00 |

| Scalable Capital | x | x | €0.00 | €0.00 |

| Trade Republic | x | x | €0.00 | €0.00 |

| Swissquote | €23.95 | €59.95 | €15.55 | €186.6 |

| Bux Zero | €2.50 | €12.50 | €0.00 | €0.00 |

| Trading 212 | €1.50 | €7.5 | €0.00 | €0.00 |

U.S. stock trading fees

U.S. stocks are the most traded asset class globally and represent a significant portion of many people’s portfolios. To see how much it costs to trade U.S. equities with each broker, we calculated the all-in cost of buying 1,000 EUR and 5,000 EUR worth of USD-denominated shares of stock in companies in the S&P 500.

These examples are purely based on pricing available on each broker’s website at the time of writing. They do not account for other important factors like order execution and routing quality, effective spreads, foreign currency loss/profit, inactivity fees, and jurisdictional differences.

It’s worth noting that many of the largest U.S. stocks are listed on European exchanges in EUR, GBP, or CHF equivalents. These dual-listings allow European investors to buy the same shares as U.S. investors but denominated in their home currency. This can help reduce or eliminate the costs associated with converting between currencies.

Important: Spreads between the bid and ask prices are not factored into cost examples. The spread is a latent third-party cost that is not subtracted from your account but, in reality, forms part of the overall price. The bid-ask spread is the difference between the best price to buy (the “ask” price) and the best price to sell (the “bid” price). It’s primarily determined by the trading venue your broker uses.

ETF trading fees

We copied a standard investor profile, the passive index investor who averages into the total stock market with around 12 ETF buys per year. We assumed €1,000 per month for 12 months into a EUR-denominated ETF in the example.

Suppose you’re unfamiliar with world index investing. In that case, the basic idea is to track the performance of the world’s largest public companies by investing in a fund that holds all or a representative sample of shares in the companies.

The most cost-effective and least time-consuming way to invest in a world index is by buying an ETF (exchange-traded fund) that tracks it. We decided on the Vanguard FTSE All-World because it is one of the most traded ETFs in Europe and can be bought on all of the brokerages we tested.

How European online brokers make money

Don’t be fooled. Stockbroking is not a charity. It’s an increasingly competitive industry with thin margins. Contrary to popular belief, many brokerages aren’t profitable at all, but rely on venture capital and other investors to keep the wheels turning.

It’s only when you start looking into the details that you realize how online brokerages operate and how their business models work. All brokers want to make money, including the commission-free ones, in one way or another, whether through commissions, fees, or from your losses. So how do they profit from you?

Business model 1: Commissions

Most traditional brokerages make their money from commissions and fees. For example, Interactive Brokers’ 2020 financial report says, “We earn commissions from our cleared customers for whom we act as an executing and clearing broker and from our non-cleared customers for whom we act as an execution-only broker.” Fees accounted for $1,287 million or 58% of IBKR’s $2,218 million total revenue for that year. FlatexDEGIRO similarly made €212 million or 80% of its revenue from commissions. If a broker has a large client base that is willing to pay for its services, making money in the form of commissions is the most lucrative business strategy. It’s also the most transparent model.

Benefits: Potentially a more sustainable long-term business model, more transparency for users, not reliant on CFDs and other high-risk instruments for revenue generation.

Downsides: More expensive outright, no guarantee that higher prices produce better quality.

Business model 2: Zero-commissions (but with a catch)

