Wise (TransferWise) Statistics: Key Facts and Numbers for 2024

All the numbers and stats you were looking for about the popular online bank

Wise, formerly known as TransferWise, is one of the world’s largest online banking platforms. The company’s success comes from empowering users from all parts of the world to transact in multiple currencies with much lower fees compared to traditional rivals.

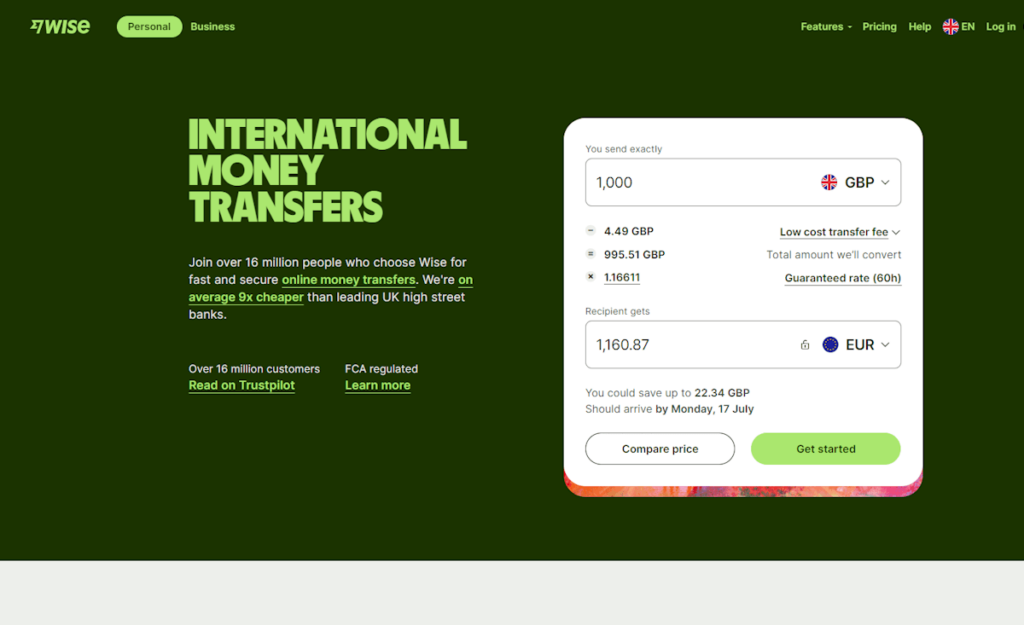

Today, Wise has over 16 million registered users and processes transactions worth £105 billion per year. It’s one of Europe’s most successful fintechs, and it’s expanding fast, adding around 3 million new customers per year and taking up a larger and larger part of the global market share.

We collected data, statistics, plus some controversial titbits on Wise. Continue reading to find the latest numbers on the company.

Wise key statistics and facts

- Wise currently has 10 million active customers, with a total of 16 million registered users.

- 4.5 million people and businesses registered on the platform in the fiscal year 2023 (FY23), of which 2.6 million became active customers.

- Wise customers conducted transactions worth £105 billion through the platform in FY23, an increase of 37% compared to FY2022

- During FY23, Wise saw an income increase of 73% to £964.2 million. The company’s adjusted EBITDA nearly doubled, reaching £238.6 million.

- Thanks to the new interest environment, Wise made £140.2 million in interest income.

- Wise customers hold a total of £11 billion on the platform, up 57% from 2022

- The average private customer sends £10,500 through Wise per year, while the average business customer sends £53,700 through Wise yearly.

- The Wise Group consists of 33 legal entities with circa 470 separate bank accounts, which is possibly the highest number of bank accounts in the world.

- Wise employs over 5,000 people from 117 nationalities across 17 locations.

- Wise co-founders Kristo Käärmann and Taavet Hinrikus became Estonia’s first billionaires thanks to the company’s success.

- Wise’s revenue comes primarily from Europe (52%), followed by North America (21%), Asia-Pacific (19%), and the Rest of World (8%).

- 66% of all Wise customers join the platform through word of mouth

- Wise is not a bank. It does not have a banking license. Instead, it holds licenses as a money transmitter and Electronic Money Institution (EMI) in the areas where it operates.

