Bulgaria Capital Gains & Investment Tax Guide for 2024

All the essential information about capital gains taxes in Bulgaria in one place

If you’re tired of paying high taxes while getting less and less in return from the government, here’s a simple solution for you: Move to a country with lower tax rates. But instead of looking to the West, it may be time to turn your gaze eastward to Bulgaria, one of Europe’s hidden treasure troves when it comes to low tax rates on both personal and business income.

But if you’re planning to make the move, what about your investments, how are they taxed in Bulgaria? Like most other countries, Bulgaria has rules treating gains and income earned from stocks, ETFs, bonds, property, interest payments, cryptocurrencies, and other assets. Fortunately, the rates you’re going to pay in Bulgaria are some of the lowest in Europe.

Below is an in-depth overview of Bulgaria’s tax rules on capital gains and investment income. All the bases are covered, including how to legally avoid paying tax on capital gains in Bulgaria, how to calculate your tax obligations, and how to report your taxes to the National Revenue Agency (NRA). With this guide, those who are considering moving there or have already made the decision will hopefully have a better understanding of the system.

👋 A necessary disclaimer: Although we use primary sources such as government websites to back up what we write, this article shouldn’t be viewed as official tax or legal advice. Think of it as a handy introduction to the country and its tax system. If you have any doubts, always talk to a certified specialist to figure out what you should do based on your unique circumstances.

Do you have to pay tax on capital gains in Bulgaria?

Sometimes, sometimes not. Your exposure to Bulgarian capital gains and investment tax depends on what you invest in, how you own the asset, how frequently you trade, and with property, how long you own it and whether it’s your main home. In general, you can expect to pay between 0% to 10% in tax on your capital gains and investment income.

Overview of investment taxes in Bulgaria

If you’re a Bulgarian tax resident, you’re liable to tax on your worldwide capital gains and other investment income. Your tax obligations are determined by Bulgaria’s Personal Income Tax Act, known as the Закона за данъка върху доходите на физическите лица. Article 13 of this law, titled “Non-taxable income,” outlines the rules for the taxation of capital gains and investment income, while interest income is treated in various other sections of the law.1

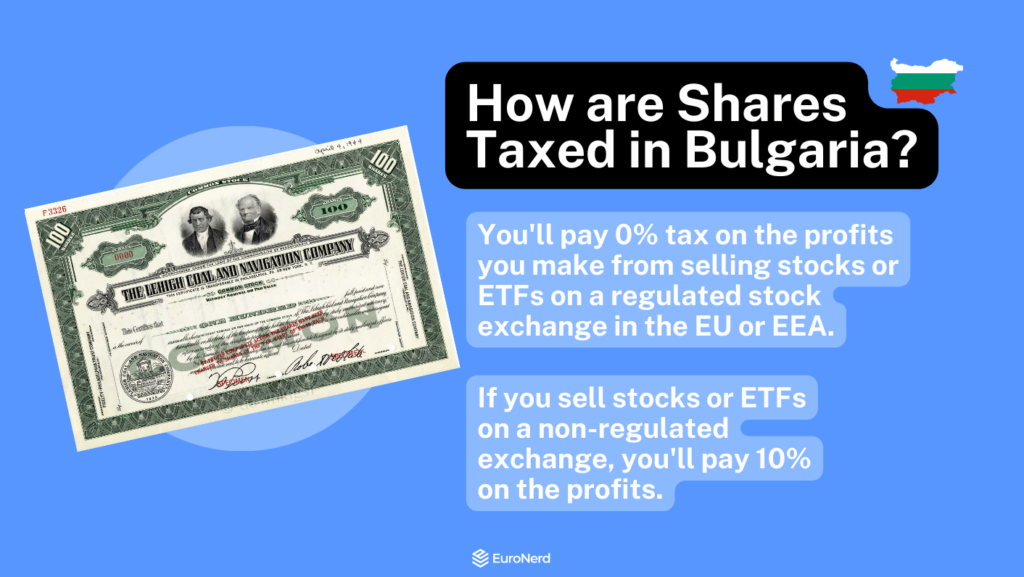

Stocks, ETFs, and other securities profits are taxed at 0% to 10% in Bulgaria. Bulgaria’s Personal Income Tax Act is clear that gains from selling financial assets are taxed at 10%. However, the law also says there is 0% tax on profits from equity instruments traded on a stock exchange licensed in a European Union member state and listed as a “regulated market” in the registry of the European Securities and Markets Authority (ESMA). This means profits from shares, ETFs, and mutual funds sold on these exchanges are taxed at 0%, while gains from instruments that are bought and sold on all other stock exchanges are taxed at 10%.2

