Greece Capital Gains & Investment Tax Guide for 2024

Greece’s surprisingly low taxes on investment income might have you thinking you’ve discovered financial ambrosia.

Greece has a notoriously complicated tax system that can make both locals and foreigners feel like they’re Theseus navigating the Labyrinth of Minos, except their Ariadne forgot to hand out the guiding string. But much like the hope left in Pandora’s box, Greece’s tax system has its own form of optimism: a surprisingly generous approach to capital gains.

In Greece, capital gains and capital income are taxed at low rates or not taxed at all, depending on the kind of investment income you make. At present, the country has some Europe’s lowest rates on investment income. But to understand if you owe taxes and how to work the system to your benefit, you need a thorough understanding of the rules. This way, filing your taxes won’t feel like deciphering an ancient Greek epic.

If you’re considering moving to Greece, you should also know that the country offers different tax incentives to attract foreign individuals. These include the High Net Worth Individual (HNWI; “Non-Dom”) Tax Regime, the Foreign Pensioners Flat Tax Regime, and the Foreign Employees and Entrepreneurs Tax Regime. These can all be combined with Greece’s low capital gains tax.

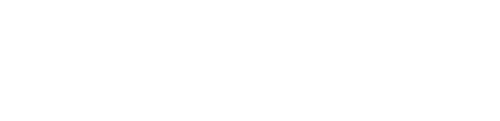

Overview of capital gains and investment taxes in Greece

In Greece, investment income isn’t taxed at a single rate; instead, the rates vary depending on the type of investment. This income can come from various sources, such as interest payments from bank accounts and bonds, dividends, capital gains from selling stocks, property, cryptocurrency, or other assets, as well as profits from other types of investments. Each category of investment income is subject to its own specific tax rate.

Capital income and capital gains in Greece are taxed according to the Greek Income Tax Code (Law 4172/2013), known as the Κώδικα Φορολογίας Εισοδήματος (ΚΦΕ) 4172/2013 in Greek. Chapters 5 and 6 of the tax code respectively deal with capital income (from dividends, interest, and rental income) and capital gains (e.g. from immovable property, shares, owner shares, bonds, derivatives, and options).1 Here is a summary of the rules. Here is a summary of the rules.

Shares (stocks): Profits you make from selling shares of public companies are subject to a 0% capital gains tax in Greece as long as you own less than 0.5% of the company. This exemption applies to shares listed on the Athens Stock Exchange, in the EU/EEA, and elsewhere, regardless of the size of the profit made. However, there is a 0.2% financial transaction tax on the total transaction value of the sale. If you own more than 0.5% of the shares in a public company, you’ll owe 15% in capital gains tax on the profits.

Shares in private companies: If you own shares in a company that isn’t listed on the Athens or a foreign stock exchange – i.e. private company stock such as your own limited company – you’ll be taxed 15% on any profits when you sell them.

ETFs, mutual funds: When you sell shares for a profit in a UCITS-type exchange-traded fund (ETF) or mutual fund listed either in Greece or the EU/EEA, there’s 0% capital gains tax to pay. However, profits from non-UCITS funds or those registered outside the EU/EEA are subject to a 15% capital gains tax. It’s worth mentioning that most publicly available European ETFs are categorised as UCITS.

Bonds: Interest income (coupons) from Greek government bonds and bills is tax-exempt, but if sold before maturity, the capital gain is taxed at 15%; if held till expiry, it’s exempt. Foreign government bonds, inside or outside the EU, incur a 15% tax on interest and pre-maturity capital gains, but gains are tax-free if held till expiration. Corporate bonds, whether Greek and EU-issued, are taxed 15% on interest with tax-exempt capital gains, while non-EU corporate bonds face a 15% tax on both interest and capital gains.

Dividends: A 5% dividend tax applies to dividends from Greek companies and is withheld by the company that issues them. Dividends from non-Greek sources, including EU/EEA and non-EU/EEA companies, are taxable at 5% in Greece. Dividends from UCITS ETFs and mutual funds are exempt from taxation. However, dividends from non-Greek sources typically have a higher effective tax rate since the source country often withholds taxes; but the withheld tax can usually be offset against the Greek tax rate, with a cap at the Greek tax amount of 5%.

Property (real estate): If you sell a property in Greece, as an individual, you’re usually subject to a 15% capital gains tax on the profit. However, since 2013, an ongoing exemption has applied to property sales, meaning the actual tax rate is 0%. This exemption has been in place since 2013 and is expected to continue until real estate taxes are completely restructured. During this period, any losses you incur from the sale of Greek real estate are not recognised, just as gains are non-taxable.