- Co-founder Kristo Käärmann failed to pay £720,000 in tax for the 2017-18 tax year and received a fine of £366,000.

Wise overview

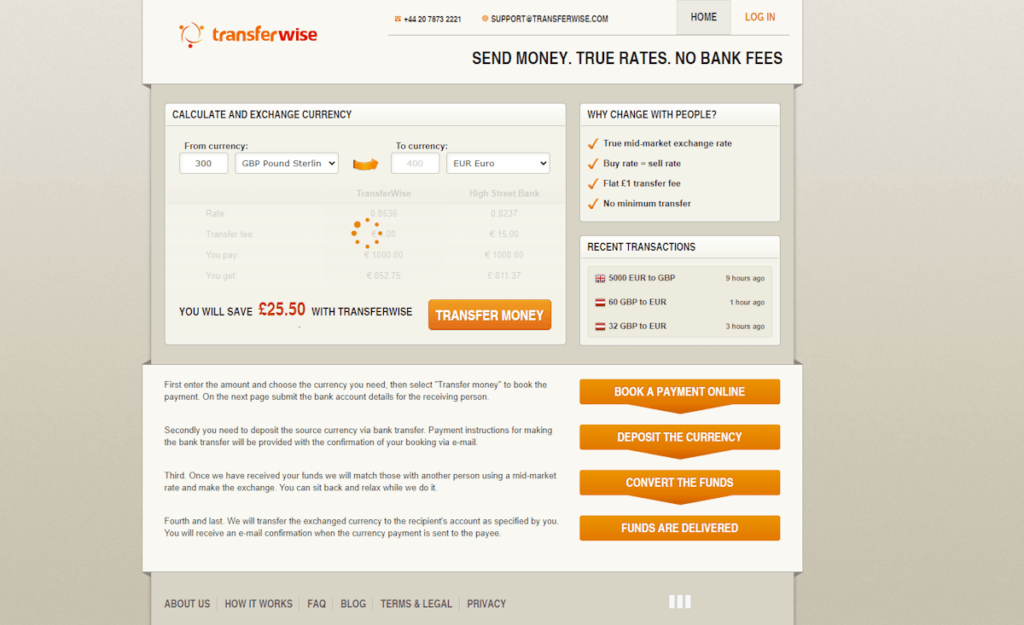

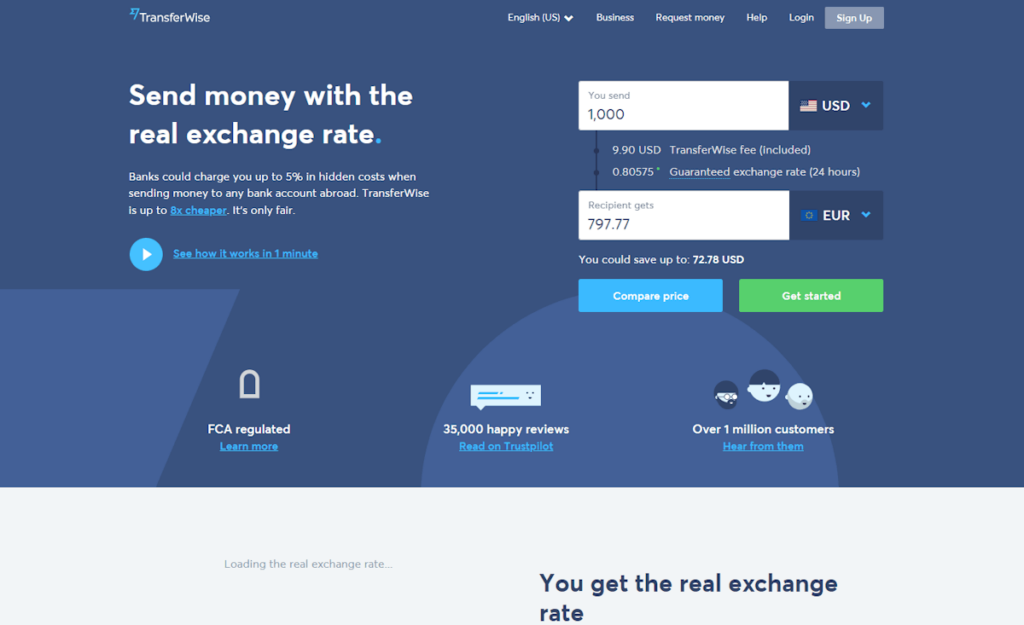

Wise was incorporated in 2010 in the UK as Exchange Solutions Ltd but changed its name in August 2012 to TransferWise, and again to Wise in June 2021. The company was launched by Kristo Käärmann and Taavet Hinrikus, two Estonians working in London who were frustrated with the high currency exchange fees and hidden charges of their own banks.

Hinrikus and Käärmann developed TransferWise as a peer-to-peer currency exchange platform based on a currency matching system. This means that a user’s foreign currency transaction is paired with one or several other people making an exchange in the other direction. If TransferWise cannot find a match, it becomes a market maker, using its own money to complete the deal.

Beyond its core service of international money transfers, Wise has also established itself as a viable alternative to traditional banks. It provides individuals and businesses with the convenience of bank accounts in multiple different currencies and comprehensive banking features that have traditionally been reserved for large institutions. All this and more have contributed to the Wise’s explosive growth and influence in the banking industry.

| Company name | Wise PLC (ticker: LSE: WISE) |

| Company type | Public |

| Headquarters | London, United Kingdom |

| Financial year | 1 April to 31 March |

| Launch date | January 2011 (incorporated on 31 March 2010) |

| IPO date | 7 July 2021 |

| Key people | Kristo Käärmann (CEO, co-founder), Taavet Hinrikus (co-founder) |

| Significant shareholders | Kristo Käärmann (18.23%), Baillie Gifford (9.18%), AH Capital Management (8.62%), Taavet Hinrikus (7.08%), Valar Ventures (4.86%) |

| No. of employees | 5,000+ |

Wise number of customers

Wise defines an active customer as a unique customer that has completed at least one cross-currency transaction during the year.

As of 2023, Wise has 16 million registered customers, of which 10 million are active users. That’s 2.6 million more active customers than in the previous fiscal year.