Dividends are taxed at 5% in Bulgaria but sometimes 10% or more, depending on whether the dividend source country withholds taxes. If you receive dividends from a Bulgarian company, for example, your own Bulgarian company, the dividend tax is 5%. If you receive dividends from a foreign company, the tax rate depends on the percentage the company’s country withholds. For example, U.S. dividends are effectively taxed at 10% due to the BG-U.S. tax treaty.3

Bitcoin and cryptocurrency profits are taxed at 10%. The National Revenue Agency (NRA) unequivocally states that income from virtual currencies is treated the same way as income from the sale of other financial assets and is “taxable income that you must declare.” Crypto losses, however, are deductible from crypto gains or other taxable gains on financial assets.4

Property (real estate) gains are taxed at 0% or 10% in Bulgaria. There is no capital gains tax on property sale profits in Bulgaria if it is a residential property that you have owned for three or more years, regardless of whether it’s your main residence. Otherwise, the tax rate is 10%. If you own two or more properties, you must wait five years to realise the capital gain tax-free.5

Interest income is taxed at 0%, 8%, or 10%, depending on the source. Interest on bank deposits is taxed at 8%, regardless of whether the source is a Bulgarian or foreign bank. Interest on bonds or other debt securities issued by the European Union member country or municipality is exempt from taxation. Interest from bonds issued in other countries and interest income from other sources is taxed at 10%.6

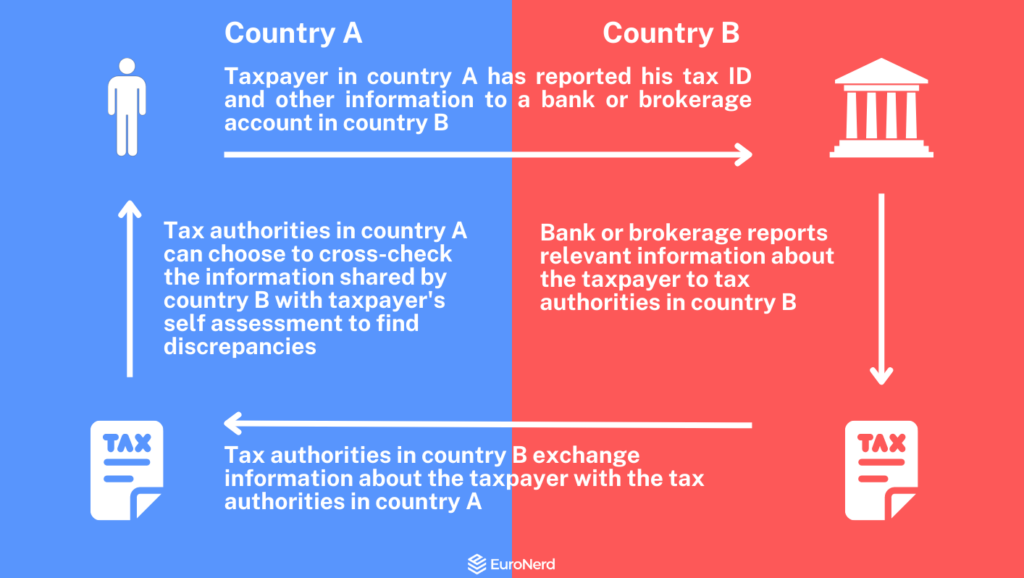

Does the НАП (NRA) know about my investments?

Yes, it’s very likely since Bulgaria participates in the Common Reporting Standard (CRS). If you have shared your Bulgarian tax-identification number and address with your brokerage or bank, these institutions will share information about your transactions and balances with their local tax authority, who in turn passes it on to the National Revenue Agency of Bulgaria (NRA).