Interest income: In the Greek tax code, “interest” encompasses income from various claims, including deposits, government securities, bonds, and any form of loan arrangement, whether or not they’re backed by collateral or linked to the debtor’s profits. Interest income is taxed at 15% in Greece. For tax specifics on bond and government security interests, refer to the previous section.

Derivatives, options, forex: Gains arising from trading financial derivatives — such as foreign exchange trading (forex), contracts for difference (CFDs), options contracts, futures contracts, commodities, etc. — are taxed at 15%.

Cryptocurrencies: Capital gains from trading cryptocurrencies (Bitcoin, Ether, etc.) are taxed at 15%. However, the Greek tax code does not explicitly mention cryptocurrencies, as the Greek tax authority (the AADE) hasn’t codified their tax treatment. Despite the absence of specific guidelines, the general consensus among experts is that cryptocurrency gains fall under the category of capital transfer gains and are, therefore, taxable as such.

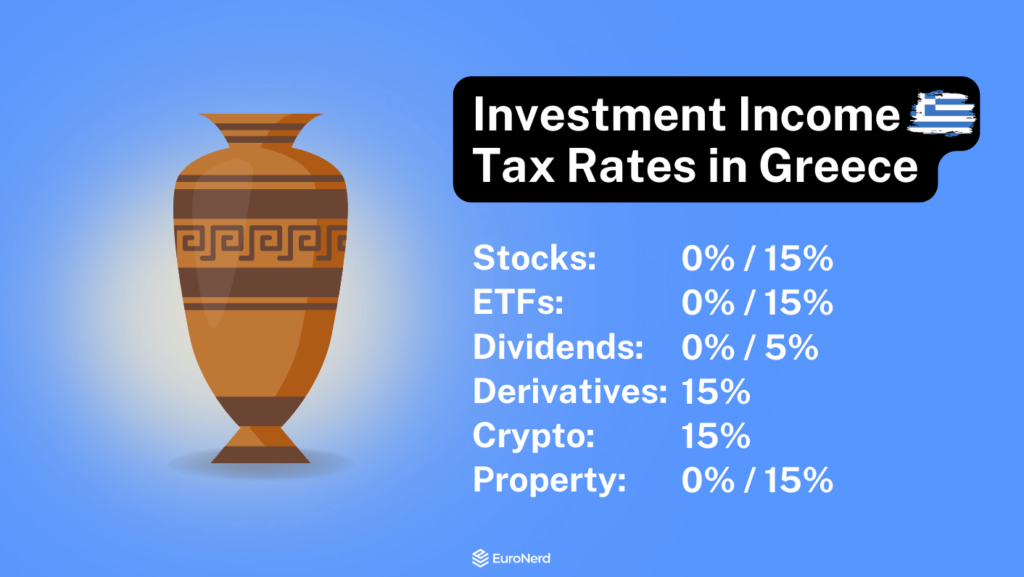

Does the AADE know about my investments?

Yes, it’s very likely that the Greek tax authority – the Independent Authority of Public Revenue (AADE) – is aware of your investments, even if they haven’t contacted you about them. This is because Greece has several tax information exchange agreements with other countries, including the U.S., most European countries, and many others. Here’s how the AADE gets your data:

- Greece is part of the Common Reporting Standard (CRS), which is a global agreement among countries for the Automatic Exchange of Information (AEOI) of financial information. Greece is one of over 100 jurisdictions that have signed up to the CRS. Under CRS, banks, stock brokerages, and other financial institutions located in other CRS countries are forced to share information about your accounts with their local tax authority, which in turn passes it on to the AADE. This includes balances, income, and disposals, among other things.

- Council Directive 2011/16/EU (DAC) provides for the exchange of taxpayer information between the tax administrations of EU Member States. In December 2014, the DAC was amended by Council Directive 2014/107/EU (DAC2). DAC2 made the operation of the CRS mandatory for all EU Member States and brought the CRS into EU legislation. Under DAC2-CRS, European financial institutions report details of account holders that are not tax-resident to their country of residence.

- Greece has signed double taxation treaties with over 55 countries. These treaties include an obligation for the participating countries to exchange information about the taxpayer.2

- Starting in 2026, under a new EU directive (DAC8), European Union crypto service providers, including exchanges, must report user transactions to local tax authorities, including those involving Greek users. This means the Greek tax authority will receive detailed information about Greek residents’ crypto transactions.

The odds of the AADE putting your tax return under the microscope and matching it with info from other sources are relatively low, but it’s not impossible. If they do catch a whiff of something fishy, the auditors are known to be very aggressive.

Luckily, there’s no need to embark on an epic quest for tax loopholes. Greece’s investment taxes are among the lowest in Europe and even by global standards. By familiarising yourself with the rules, you can smoothly navigate and comply with the system’s requirements. Just play by the book, and you’ll be more than fine, financially and legally.