9.4 million active customers are personal users, 0.52 million are business users, and the rest comprise various other customer types.

| Fiscal year | Active users | Registered users |

|---|---|---|

| 2019 | 3.3 million | 5 million |

| 2020 | 4.7 million | 7 million |

| 2021 | 6.0 million | 10 million |

| 2022 | 7.4 million | 13 million |

| 2023 | 10.0 million | 16 million |

Source: Wise

Wise sporadically reports the number of registered users on its website, but many of these are not active customers. For example, for 2019, Wise reported it had reached 6 million users, but according to its 2023 financial report, only 3.3 million were active customers.

Wise number of personal users

Wise has 9.4 million active personal users, accounting for 94% of the total number of active clients. Personal users contribute to 77.5% of Wise’s revenue.

| Fiscal year | Active users |

|---|---|

| 2019 | 3.2 million |

| 2020 | 4.5 million |

| 2021 | 5.7 million |

| 2022 | 7.0 million |

| 2023 | 9.4 million |

Wise number of business users

Wise has 520 thousand active business customers, which includes freelancers, sole traders, limited liability companies, partnerships, charities, and trusts.

Business customers make up around 5% of Wise’s user base but account for 22.5% of revenues.

| Fiscal year | Active users |

|---|---|

| 2019 | 0.12 million |

| 2020 | 0.19 million |

| 2021 | 0.30 million |

| 2022 | 0.41 million |

| 2023 | 0.52 million |

Wise vs competition: number of registered users

Getting an accurate picture of how Wise stacks up against the competition isn’t as easy as it seems, as many platforms only publish their number of registered users. However, a large percentage of those, often 40% to 50%, are not active users. With that in mind, here is an overview based on self-reported numbers to shed some light on Wise’s position in the market.

Wise annual revenue

Wise generates revenue primarily through foreign exchange fees charged on currency conversions. Other revenue sources include fees from ATM withdrawals, account fundings, debit card orders, and wire transfer fees.