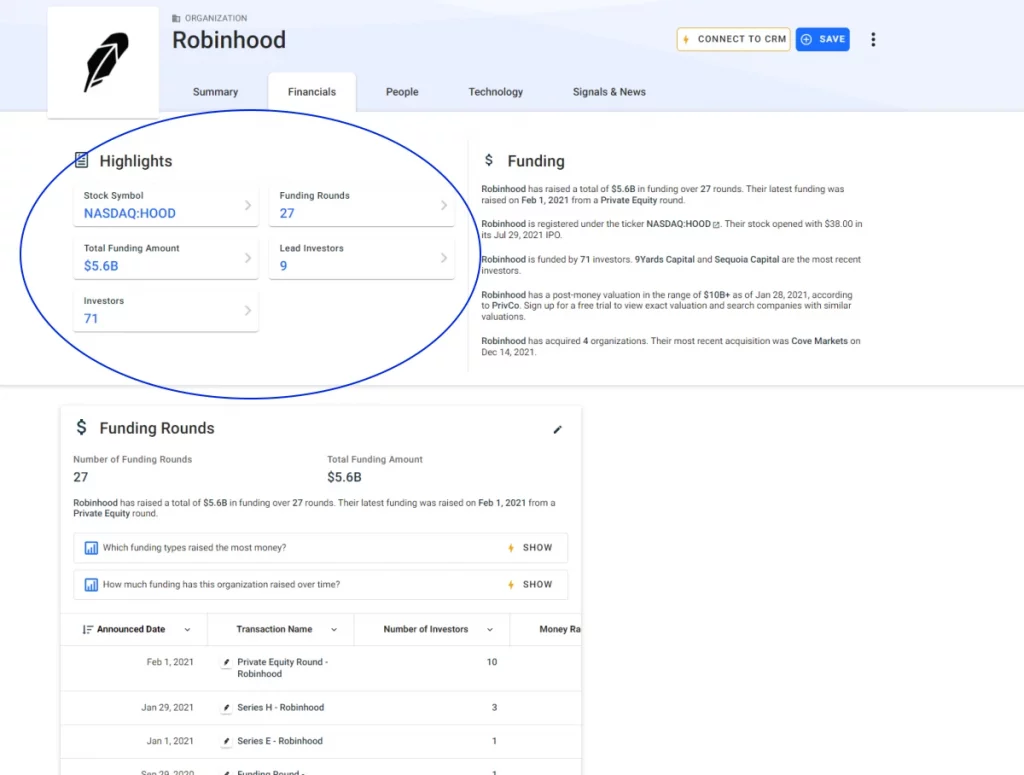

Zero-commissions brokers that don’t charge their clients any commissions when they trade. Instead, they make their money in other ways (if they’re making any money at all. Robinhood, for example, the most popular zero-commission broker in the U.S., ended the financial year 2021 with a net loss of $3.7 billion, despite having 17.3 million users).

Payment for order flow is one way in which these brokers might make a profit. Another is by having you trade products that are not subject to best execution requirements, such as contracts for difference (CFDs) or cryptocurrencies, which can be traded with wide spreads and all kinds of fees. A third revenue stream is leveraged instruments, whether CFDs or other derivatives, from which the broker earns interest on the margin.

Benefits: Low outright fees, more accessible for small accounts, order execution quality not that relevant for long-term investing, potentially more cost-effective if incentivizing aspects does entice users.

Downsides: “Free” trading incentivize users to trade actively; business model is often (but not always) sustained by: CFD and other high-risk products, payments for order flow and single execution venues (which can lead to poorer order execution quality), securities lending.

Business model 3: From your losses

Most of us want to believe we are rational in our approach to investing. But this isn’t always true. Our emotions tend to take over, especially when it comes to money. The human mind is hardwired to seek short-term gratification over long-term payoffs. Unfortunately, this behavioral disposition is easily taken advantage of. Colors, words, graphics, pop-ups, and promising green charts can nudge us to place impulse trades we might regret later. Marketing departments and designers in all industries use nudging techniques to tap into our emotions, and brokerages are no different.