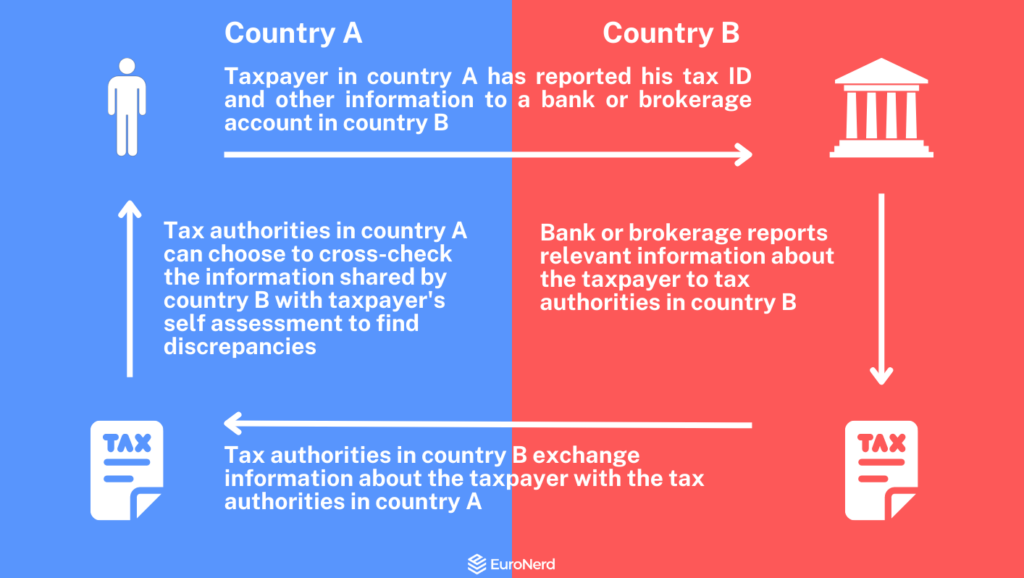

How are stocks taxed in Greece?

Capital gains from selling stocks listed on a stock exchange are exempt from taxation in Greece, according to Article 42 of the Greek Income Tax Code, if you are a Greek tax resident and own less than 0.5% of the shares in the company.

There is no cap on the amount of gains that can be realised tax-free and no geographical requirement as to where the stock is listed.

On 26 January 2015, Greece’s Ministry of Finance issued a circular (POL. 1032/26.1.2015) confirming the tax treatment of capital gains derived from the transfer of listed shares:

“(…) in the case where an individual, a tax resident of Greece, at the time they sell shares listed on the Athens Stock Exchange (ASE) or a foreign stock exchange, holds a percentage less than 0.5% of the shares of the specific S.A. (Public Limited Company) of which they are transferring the shares, the capital gains arising from this sale are not subject to the tax of Article 42, regardless of the time of acquisition of the shares, as well as the number of shares being transferred.”3

Example 1: Realising a Gain

In 2019, you purchased 100 shares of Apple Inc at €35 each, totalling an investment of €3,500. Fast forward to 2023, you sold these shares at €165 each, totalling €16,500. This transaction resulted in a capital gain of €13,000 (excluding any broker commissions and other fees). As your ownership in Apple was less than 0.5%, you are exempt from paying capital gains tax on this profit.

Example 2: Incurring a Loss

Back in 2019, you invested in 50 shares of Gamestop Corp at $50 USD per share, amounting to $2,500 USD. In 2023, you sold your Gamestop shares at $15 USD per share, receiving only $750 USD in total. This resulted in a loss of $1,750 USD. However, since both gains and losses are ignored for tax purposes, you wouldn’t be able to use this loss to offset other taxable income.

When are stock profits taxable?

In most cases, individuals residing in Greece are exempt from paying capital gains from stock disposals. However, in the following situations, a 15% tax applies on the profit, according to Article 42.

- Non-listed (private) company shares: Capital gains from the transfer of shares in a company that is not listed on a stock market are taxable. This would be relevant if you own part of the whole of a limited company, whether incorporated in Greece or elsewhere.

- Listed company shares with significant ownership: The sale of shares or other securities listed on a stock market is taxable if you own at least 0.5% of the company’s share capital. In most cases, this is relevant for entrepreneurs and early investors in newly public companies.

- Stock options: Equity compensation granted by companies to their employees in Greece is generally not taxed when granted or exercised but upon disposal (see the section on stock options).

There are other situations where stock profits are taxable, but these are generally not relevant to the majority of private investors.

The Greek financial transaction tax

While most stock sales are exempt from capital gains tax, they are not completely free from the long arm of the Greek taxman. When you sell listed shares, a transaction tax of 0.2% is applied to the sale price, according to Law 4799/2021.4

The financial transaction tax only applies to listed shares, whether they are from Greek or non-Greek companies, but it doesn’t apply to other types of securities like ETFs. Your broker will usually handle this and deduct it from the sale’s proceeds, but if it doesn’t, you must pay it yourself.