Wise generated £847.1 million in revenue in the fiscal year 2023. That’s a 51.3% increase over the previous year.

| Fiscal year | Revenue |

|---|---|

| 2018 | £117.3 million |

| 2019 | £170.1 million |

| 2020 | £302.6 million |

| 2021 | £421.0 million |

| 2022 | £559.9 million |

| 2023 | £847.1 million |

Source: Wise

Who are Wise’s best customers?

Europe (continental Europe and the U.K.) is Wise’s primary customer base, comprising the major portion of the company’s revenue.

In FY2023, Europe was responsible for over half of Wise’s revenue (52%), followed by North America (21%), Asia-Pacific (19%), and the Rest of World (8%).

| Fiscal year | Europe | North America | Asia-Pacific | Rest of World |

|---|---|---|---|---|

| 2020 | 55.2% | 20.8% | 15.7% | 8.3% |

| 2021 | 55.1% | 17.3% | 21.2% | 6.3% |

| 2022 | 55.4% | 20.9% | 18.1% | 5.6% |

| 2023 | 51.9% | 21.2% | 19.1% | 7.8% |

Source: Wise

Is Wise profitable?

Yes, Wise is a profitable business. In the financial year 2023, Wise had a gross profit of £638.2 million, up 73% from 2022, and a pre-tax profit of £146.5 million.

| Fiscal year | Gross profit | Pre-tax profit (EBT) |

|---|---|---|

| 2018 | £77 million | £8 million |

| 2019 | £109 million | £10 million |

| 2020 | £194 million | £20 million |

| 2021 | £261 million | £41 million |

| 2022 | £369 million | £44 million |

| 2023 | £638 million | £147 million |

Source: Wise

Amount of money held with Wise

According to its 2023 annual report, Wise personal and business customers held a total of £10.7 billion worth of currencies on the platform. That’s £3.9 billion or 57% more than in 2022, where customers held £6.8 billion.

| Fiscal year | Customer balances | Personal balances | Business balances |

|---|---|---|---|

| 2018 | £301.2 million | n/a | n/a |

| 2019 | £856.1 million | n/a | n/a |

| 2020 | £2.0 billion | n/a | n/a |

| 2021 | £3.7 billion | n/a | n/a |

| 2022 | £6.8 billion | £3.5 billion | £3.3 billion |

| 2023 | £10.7 billion | £5.7 billion | £5.0 billion |

Source: Wise

What’s the average Wise deposit size?

If the total balance for all personal customers is £5.7 billion and there are 9.4 million active users, the average Wise deposit size is £606.38 (£5,700,000,000 / 9,400,000). This suggests very few people use Wise as their primary bank account.

For business accounts, the average deposit size is £9,615.38 (£5,000,000,000 / 520,000). This is noticeably larger than the personal average but still in a category that indicates a preference among mature businesses to use other financial platforms or a cautious approach in keeping large sums of money within their Wise accounts.

How does Wise hold customers’ money?

Wise is not licensed as a bank, which means it cannot hold customers’ funds in its own system. Instead, the company relies on external banking partners for custody. To manage these funds effectively, Wise has 470 separate bank accounts across its various legal entities.

Wise keeps around 60% of clients’ money in short-term financial assets such as U.K. and U.S. government bonds and money market funds. The other 40% is in cash in deposit-insured banks.

Source: Wise

Wise trading volumes

Wise processed money transfers worth £104.5 billion for its customers in the fiscal year 2023, representing a 36.7% increase from the year prior and a 92% increase from 2021.

Wise’s personal customers made up 73.3% of the total volume, while business customers accounted for 26.7%.

| Fiscal year | Total volume | Personal volume | Business volume |

|---|---|---|---|

| 2019 | £27.2 billion | £22.5 billion | £4.7 billion |

| 2020 | £41.7 billion | £33.4 billion | £8.3 billion |

| 2021 | £54.4 billion | £42.1 billion | £12.3 billion |

| 2022 | £76.4 billion | £56.9 billion | £19.5 billion |

| 2023 | £104.5 billion | £76.6 billion | £27.9 billion |

Source: Wise

How much money does the average customer send through Wise?