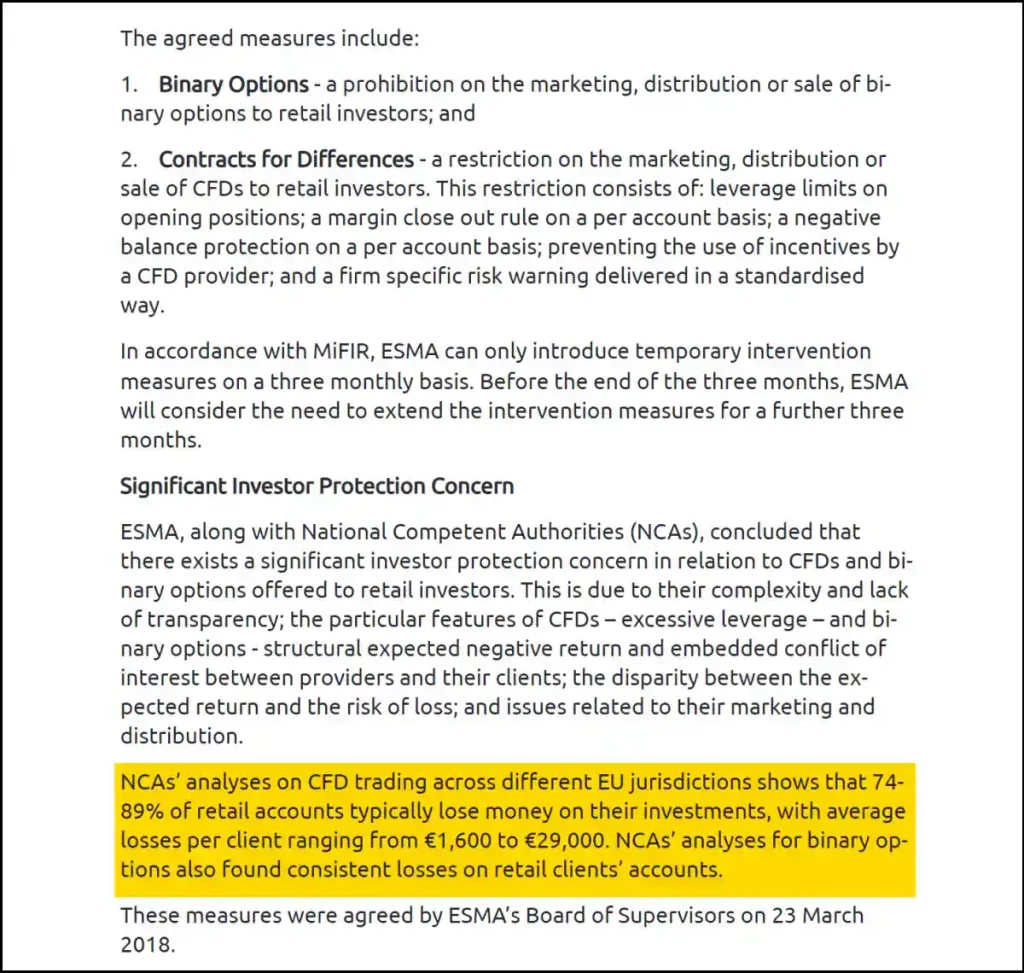

Multiple studies have shown that most individuals who trade the markets actively lose money. Still, many can’t help themselves. When you make a loss on a real stock trade, brokers are not compensated since they cannot act as counterparties. However, they benefit when you trade CFDs. This is because brokers can trade against their clients in these markets: In a CFD trade, the broker is the counterparty to the trade. And the broker walks away with your money when you lose in a CFD trade. CFD trades also incur overnight and other fees that eat into your account balance, and they are typically done with leverage. The amount of investors who lose money in CFD trading is so bad that the European Securities and Markets Authority (ESMA) has imposed a series of restrictions on these instruments since 2018:

But it gets worse: Traders who employ leverage are the most profitable customers for brokers since they are typically CFD trades. Most of these transactions will result in losses, and the broker will receive interest on margin loans and transaction commissions. CFD trading is the worst because the brokerage serves as the counterparty to the agreement.

Benefits: The same as zero-commission brokers if you stay away from CFDs.

Downsides: Brokerages with both real stocks and CFDs often rely on CFDs to generate a large portion of their revenue; the vast majority of retail investors lose money with CFDs; CFDs are subject to the goodwill of regulators and could quickly be prohibited, which could destroy the company’s business model.

Business model 4: Venture capital

The final way that online brokers make money is through what has come to be known as “Silicon Valley” money. This influx of cash comes from venture capitalists and angel investors who are looking to get in on the next big thing. This business model works by having very risk-willing investors put billions into a company that is starting up in exchange for private shares in the company. Large investments allow the business to explosively expand its operations, mass-acquire customers, and rapidly pump up its revenue figures.

A few years later, the company will have pristine financials and go public through an IPO. When this happens, its valuation will be in the tens or even hundreds of billions, and the early investors will cash out by selling their shares to the public. 2020 and 2021 had the most IPOs in history because these were some of the best years the stock market had ever seen. Venture capital financing is how many big tech companies got their start, like Robinhood, Coinbase, and Uber.

The problem with this model is that it’s not sustainable in the long term. To outpace the competition, these businesses must constantly provide new advantages while maintaining the greatest talent on payroll and keeping costs to their clients at near zero.

Benefits: Low/zero fees and unique value proposition during company’s hyper-growth phase, attractive for those new and pricing-sensitive accounts, equity capital helps develop company’s foundation for the future.

Downsides: Growth is often driven by a loss-leading pricing schedule that cannot be sustained long-term, unique edge dwindles when VC exits, with a high chance of turning into a fee-based or freemium brokerage with time.

Other business segments

Interest revenues: Interest income is typically the second-largest source of revenue for online brokers. Brokers can earn interest on margin loans and securities lending. Furthermore, they can earn interest income from government bonds and on deposits with banks (in positive rate interest currencies like the USD).

Currency exchange fees: Foreign currency exchange (FX) fees are also a significant source of revenue for online brokers. When you buy stocks in a foreign currency, the broker will need to convert your money into that currency. The broker will charge you a small fee for this service, and they will also pocket the net difference between the bid and ask prices (the net spread income after expenses).

Freemium subscriptions: Brokerage companies can earn income from premium services to customers. For example, Scalable Capital and Freetrade offer freemium pricing models where investors can get a basic service for free but can opt to pay if they want more advanced features. Premium service income can also come from providing market data, risk analysis tools, research tools, and ancillary services to customers. The revenue from such services seems to be decreasing given that most of these products are available for free from other sources on the internet.

FAQs

Zero-commissions – What’s the catch?

Many European online brokerage platforms now provide €0 commission trades for listed stocks and ETFs. But keep in mind that none of these businesses are charitable organizations. They all want to profit from you in one way or another, and free trading is a gift with a purpose.