If you’re a tax resident in Greece, you’ll have to pay the financial transaction tax on any listed shares you sell, whether they are listed on the Greek stock market or any other regulated market or trading facility worldwide. This means if you’re trading shares that are on the New York Stock Exchange, the London Stock Exchange, or any other recognised stock exchange outside of Greece, this tax still applies.

How are fractional shares taxed?

Online brokerages often offer the option to buy so-called “fractional shares”, which they market as partial ownership of a stock. However, fractional shares are usually not real shares but derivatives contracts which derive their value from the performance of a particular stock or ETF.

At present, it’s unclear if the AADE treats fractional shares the same as full shares or as financial derivatives when it comes to taxes. We know the European Securities and Markets Authority (ESMA) has stated they view fractional shares as derivative products since a fraction of a share is not the same as a whole corporate share.5 Similarly, the UK’s HMRC also does not equate fractional shares with full shares. Other tax agencies follow similar interpretations.

We urge caution in dealing with fractional shares until the AADE issues clear tax guidance or binding ruling. Should they be classified differently from full shares, they’re likely to be treated as financial derivatives and taxed as such.

How are ETFs and mutual funds taxed in Greece?

When you sell or transfer ETFs or mutual funds classified as UCITS, you won’t have to pay any capital gains tax on the profits in Greece, according to Article 103 of Law 4099/2012.6 The tax exemption also applies to any dividends you receive from UCITS funds.

There is no limit to the amount of capital gains or dividends that one can receive tax-free from these instruments.

The law states that:

“Gains in the form of dividends or other benefits from shares or units, or in the form of increased value from the sale of shares or units at a price higher than the acquisition price, which are acquired in each case by the shareholders or unit holders respectively, of UCITS that have received a licence for establishment or operation in Greece, are exempt from any tax, fee, stamp duty, contribution, right, or any other charge in favour of the state, public law legal entities, and generally third parties…”

To benefit from the tax exemption, your investments must be in UCITS mutual funds or ETFs registered within the EU or EEA. This is because UCITS-compliant funds issued in any EU or EEA country are treated equally to Greek funds due to the “passporting” principle. The source of the underlying investments of the funds, whether in the EU/EEA, US, UK or anywhere else, doesn’t affect the exemption. Just make sure the fund is categorised as UCITS by checking for the “UCITS” term in its KIID/KID or Factsheet. Any non-UCITS fund will attract a 15% capital gains tax and a 5% dividend tax.

The role of foreign withholding taxes on dividends

While investors of ETFs and mutual funds registered in the EU/EEA might escape taxes in Greece, the funds themselves can still be subject to international withholding taxes from the countries where the underlying investments are made. Here’s how it typically works:

- An Irish UCITS fund, like those offered by iShares or Vanguard, invests in a range of U.S. and other international company stocks. When these companies distribute dividends, the tax authorities in the companies’ respective home countries may withhold a portion of these dividends for taxes. The U.S., for example, applies a 15% withholding tax on dividends paid to Irish funds.

- This Irish fund, after withholding taxes are applied, receives the net of the dividends. Once or twice a year, it distributes its accumulated dividends from all of its holdings to fund investors. Due to Ireland’s tax regulations, no withholding tax is imposed on these distributions to non-resident investors.

- When these dividends are received by an investor in Greece, they are not subject to additional taxation under Greek tax legislation.

Even though investors are exempt from paying taxes in Greece on their dividends, they still encounter an effective 15% tax rate. The reason is that the fund owning the shares is considered the legal recipient of these dividends, not the individual investor. You also can’t request a refund for the U.S. tax on these dividends, nor can you offset it against your taxes in Greece because it is the fund that has paid the withholding tax, not you personally.

Sources

- Taxheaven. “Income Tax Code“, Chapter 5-6. Accessed 01 November 2023

- Independent Authority of Public Revenue. “Texts of Contracts / Treaties for the Avoidance of Double Taxation of Greece With”. Accessed 01 November 2023.

- Greek Ministry of Finance. “POL.1032/26.1.2015 Transfer of securities.” Accessed via Taxheaven, 2 November 2023.

- Greek Ministry of Finance. “Law 4799/2021, Article 112: Regulations Regarding Sales Tax on Stock Market Transactions.” Accessed via Taxheaven, 3 November 2023.

- ESMA. “ESMA publishes guidance on fractional shares.” 28 March, 2023.

- Greek Ministry of Finance. “Law 4099/2012, Article 103.” Accessed via Taxheaven, 6 November 2023.