While the likelihood of being audited or the NRA cross-checking information received by third parties with your self-assessment is low, there is still a risk that they eventually discover discrepancies and impose penalties or worse. That being said, the NRA generally has a less intrusive approach compared to its more aggressive colleagues in Northern Europe.

Fortunately, there’s no need to play hide-and-seek or embark on a wild goose chase for loopholes. Bulgaria is a low-tax country by European and even international standards, so as long as you grasp the rules of the game, you should be able to navigate through its tax system and fulfil all your legal obligations. No need for acrobatics or magic tricks — just a solid understanding of the basics and a pinch of common sense.

Understanding tax-free investing in Bulgaria

You don’t normally face a capital gains tax bill in Bulgaria if you sell shares and other securities on so-called regulated markets. A regulated market is a stock exchange located in the EU/EEA that is registered in the ESMA database as a “Regulated market” or “Multilateral trading facility”.

Here are the key requirements that must be fulfilled to benefit from the exemption:

- The transactions must involve shares, units or shares of investment funds, or government-issued securities.

- The transactions must take place on the Bulgarian Stock Exchange or another regulated stock exchange in the European Union.

- Your investing activity should not go beyond the scope of what could be considered normal portfolio management (“обикновено управление на портфейлна инвестиция”). To play it safe, investors should avoid active trading.

The third criterion is not a hard and fast rule. It’s a conservative recommendation many advisors give based on past court judgements relating to gains from real estate sales. We’re not aware of any specific rulings that directly address gains from financial instruments like stocks. In general, however, you want to think twice before engaging in investment practices that look like professional or business activities, such as day trading or algorithmic trading. If that’s your goal, it’s worth considering setting up a company structure in Bulgaria or Cyprus.

A detailed explanation of the rules

By default, investment income from financial instruments is taxed at 10%, according to Article 13 of the Bulgarian Personal Income Tax Code. However, Article 13 also provides exceptions to this rule, specifically to “income from disposal of financial instruments within the meaning of § 1, item 11 of the additional provisions”.

The tax-exemption therefore hinges on the meaning assigned to “financial instruments” in provision § 1, item 11 of the Income Tax Code. According to this clause, “Disposition of financial instruments” is defined as “transactions […] with units and shares of collective investment schemes and of national investment funds, shares, rights and government securities traded on a regulated market within the meaning of Art. 152, para. 1 and 2 of the Law on Financial Instruments Markets”.

Not just any market is considered “regulated”, only those within the meaning of the Law on Financial Instruments Markets. To find out what qualifies as a regulated market, we have to journey deeper into the labyrinth, to Article 152 of the Law on Financial Instruments Markets. According to Paragraph 2 of this article, a “regulated market” is defined as “any multilateral system that is licensed and functions as a regulated market in accordance with the requirements of Directive 2014/65/EU”.

The final step is to find out which markets, or stock exchanges if you will, are “multilateral” and follow the aforementioned EU directive. In our opinion, if the exchange is registered in the ESMA register under “Entity type” as a “Regulated market” or as a “Multilateral trading facility”, then it meets the definition of a “regulated market” of the Law on Financial Instruments Markets.

The takeaway is that to invest tax-free in Bulgaria, you need to sell your investments on one of the stock exchanges from the ESMA list. To do that, you need to make sure your broker actually routes your orders through one of these venues. For example, on Interactive Brokers, you need to disable the Smart Routing feature and explicitly set your desired exchange. It’s also worth noting that it’s not European companies that are listed on European exchanges. Several U.S. companies from the S&P 500 are “dual-listed” on European exchanges in addition to Nasdaq and the NYSE.

Capital gains tax on stocks in Bulgaria

A capital gain is the profit you make when you sell an asset for more money than what you paid for it. In Bulgaria, you don’t have to pay any capital gains tax on profits from selling shares that are listed on a regulated stock exchange within the EU. In other words: 0% tax. For example, if you made €10,000 by selling a particular stock after holding it for a few years, the entire profit would be considered tax-exempt.