The average personal customer sends £8.1 thousand per year through Wise. This number has remained flat since FY22, despite the large increase in new active customers.

The average volume per business customer on Wise is £53.7 thousand. That’s 13% more than £47.7 in the year prior. According to Wise, this increase in business transactions is due to business customers scaling their use of Wise as they mature.

However, we would interpret the low double-digit volumes to indicate few businesses use Wise as their primary account.

| Quarter, fiscal year | Total average volume | Average personal volume | Average business volume |

|---|---|---|---|

| Q4 FY2021 | £4.4 thousand | £3.6 thousand | £18.1 thousand |

| Q1 FY2022 | £4.5 thousand | £3.6 thousand | £18.6 thousand |

| Q2 FY2022 | £4.6 thousand | £3.7 thousand | £19.4 thousand |

| Q3 FY2022 | £4.7 thousand | £3.7 thousand | £21.6 thousand |

| Q4 FY2022 | £4.7 thousand | £3.7 thousand | £20.8 thousand |

| Q1 FY2023 | £4.9 thousand | £3.8 thousand | £22.2 thousand |

| Q2 FY2023 | £4.9 thousand | £3.9 thousand | £22.9 thousand |

| Q3 FY2023 | £4.6 thousand | £3.5 thousand | £23.2 thousand |

| Q4FY2023 | £4.4 thousand | £3.4 thousand | £21.4 thousand |

Source: Wise

How many currencies does Wise support?

In 2011, Wise (then Exchange Solutions) only supported EUR to GBP transfers and vice versa. Today, Wise supports 40 currencies that users can hold and convert. Out of those, it gives users unique account details in 8 currencies they can use to receive and send money.

Here’s a table showing the number of currencies supported by the Wise at the end of each year since 2011:

| Year | No. of currencies |

|---|---|

| 2011 | 2 |

| 2012 | 8 |

| 2013 | 20 |

| 2014 | 23 |

| 2015 | 34 |

| 2016 | 38 |

| 2017 | 45 |

| 2018 | 49 |

| 2019 | 46 |

| 2020 | 54 |

| 2021 | 54 |

| 2022 | 52 |

Source: Archived Wise.com

How many people work at Wise?

Wise employs more than 5,000 people as of July 2023. The monthly average number of employees during the year ended 31 March 2023 was 4,411, up from 2,919 in 2022.

| Financial year | No. of employees |

|---|---|

| 2010 | 2 |

| 2011 | 3 |

| 2012 | 19 |

| 2013 | 50 |

| 2014 | 100 |

| 2015 | 348 |

| 2016 | 535 |

| 2017 | 720 |

| 2018 | 1,140 |

| 2019 | 1,500 |

| 2020 | 1,881 |

| 2021 | 2,243 |

| 2022 | 2,919 |

| 2023 | 5,000 |

Source: Wise, Companies House filings

Wise FAQs

How many users does Wise have?

Wise has 16 million registered users, of which 10 million are actively using the platform.

Is Wise profitable?

Yes, Wise has been a profitable business since 2017.

Is Wise bigger than Revolut?

In terms of registered users, Revolut is bigger than Wise. Revolut had 30 million users in 2023. However, it’s unclear how many of Revolut’s users are active customers, which makes the comparison difficult.

Where do Wise customers come from?

Wise generates the majority of its revenue in the EU/EEA and the U.K., which suggests most customers are located in Europe. In terms of website visitors, Wise receives the most traffic from the U.S. (15.90%), followed by the U.K. (8.01%), Germany (4.07%), Australia (3.52%), and Canada (3.36%).

How many employees work for Wise?

Wise has 5,000 people working in 17 countries across 4 continents. Wise hired its first employee in 2021, who stayed with the company for 8 years. In January 2018, the headcount reached 1,000, and in December 2019, it doubled to 2,000. In August 2022, it doubled again to 4,000.

Is Wise a bank?

No, Wise does not have a banking license anywhere in the world. It relies on other banks to hold customer funds. In the U.K., Wise is registered as an Electronic Money Institution (EMI); in the EU, Wise is registered as a Payment Institution in Belgium; in the U.S., it’s licensed as a Money Transmitter in 48 states. In other countries, Wise has similar licenses.