The elimination of upfront commissions has been the result of fierce competition in the online brokerage space — it sounds like great news for investors. So what’s the catch?

- Brokers who provide free trades can profit by routing orders through many market makers. In return, the broker may receive a fee. This practice is known as payment for order flow and not explicitly banned under the EU’s MiFID II framework but may conflict with best execution rules. However, zero-commission brokers might argue that they provide greater benefits to clients than drawbacks.

- Best execution rules demand that brokers take all reasonable steps to achieve the best possible price for their clients when placing orders. However, best execution under MiFID II was defined before the evolution of the “free trade” model. It was developed when only full-service brokers (banks etc.) existed.

- If the broker is the only execution venue for all of its clients’ orders or routes 100% of them through a single external market maker, it’s difficult to argue that best execution is achieved. A single market maker may not be able to match the closeness in spreads of a market order book with many market participants. Because of the wider spread, customers still pay more than they would with other brokers who do not utilize single market makers.

- They can also profit by loaning your assets to short sellers and keeping the loan repayments with no kickback to you. This is known as securities lending and is an increasingly common practice among brokers. If the borrowing party cannot pay back the loan and the broker cannot return the shares, you might find yourself out of luck.

- Finally, the gamification of trading combined with the psychology of “free” has lured many investors into overtrading. Multiple studies have shown that 80% of retail day traders lose money. Those free trades may tempt you to more considerable losses than the commission you saved.

What you should do before considering a cheap broker

As discussed above, “zero commissions”, “zero fees”, and other hyphenated zeros are buzzing around the internet like mosquitoes on a hot summer night. And it’s no wonder because who wouldn’t want to trade stocks and ETFs fee-free?

There’s nothing wrong with saving money on commissions; however, you should consider a few things before jumping the gun with the “cheapest” broker. First of all, it’s crucial to think about why you are opening a brokerage account in the first place.

Look at it this way: If your goal is to buy and hold a simple portfolio for multiple decades, you want a well-capitalized broker that will be around for just as long but not necessarily one with access to a billion products or complex trading tools. But say you plan to mix the buy-and-hold approach with a bit of active stock trading. You might want a broker with more sophisticated tools and a more comprehensive range of products.

No matter your goals, it’s always a good idea to compare the true costs of trading. Here are a few things you should always keep in mind:

- Inferior spreads: If a brokerage doesn’t charge commissions outright, it may still makes money by adding a “spread” between the bid and ask price. This spread is often called an “overcharge” because it’s in addition to the price you see quoted on your screen.

- Account fees: A few companies still charge obsolete “activity fees” for things like placing a trade or having a balance below a certain threshold. Others may charge an annual account fee, whether you’re active or not. However, most brokers have removed this fee.

- FX fees: Chances are you dealing in multiple currencies if you invest in stocks worldwide, so your broker’s foreign exchange rates are essential. A good broker has low and transparent exchange fees, preferably with a mark-up below 0.5%. Moreover, it should allow you to hold multiple currencies (EUR, USD, GBP, etc.) in the same account.

- Customer data monetization: Some brokerages make money by selling your data to third parties. Your behaviour, interests, and other personal information may be sold to advertisers who then bombard you with online finance ads.

- Payment for order flow: A stockbroker can make money by selling your orders to third-party firms. These are mainly high-frequency algorithmic trading firms that pay a brokerage for the opportunity to access their order flow first. This is one of the reasons why they’re able to claim “zero-fees”. Payments for order flow create an apparent conflict of interest between the broker and its customers since it encourages the firm to select the highest-paying third party market maker. Payments for order flow is only vaguely regulated in the EU. However, plans are being discussed to ban the practice in future European legislation.

The bottom line

More and more people are investing in the stock market. And with good reason: over the long term, stocks have outperformed most other asset classes, such as bonds and gold. Also, many investors believe that there is no viable alternative to stocks today because other asset classes are either too risky, expensive or underperform.

Before you start buying stocks, you need to open a brokerage account. However, not all online brokers are created equal: It’s easy to burn your fingers by going with the wrong one. Yes, there are great opportunities to be had in the stock market. But new investors face all kinds of risks and temptations in today’s digital world. Some brokers may try to steer you towards high-risk investments that promise high rewards but can also lead to big losses.

Whatever choice you go with, it’s worth remembering that buy-and-hold investing in sound companies or broad market indexes is the most reliable path for most private investors. Start small by choosing a stockbroker with no hocus-pocus marketing gimmicks and concentrate on steady wealth accumulation from the beginning.

Either way, I hope you found this comparison helpful. If you are still undecided about which broker to choose, the two top European broker picks are Interactive Brokers and DEGIRO. They offer the best value for money and are run by reputable people.