Profits from stock trades made on exchanges that are not considered regulated within the EU, such as those in the U.S., U.K., or Hong Kong, are not tax-exempt. In these cases, a capital gains tax of 10% applies. This tax also applies to profits from exchanges within the EU that are not regulated exchanges.

Does a capital loss reduce taxable income?

You cannot use losses from stock sales you made on a regulated exchange to offset your taxable income; just any gains you make from selling stocks on a regulated exchange cannot increase your taxable income base. Remember, both are ignored for tax purposes.

For example, if you sold stock A at a loss of €2,000, and during the same year, you also sold stock B with a profit of €1,000, you have a total loss of €1,000 that cannot be deducted in any way.

However, according to Article 33, Paragraph 3, what you can do is offset losses against profits on financial assets that are taxable: “the sum of the profits realised during the year, determined for each specific transaction, reduced by the sum of the realised during the year losses determined for each specific transaction.” This means you’re taxed on the net income from all your transactions after accounting for both profits and losses for each trade.

For example, imagine you realised a profit of €10,000 by selling a stock on a non-regulated exchange. If you did nothing else, you would receive a tax bill of €1,000, equal to 10%. However, you happened to have an unrealised Bitcoin loss of €10,000 or another stock for that matter. If you were to sell that Bitcoin within the same tax year, something interesting would happen: your tax bill would be reduced to zero because €10,000 loss would be subtracted from the €10,000 profit, resulting in a net gain of €0.

Buying shares on one exchange and selling on another

What if you initially bought a stock on a non-regulated exchange, and if you were to sell it and realise a gain, you would face a substantial tax bill. You could simply pay the 10% and be done. However, if this same stock is also listed on a regulated exchange, which many of the big companies are, it might be possible to sell it on one of those exchanges and potentially reduce the tax to zero. As the law is written, the requirement for the stock profit to be exempt from taxation is where it’s sold, not where it’s bought.

Conversely, say you had purchased a stock on a regulated exchange, but if you were to sell it now, you would suffer a loss. At the same time, you had an opportunity to realise a taxable capital gain from another trade. Normally, there would not be much you could do in this situation: the loss would be ignored, and the gain would be taxed. However, there’s a chance the same company is listed on a non-regulated exchange as well. If that’s the case, you could potentially sell the stock there to balance out your net income.

In practice, the problem is most brokerages will only let you sell a stock on the same exchange where they bought it. One broker where this feature is somewhat accessible, although not easy to figure out, is Interactive Brokers, where you can manually disable their SmartRouting feature and pick a specific destination for your order, depending on where the stock is tradable.

Dividend tax in Bulgaria

Companies can distribute part of their profits in the form of dividends to their shareholders. As a tax resident of Bulgaria, any dividends you receive from stocks or funds are taxable at a rate of 5%. If you receive dividends from a Bulgarian company, such as your own Bulgarian limited company (OOD), the company must withhold and pay the tax, after which the remaining 95% will be distributed.

Tax on foreign dividends

In the case you receive dividends from a non-Bulgarian company, the company or your brokerage will typically withhold a specific percentage of the distribution as taxes. The exact withholding rate depends on the tax agreement between Bulgaria and the country where the company is registered.

If 5% or more has been withheld in the foreign country, no additional tax is due in Bulgaria. If the tax paid abroad is less than 5%, the difference up to 5% needs to be paid in Bulgaria. According to Article 76 of the Income Tax Act, you’re allowed to offset the dividend tax paid abroad so that it is subtracted from what you owe in taxes in Bulgaria. However, Bulgaria will not refund any extra tax paid beyond the 5% rate. When filing, you need to provide the NRA with proof showing the amount of tax that was withheld.

Taxation of dividends from U.S. shares

Many investors own stocks in U.S. companies that pay dividends to their shareholders, like 3M (MMM) or Coca-Cola (KO). According to Article 10 of the Bulgaria-U.S. tax treaty, the U.S. is allowed to withhold 10% in dividend tax for Bulgarian residents. However, to get the 10% rate, you need to fill out Form W-8 BEN with your brokerage. Otherwise, you will end up paying 30%, which is the standard U.S. withholding rate. What this means is the effective dividend tax rate for U.S. shares is actually 10% rather than 5%.

ETF taxes in Bulgaria

ETFs, mutual funds, and investment funds, properly known as collective investment schemes in EU lingo, follow the same tax rules as stocks. Meaning, if you make a profit from selling shares or units of investment funds through a regulated stock exchange in the EU, 0% taxes are due on the capital gain. If the ETF sale is made on a non-regulated exchange, a 10% tax on the gain applies.

Deducting ETF losses

Losses from ETF trades on regulated exchanges cannot be used to offset your taxable income.

If the ETF sale is made on a non-regulated exchange, you can subtract those losses from your other taxable gains. You’re only taxed the overall net income from all your transactions involving taxable financial assets.

Taxes on distributing ETFs

Dividends from ETFs and other investment funds are taxable at 5% in Bulgaria.

If you receive dividends from outside Bulgaria, and the dividends have been subjected to withholding tax of more than 5%, there is no additional tax in Bulgaria. If the foreign dividend withholding tax is less than 5%, the dividends are taxable in Bulgaria up to the difference of 5%.

Risk of double-taxation with distributing ETFs

Regarding dividend-distributing funds domiciled in Ireland and Luxembourg, which is where most European funds are based, there is some uncertainty about whether individuals need to pay dividend taxes in Bulgaria. This uncertainty arises because, before distributing dividends to investors, these funds typically have already paid tax in the countries where their stocks are located.

For example, an Irish-domiciled UCITS fund holding U.S. stocks pays 15% in tax to the U.S. IRS. When the fund distributes dividends to EU residents, there is no additional tax, as Ireland does not withhold taxes.

The risk-conservative interpretation is therefore that you must pay 5% in Bulgaria, as the 15% tax is between the fund and the U.S., not between you and the U.S. This creates a situation of de facto double-taxation, where individuals indirectly pay 15% tax to the U.S. and then another 5% to Bulgaria. There are three solutions to this issue: investing in synthetic funds/ETFs, U.S.-domiciled non-UCITS funds, or accumulating funds.

Bond taxes in Bulgaria

Bonds are debt instruments that represent a loan made by an investor to a borrower, typically a government, municipality or business. When you invest in bonds, there are two ways you can earn money: through interest and capital gains. These two types of income are subject to different tax rules in Bulgaria.

Interest (coupons) from bonds

Interest payments, also called coupons, from government or municipality bonds, as well as other government securities and corporate bonds, are not taxed in Bulgaria if the issuer of the bond is based in the EU or EEA. This means you can create a bond portfolio and receive periodic tax-free interest income without having to pay taxes on it in Bulgaria.

Interest income you receive from bonds issued outside the EU or EEA is taxable at 10%.

If the bond or debt issuer’s country has withheld taxes, you can deduct the amount of taxes withheld from your tax liability in Bulgaria up to the 10% rate. If less than 10% was withheld, the difference is taxable in Bulgaria.

Capital gains on bonds

Bond investors usually hold their bonds until the debt matures, but sometimes it can be more advantageous to sell a bond ahead of time. If you sell a government bond on a regulated market in the EU, any capital gain you make from the sale is not subject to tax in Bulgaria. However, if the bond is sold on a non-regulated market or if it’s a corporate bond, the tax rate on the capital gain is 10% in Bulgaria.

Cryptocurrency tax in Bulgaria

Bitcoin and other digital currencies are not specifically mentioned in the Bulgarian Income Tax Act or any other of the country’s tax laws. However, the NRA has published official guidelines stating cryptocurrencies are considered financial assets and that profits made from selling or exchanging cryptocurrencies therefore are taxable income. This means crypto profits are taxed at 10% in Bulgaria.

According to the NRA, crypto profits fall within the scope of income from the transfer of financial assets and must be reported in Schedule No. 5 of your annual tax return.

How to calculate your crypto taxes in Bulgaria

The NRA views cryptocurrencies as financial assets, which means crypto trades are treated in accordance with Article 33, Paragraphs 3-4 of the Bulgarian Income Tax Act. According to the rules, you have to calculate your profit and loss for every crypto sale, swap, or exchange you make. The way you do this is to subtract the purchase price from the sales price for each trade. You then add up the individual profits and losses to determine your total taxable net income.

However, your crypto gains or losses are not viewed in isolation but are taken together with your other taxable income from financial assets within the year. Meaning, for example, if you have a crypto loss of €1,000 and a profit of €1,000 from gold or another asset, your overall profit is not €1,000 but €0, and no taxes are due. Just remember, unlike many other countries, Bulgaria does not allow capital losses to be carried forward to offset gains in the following years.

Capital gains tax on property (real estate)

Like in many other countries in Europe, you will not have to pay any tax when you sell your home in Bulgaria, although there are a few straightforward conditions to meet. The exemptions can be found in Article 11, Paragraph 1 of the Personal Income Tax Code. Here are the general rules:

- If you have owned a residential property for 3 years or more, you won’t have to pay tax on the capital gain when you sell.

- If you own more than 1 property, or agricultural or forest land, and you have owned these for more than 5 years, you can sell up to two of these properties in the same calendar year without being liable for capital gains tax.

If you don’t meet these requirements, the property sale income is taxed at 10%, based on the

difference between the sale and purchase price of the property, with 10% of expenses deducted.

For example, if you bought a property for 200,000 BGN in 2019 and sold it for 300,000 BGN in 2021, the profit would be 100,000 BGN. You are then allowed to deduct 10% or 10,000 BGN of the profit as expenses, which reduces the gain to 90,000 BGN. Applying the 10% tax rate to this amount, you would owe 9,000 BGN.

Avoid being categorised as a professional investor

By default, capital gains generated by a private individual in Bulgaria are either tax-exempt or taxed at 10%, depending on the circumstances. If your investing activity falls within the boundaries of what could be considered normal management of your private property, these are, generally speaking, the rates you’re going to pay. However, like in many other countries, there is a distinction in the eyes of the law between private and professional investors.

Unfortunately, when it comes to defining the exact criteria for this distinction, the rules are not clear. This means there is a small — but not insignificant risk — of being taxed on your investment income at 15% as if you were operating as a sole trader business and, in some cases, also being liable for social security contributions and VAT. However, you can mitigate the risk by sticking to a few rules of thumb.

Primarily, you want to avoid frequent and professional-like trading. If your investment activities make up a business-like economic activity and are your primary main source of income, the NRA may classify you as a sole trader subject to taxation under Article 26, paragraph 7 of the Income Tax Act: “The income from economic activity of an individual who is a trader within the meaning of the Commercial Law, but is not registered as a sole trader, is also taxed.” However, at present, there are no clear-cut criteria that objectively determine whether a private investor’s activity has an economic nature or not.

There is no mention of specific numbers, frequency, time intervals, etc., in the law that determines when something is an economic activity. The lack of specifics is also evident in the answers presented by the NRA in their binding rulings and to enquiries from individuals. You may find some legal experts reference previous rulings by the Supreme Administrative Court of Bulgaria, which considered three or more sales within 12 consecutive months as a regular activity, but this stance is directed towards real estate sales and not an official opinion presented by the NRA with regards to financial investments. Furthermore, the Court of Justice of the European Union (CJEU) has ruled that the number and number of sales, duration of activities, and income generated is not decisive criteria on their own to call something an independent economic activity for VAT purposes.

“In the previous practice of the Supreme Administrative Court (SAC), a criterion for determining regular activity has been the systematic engagement (three or more times within a year) in a particular activity with the purpose of deriving profit for personal interest. This is evident in SAC Decision No. 7301 of May 23, 2012, case No. 1394 of 2012, and SAC Decision No. 5935 of April 26, 2013, case No. 7552 of 2012. For instance, in cases of property sales, the SAC has considered that a person engages in regular activity if they perform three or more sales within 12 consecutive months with the intention of making a profit.

However, this criterion is not shared by the Court of Justice of the European Union (CJEU). According to the CJEU, the mere exercise of property ownership rights over real estate cannot be considered an economic activity. This is evident in points 43 and 19 of its judgments in the combined cases C-180/10 and C-181/10 of 2011 and the Fini H case, C-32/03 of 2005.

Based on the CJEU’s practice of distinguishing between activities of private individuals outside the scope of the directive and those of operators engaged in economic activities, the number, scale, duration, and income generated from transactions in themselves are not determining criteria. Instead, all these circumstances can actually be interpreted in the context of managing personal property of the interested person (combined cases C-180/10 and C-181/10 of 2011 and Wellcome Trust case, C-155/94 of 1996).”

How to declare your investment income

The tax return deadline is April 30th, following the year the income was earned. The tax return is submitted online through the NRA’s website with an electronic signature (KEP) or a Personal Identification Code (PIC). The PIC code is the most commonly used option, as it is issued for free by contacting the NRA.

- Shares: Gains and losses from the sale of shares are declared in Appendix No. 5, table 2. Gains and losses from tax-exempt sales are not declared. Foreign company shares owned during the previous year are declared in Appendix No. 8.

- Dividends: Dividends received from Bulgarian entities are not declared. Dividends from foreign entities are declared in Appendix 8, Part IV, including foreign withholding taxes paid and claims of entitlement to a tax credit.

- Cryptocurrency: Gains and losses on crypto sales are declared in Appendix No. 5, table 2. Holdings of crypto assets are not declared.

How to become a Bulgarian tax resident

Unless your tax situation is very complicated, relocating your affairs to Bulgaria is relatively straightforward. To become a Bulgarian tax resident, you need to tick off the usual checklist: have a residential address in the country, stay for more than 183 days in any 12-month period, or have your “centre of vital interests” there. In layman’s terms, you need to physically move to Bulgaria and cut ties with your former country.

Citizens of the EEA and Switzerland are free to move to Bulgaria without any restrictions, while those from regions need a type D Visa and a residence permit.

Digital nomads or expats who prefer spending time abroad can easily move their tax base to Bulgaria. Just find a cheap rental outside the big cities or buy a place and rent it out, and you’re free to travel the world. As long as you pay your taxes, no one will bother you about where you live. Those who prefer a more traditional lifestyle, like couples with kids, are often surprised by how affordable buying a house is. There are plenty of great deals for less than €80,000 or even less than €40,000 if you’re willing to roll up your sleeves and do some renovation work.

Wealth taxes in Bulgaria

There is no wealth tax in Bulgaria.

Exit taxes in Bulgaria

There is no exit tax for individuals leaving Bulgaria. It only applies to companies.

Further reading

Note that the best resources are only available in the Bulgarian language.

Taxmonkey.bg, a boutique law and accountancy firm headed by lawyers Nikola Penchev and Veselka Velikova. They provide excellent guides on taxes for companies, freelancers, and investing. It’s a great resource if you’re planning to move to Bulgaria and open a company.

Redtapepayments.blogspot.com, a blog run by private investor Valentin Stoykov. He delves deep into the intricate details of Bulgarian tax law related to investing. His reports are thorough, insightful, and fortunately often humorous. It’s definitely for the more nerdy audience.

Sources

- National Revenue Agency. “Personal Income Tax Act“, Art. 13. https://nra.bg/wps/portal/nra/zakonodatelstvo/zakonodatelstvo_priority/da0cc1aa-c4b2-4863-b1de-5f2f94d9f2d6

- National Revenue Agency. “Sale of property” (Продажба на имущество). https://nra.bg/wps/portal/nra/taxes/godishen-danak-varhu-dohdite/prodazhba-na-imushtestvo.

- National Revenue Agency. “Dividends” (Дивиденти). https://nra.bg/wps/portal/nra/taxes/okonchatelen-danak-varhu-dohodi/dividenti.

- National Revenue Agency. “Virtual currencies” (Виртуални валути). https://nra.bg/wps/portal/nra/taxes/godishen-danak-varhu-dohdite/virtualni-valuti.

- National Revenue Agency. “Sale of property” (Продажба на имущество). https://nra.bg/wps/portal/nra/taxes/godishen-danak-varhu-dohdite/prodazhba-na-imushtestvo.

- National Revenue Agency. “Interest income” (Доходи от лихви). https://nra.bg/wps/portal/nra/taxes/okonchatelen-danak-varhu-dohodi/dohodi-ot-lihv.